We met with Windermere's Chief Economist, Matthew Gardner, and want to pass along his thoughts on Portland's housing market. We've get a lot of questions on where the market will head with the impact of new policies ranging from the new tax plan to Portland's tenant relocation costs. Here are the key points we're focusing on.

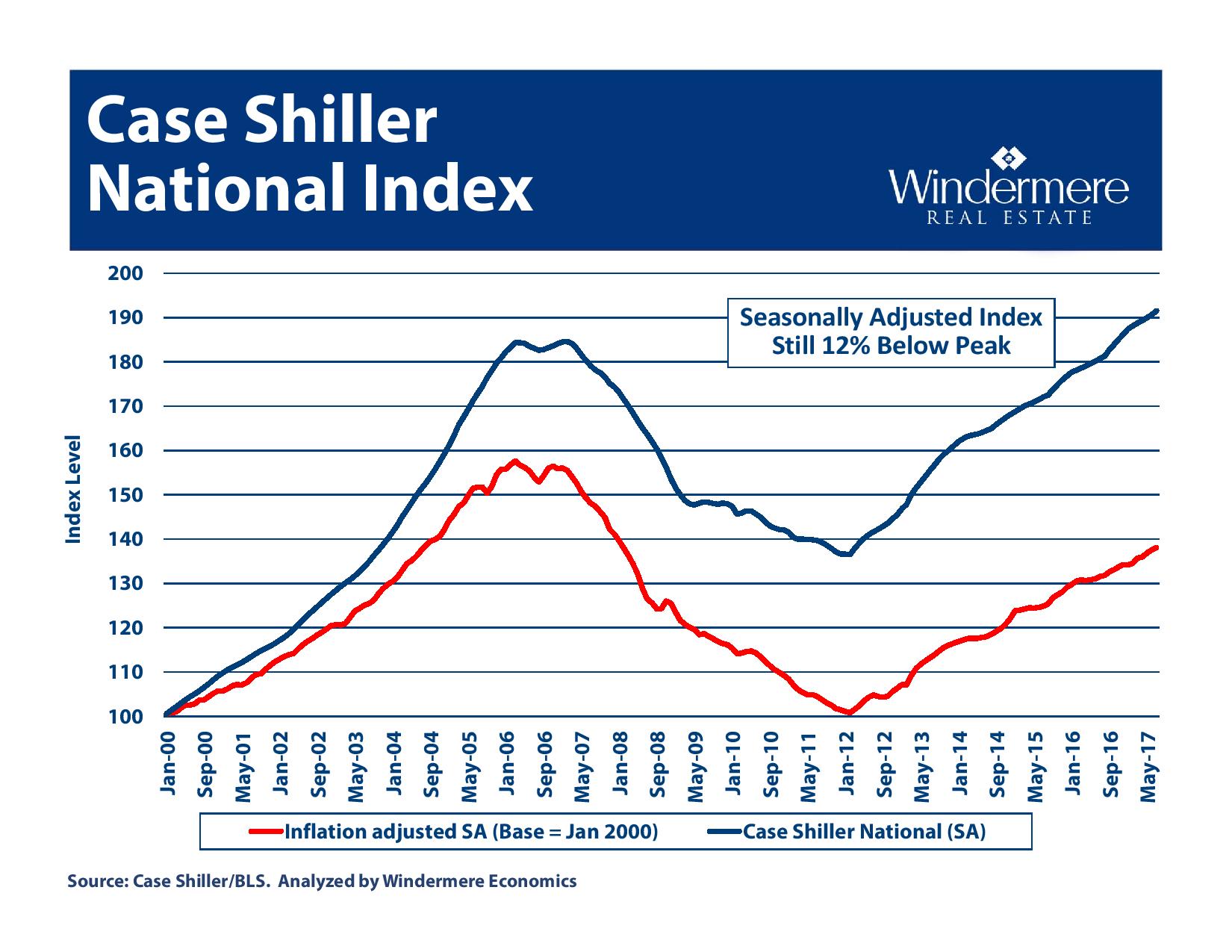

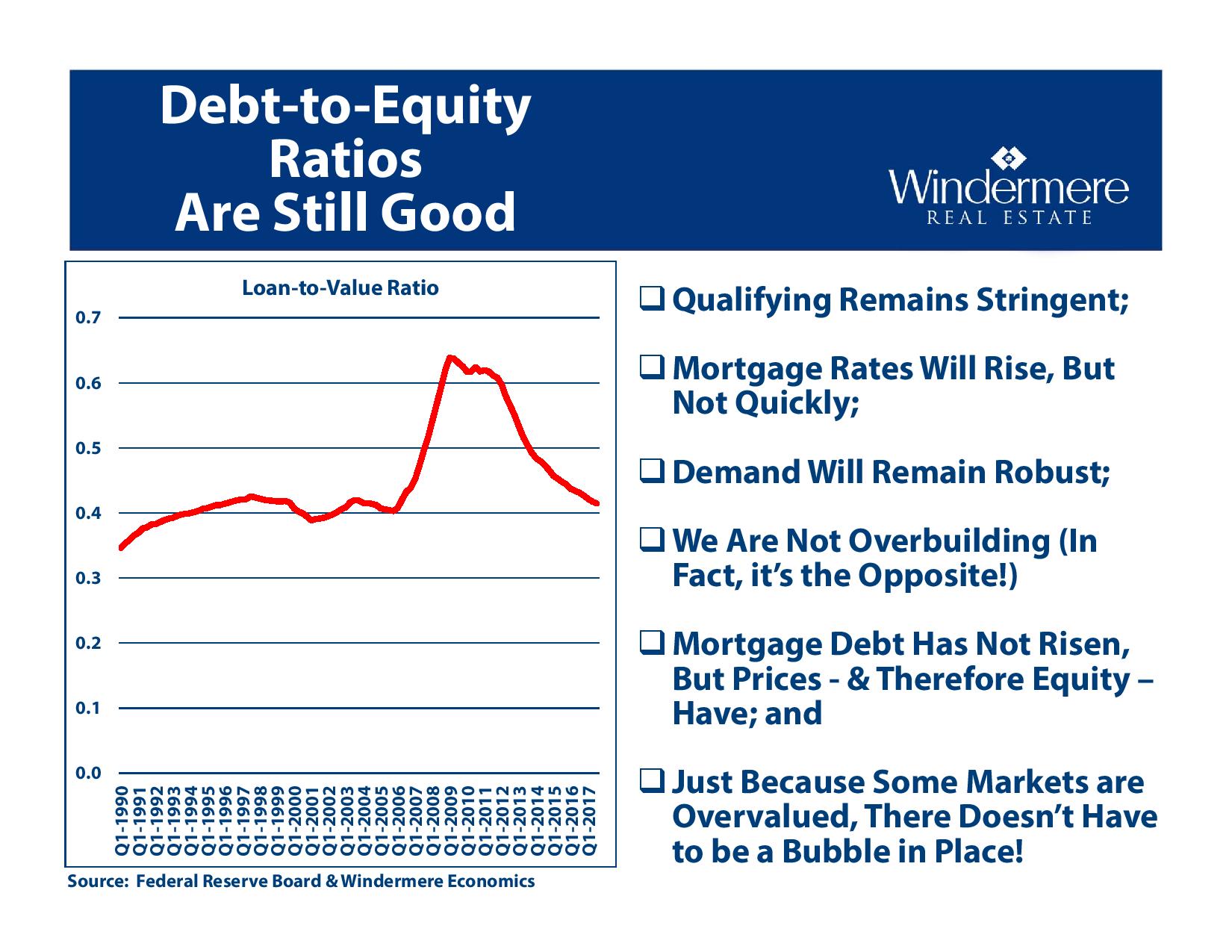

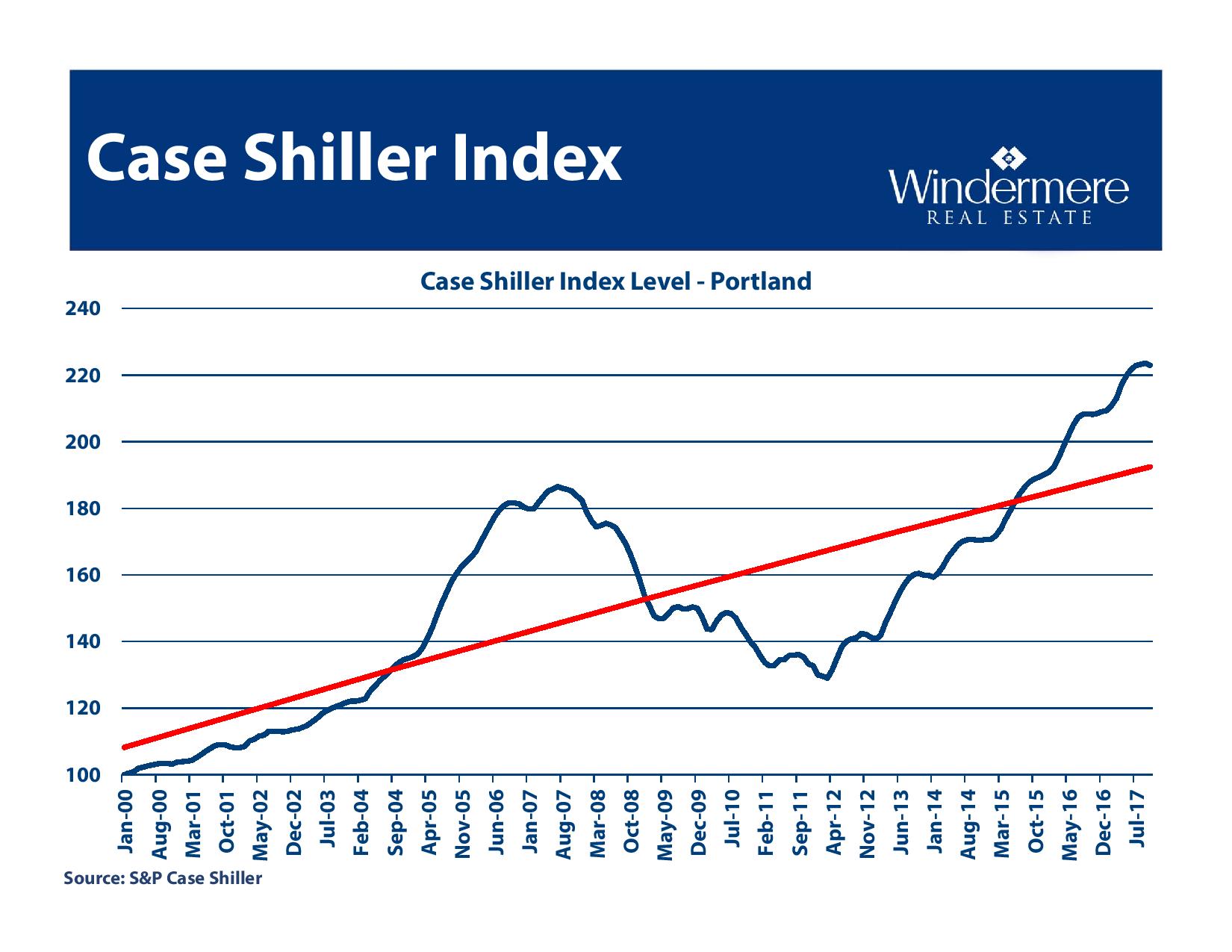

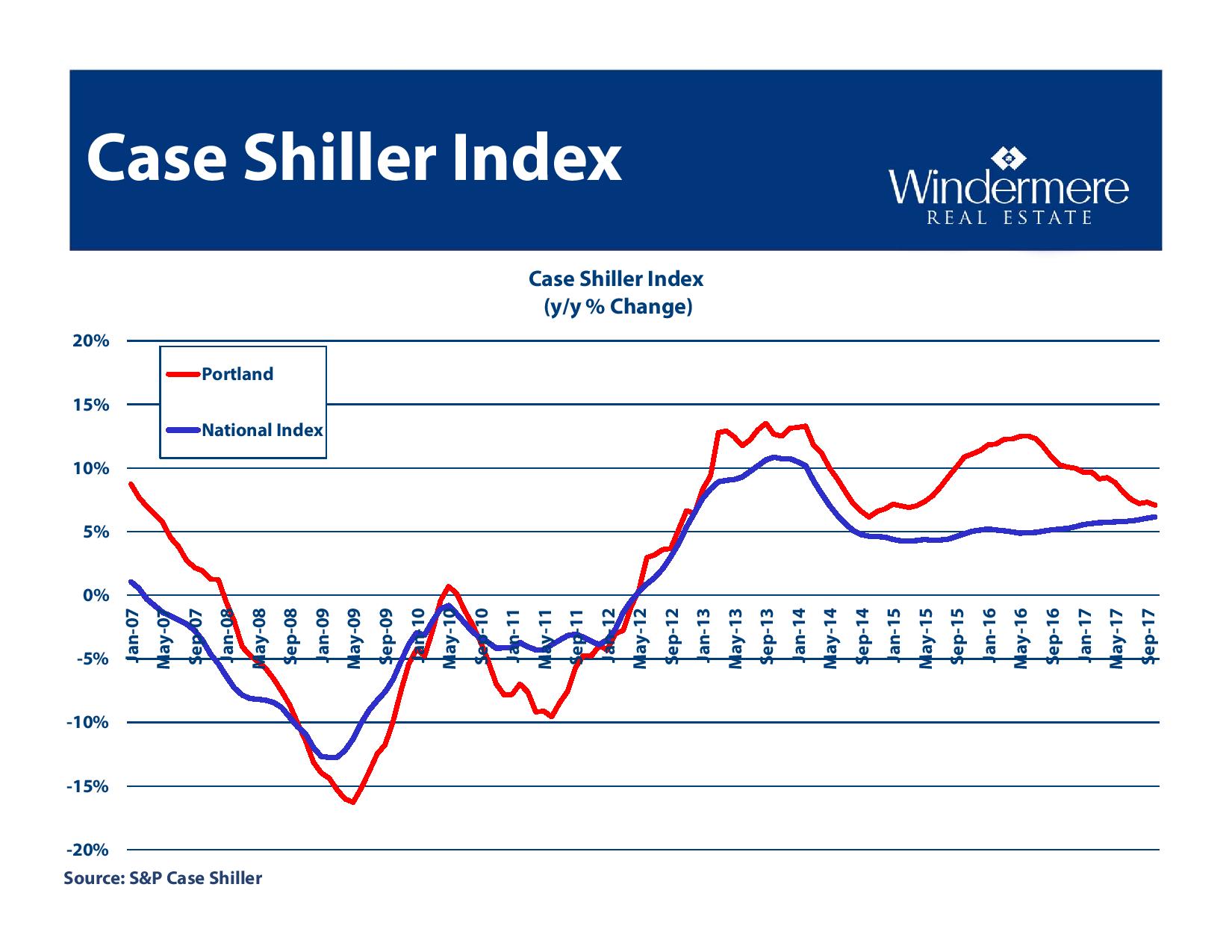

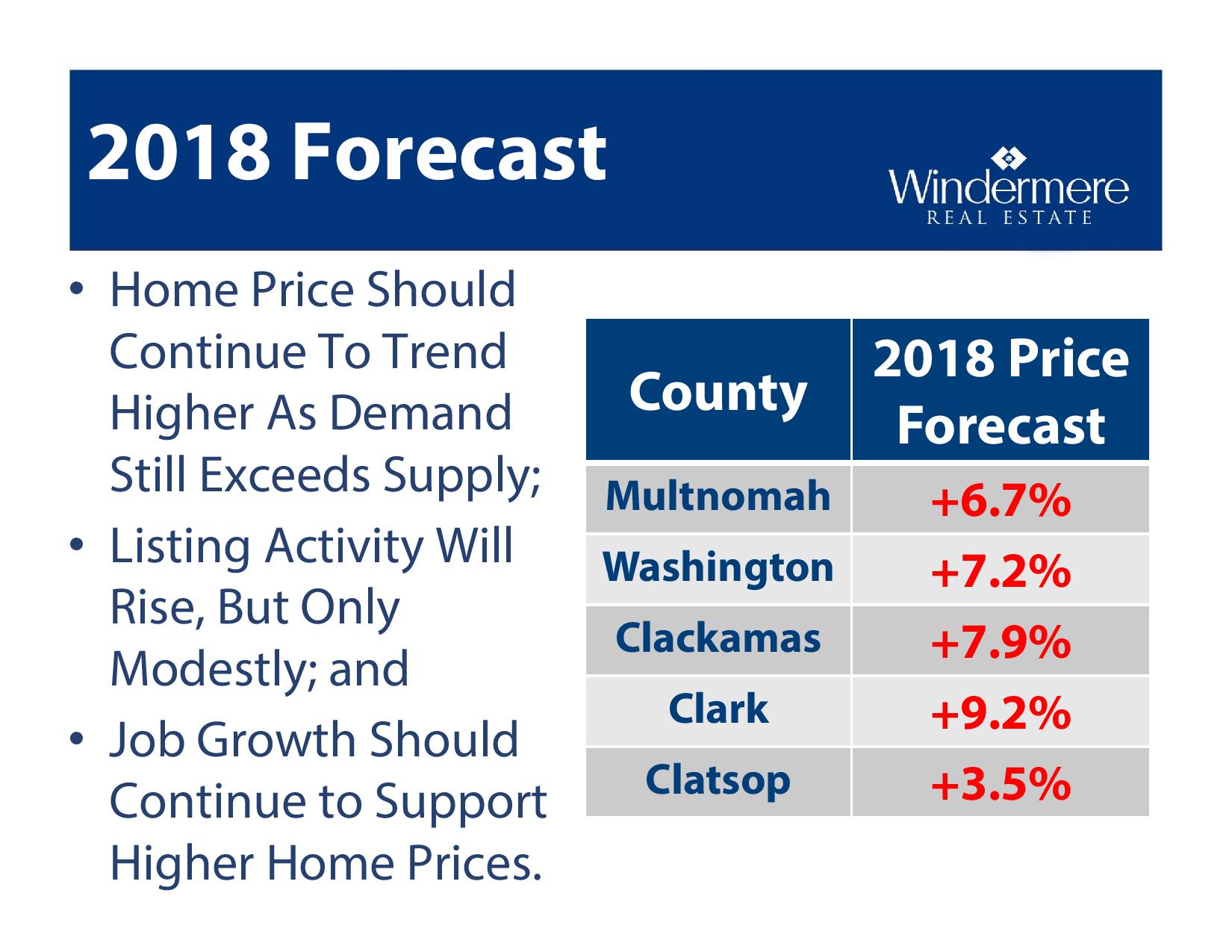

Portland is not in a bubble. But price growth is slowing.

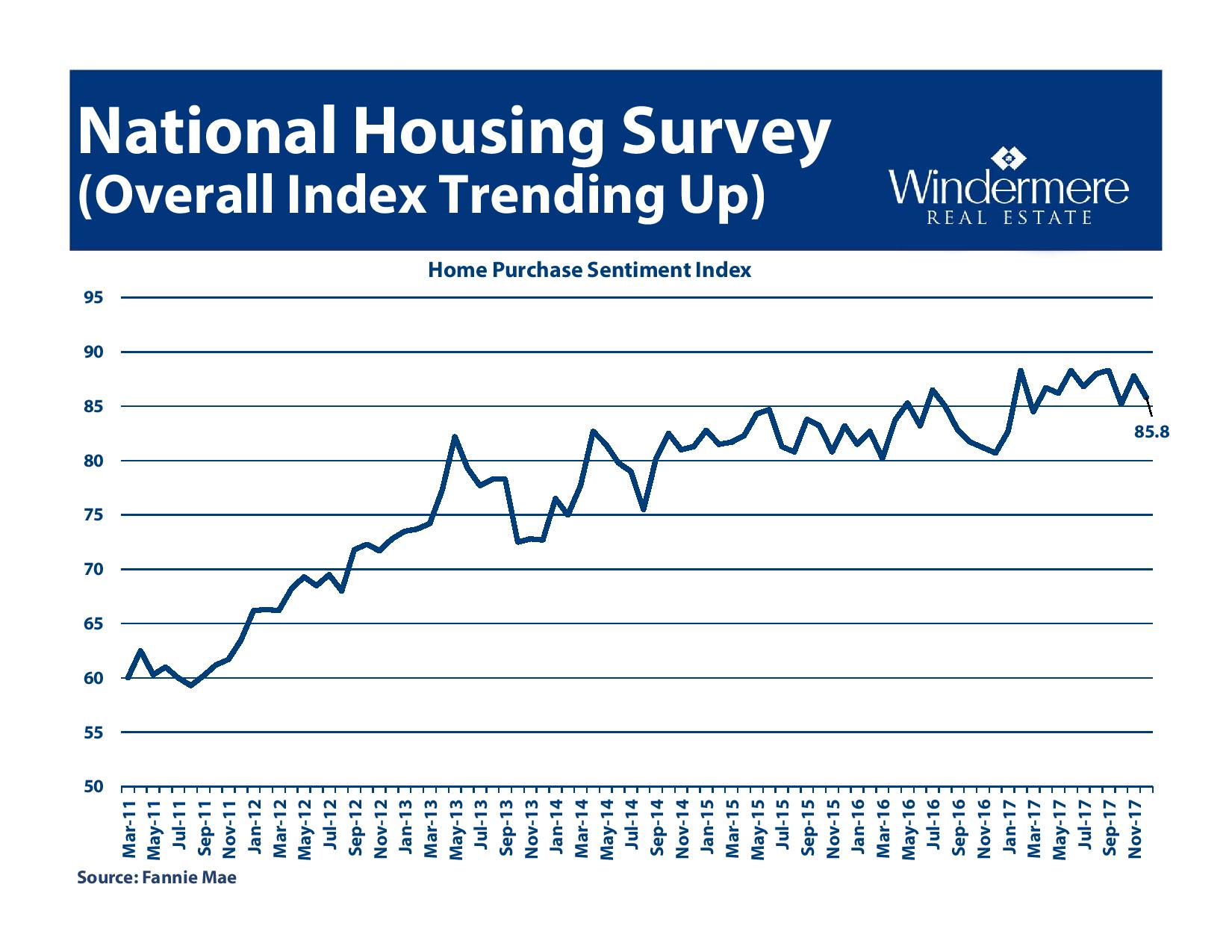

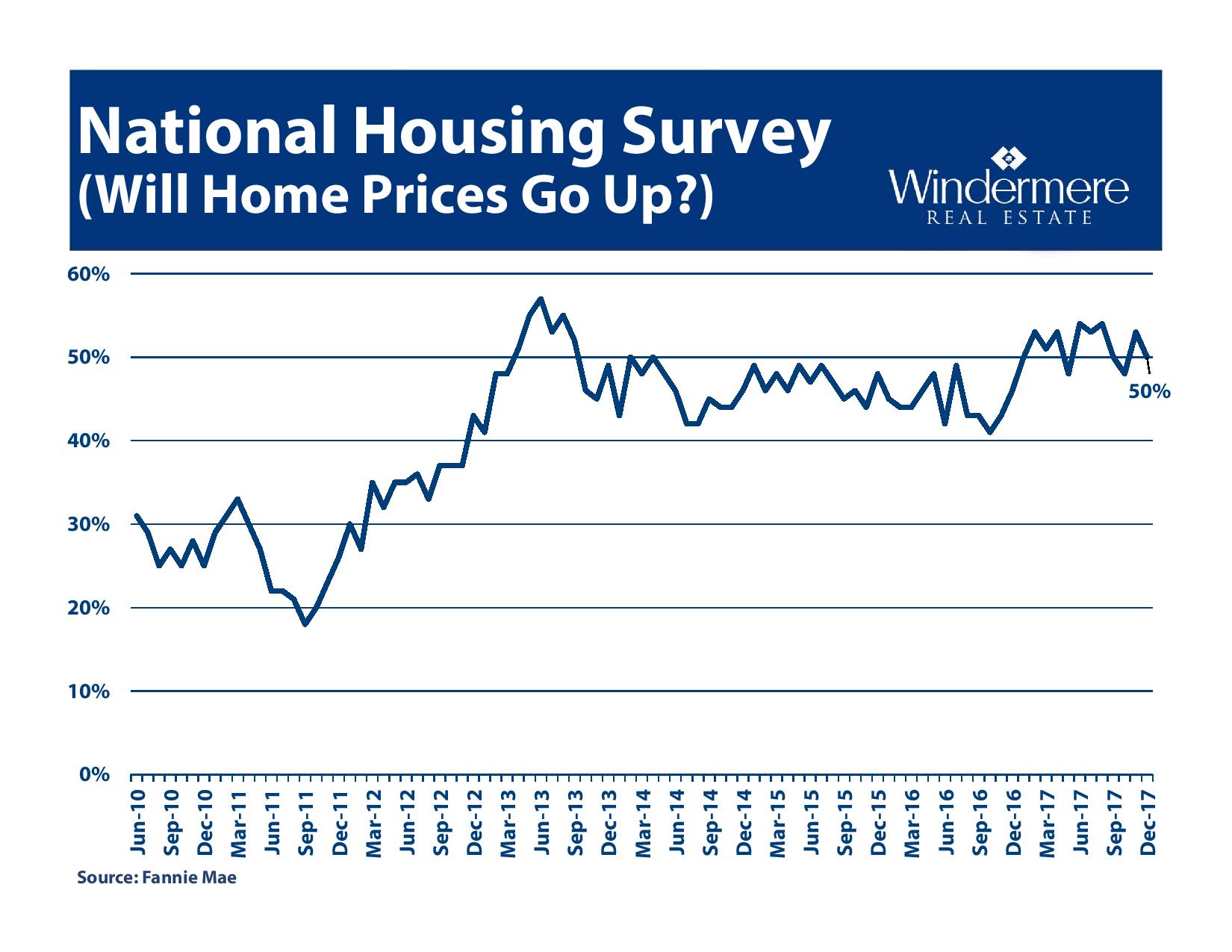

The incredible double-digit growth in housing prices we've seen over the past 5 years is not sustainable. We're predicting 2018 home value growth between 6-7%. This is based on This is still strong growth, but less than we've been used to in the past few years. Here are the reasons why:

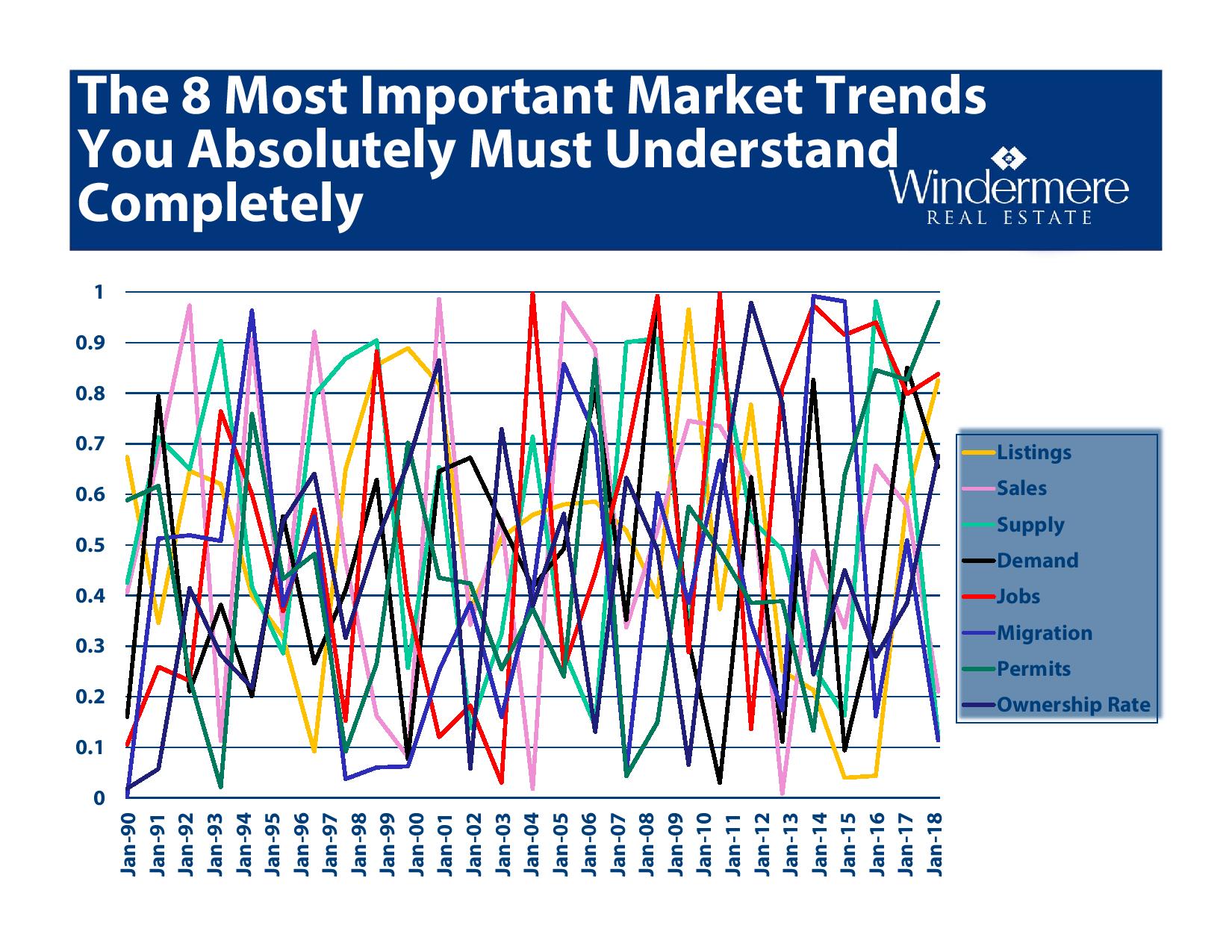

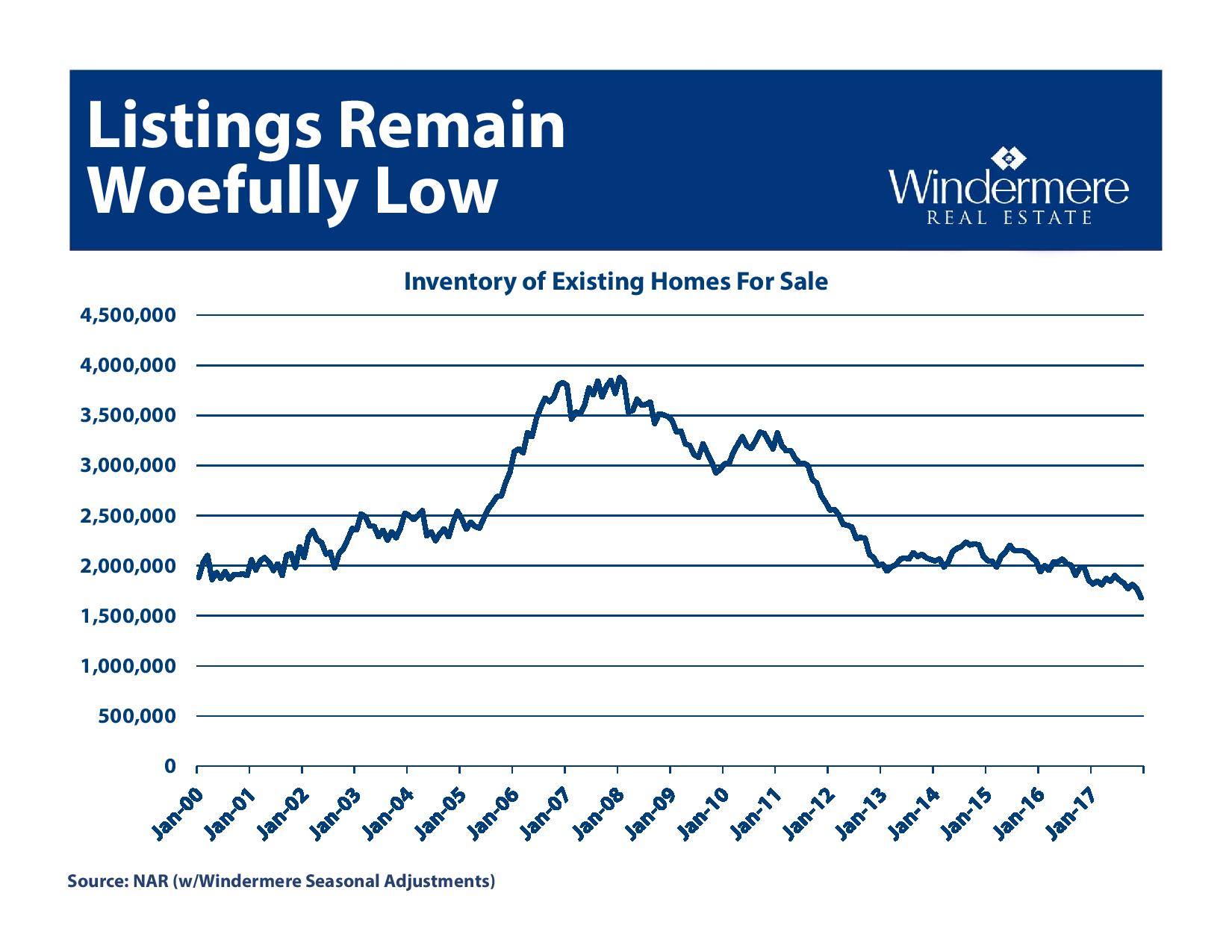

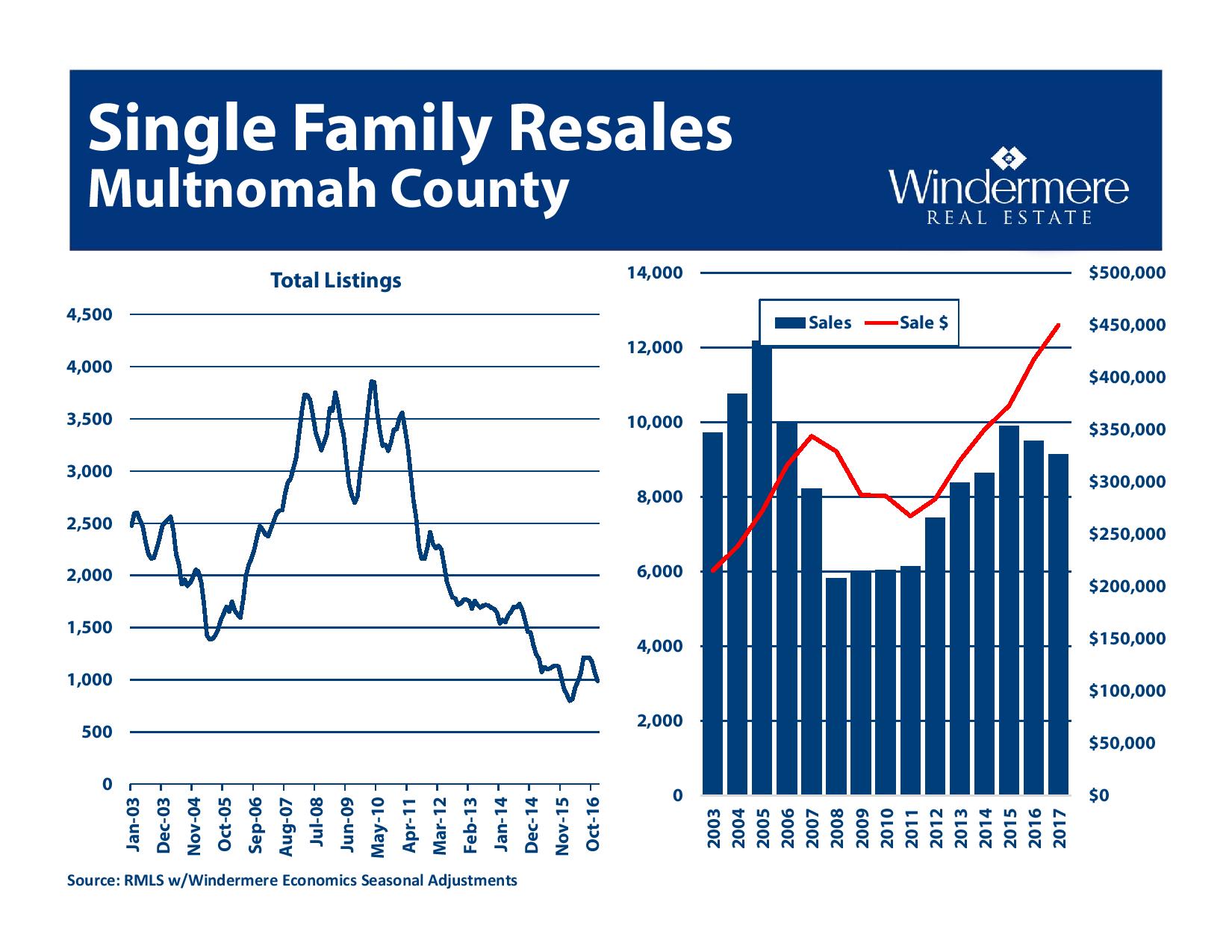

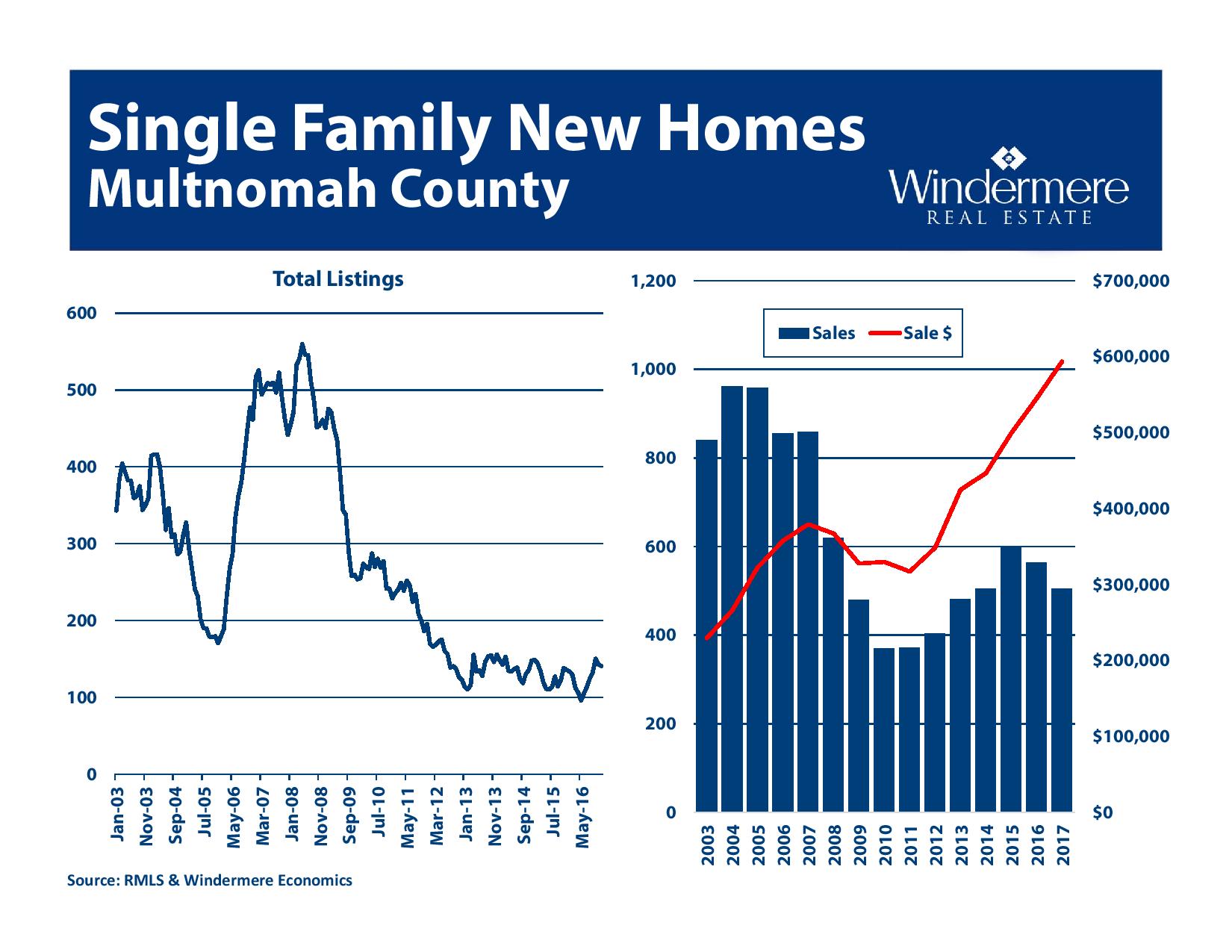

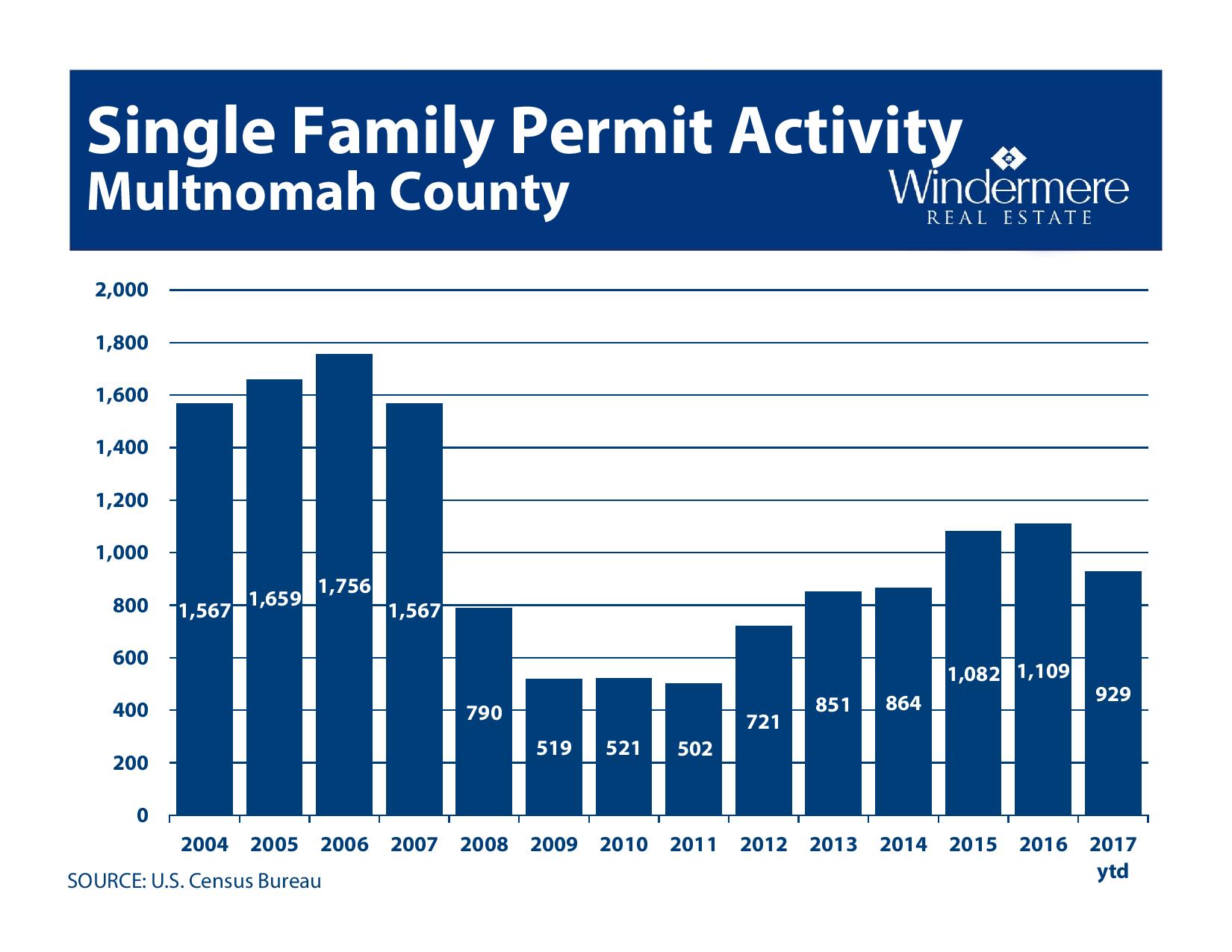

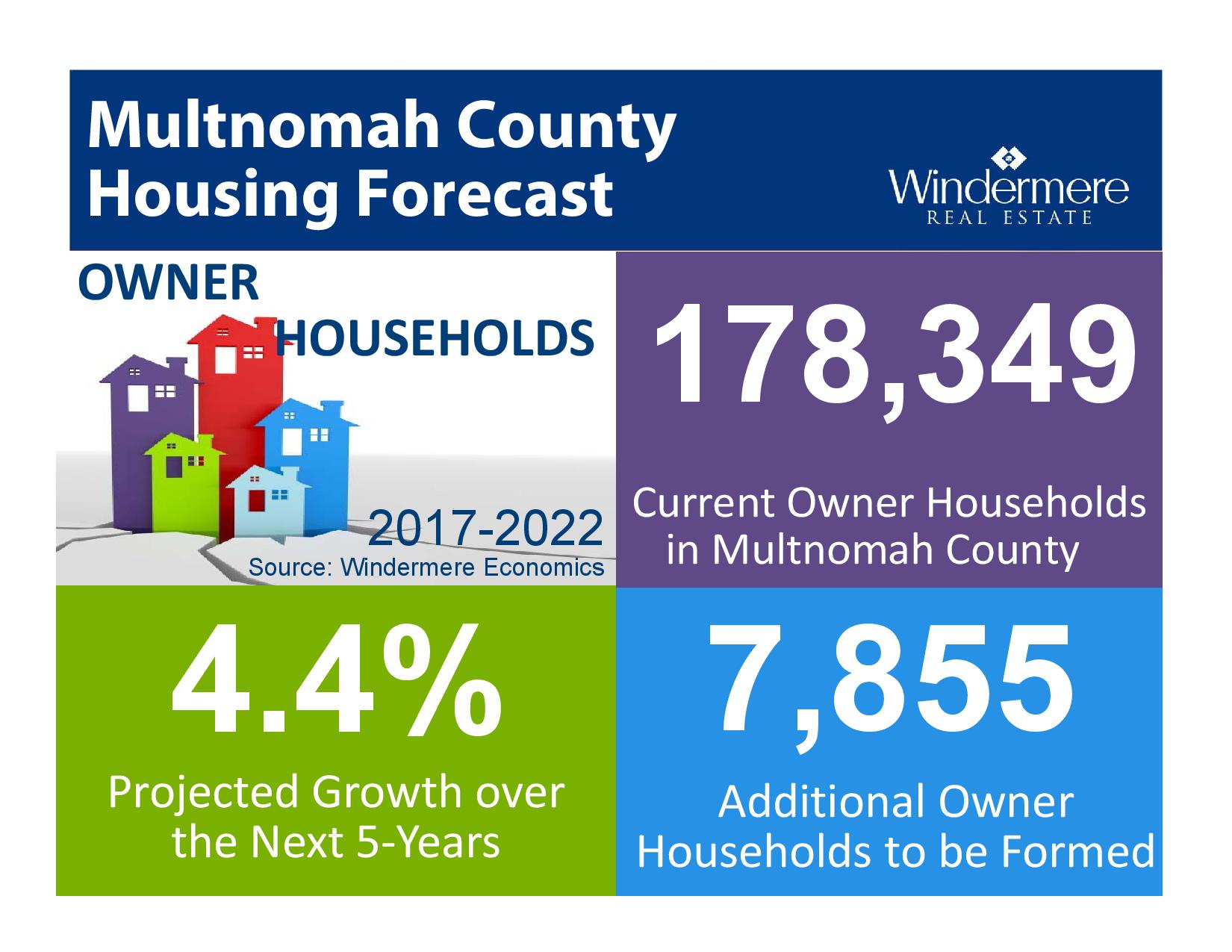

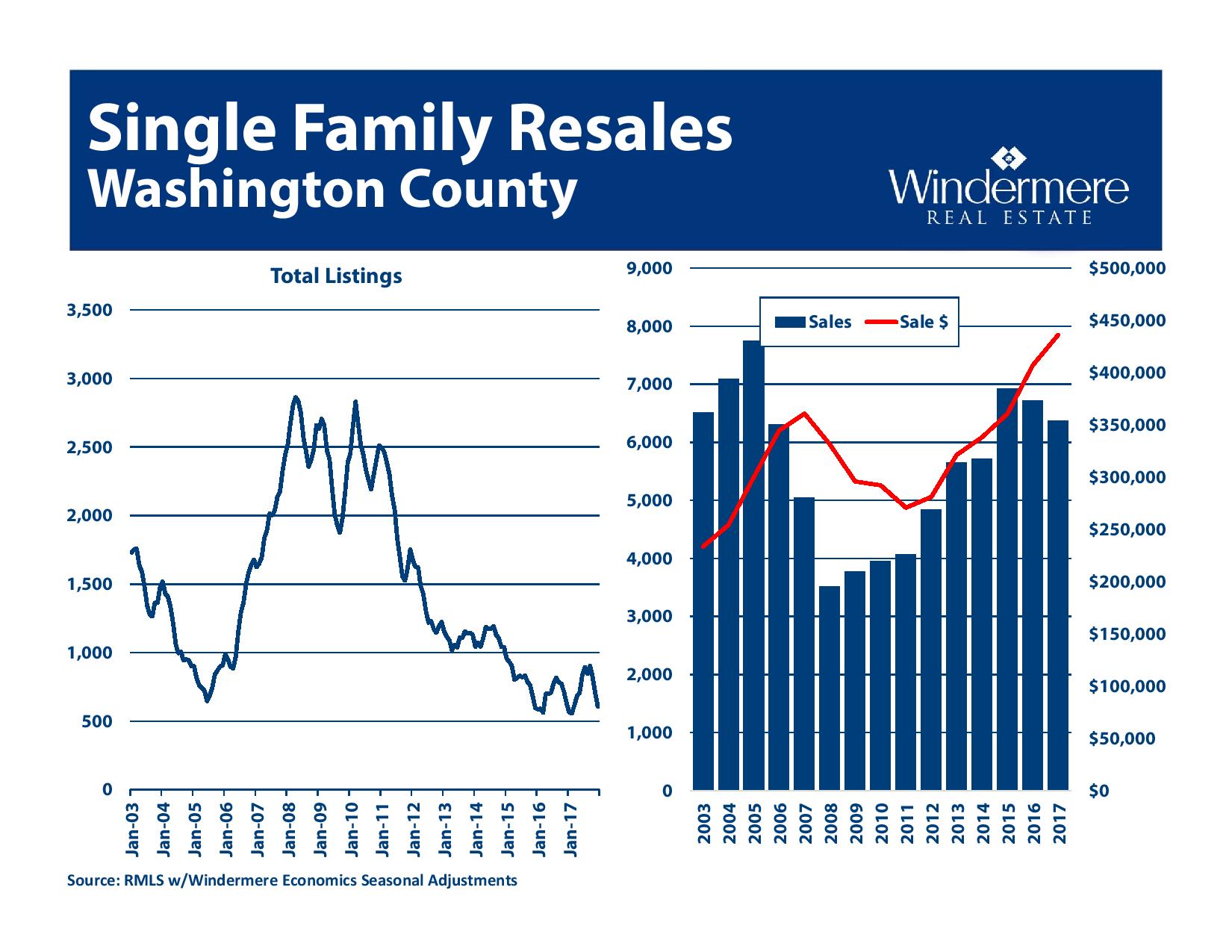

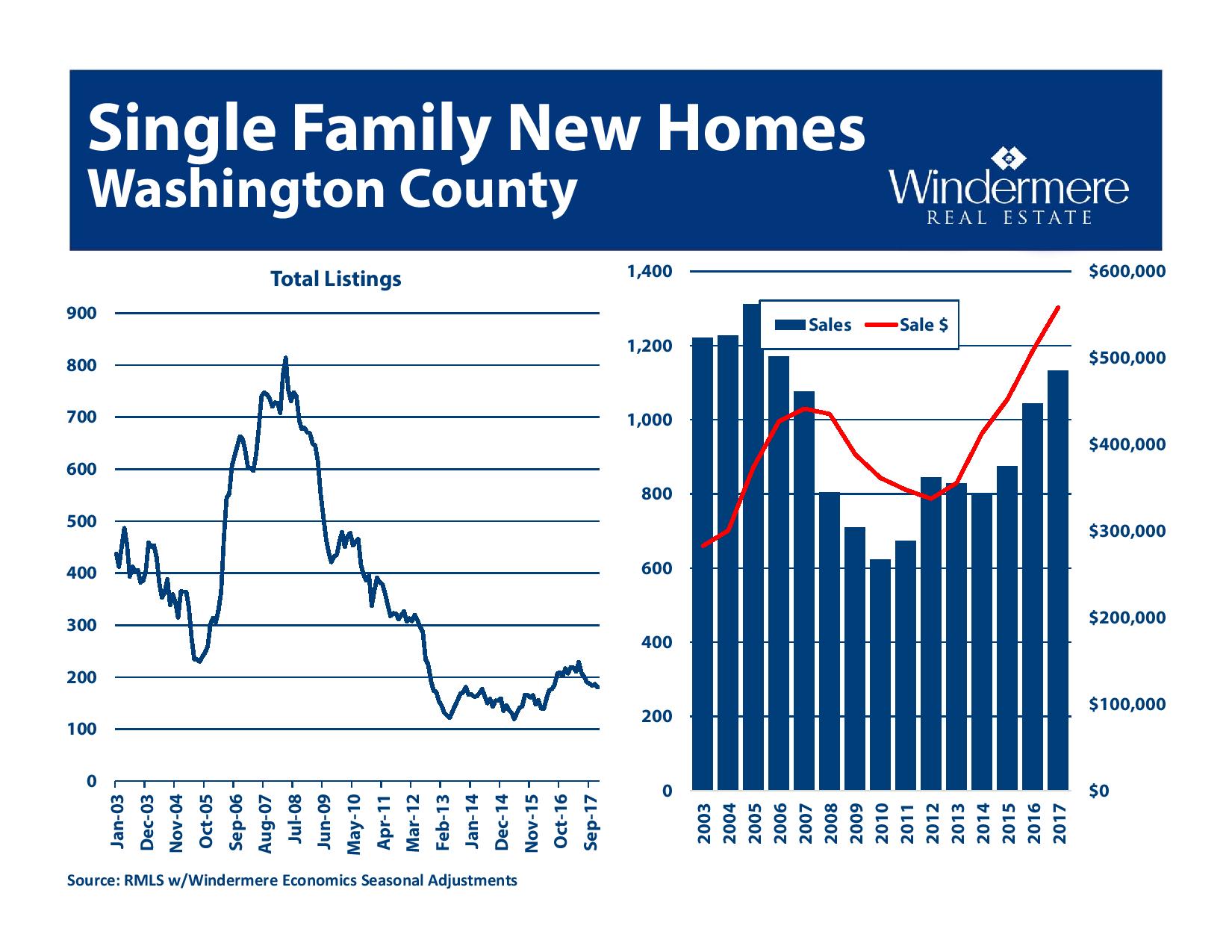

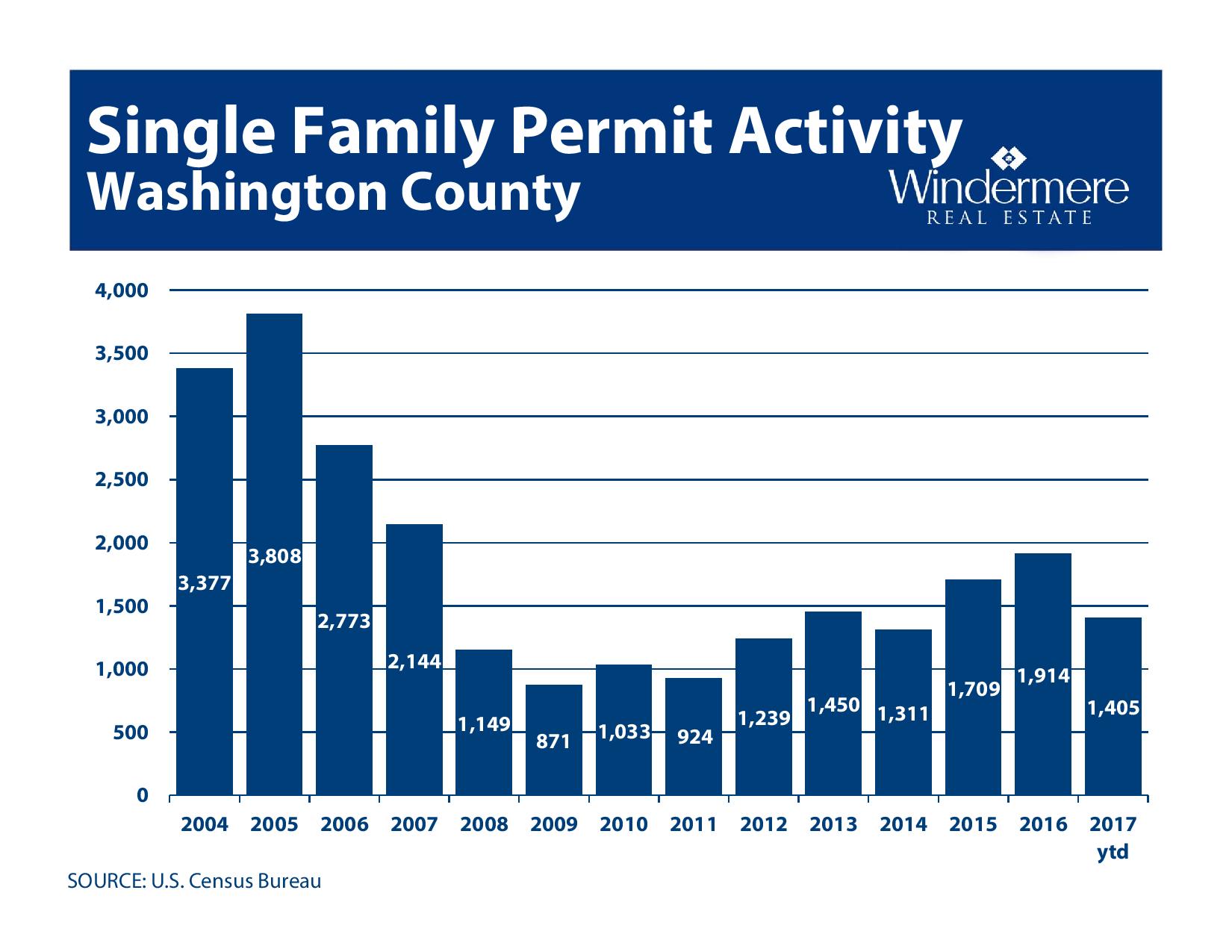

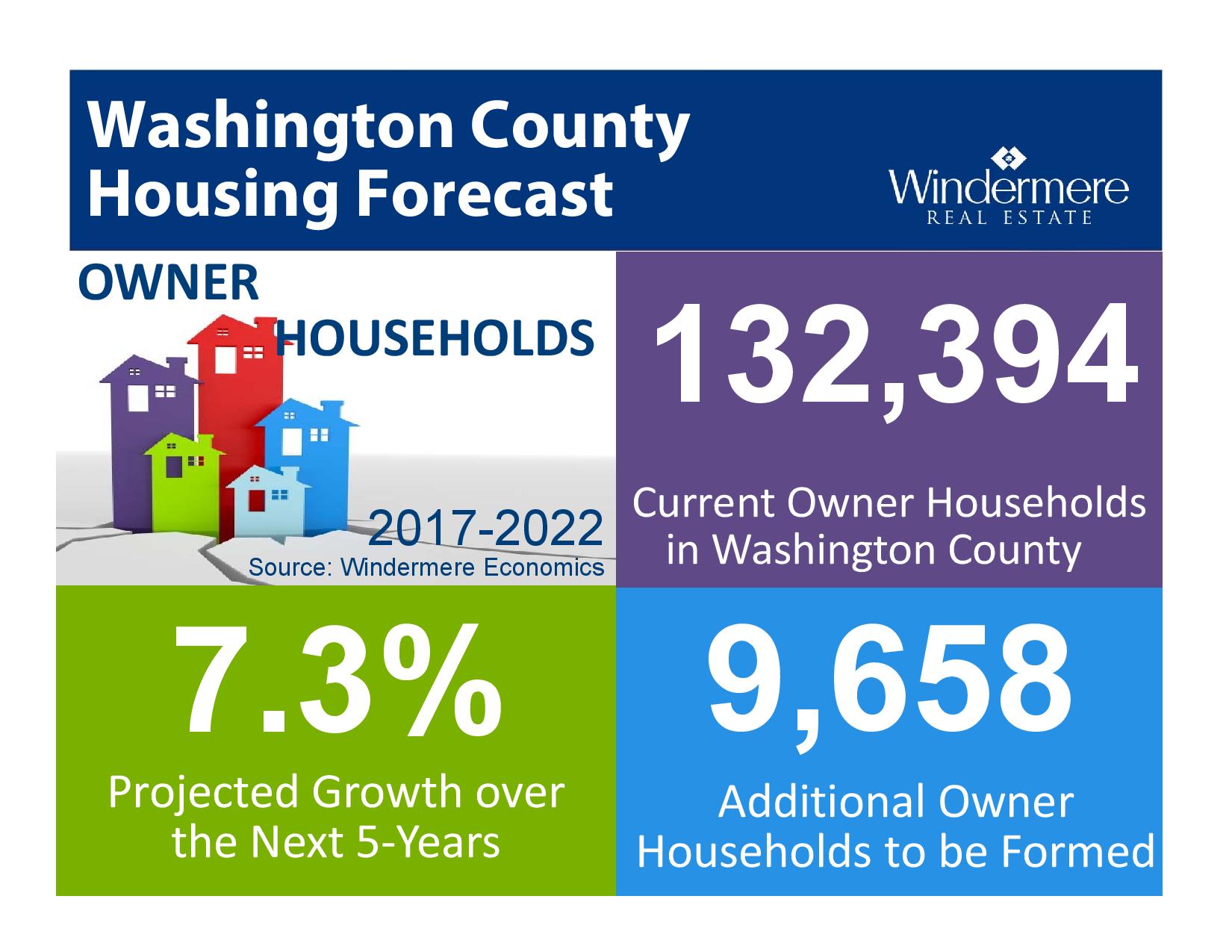

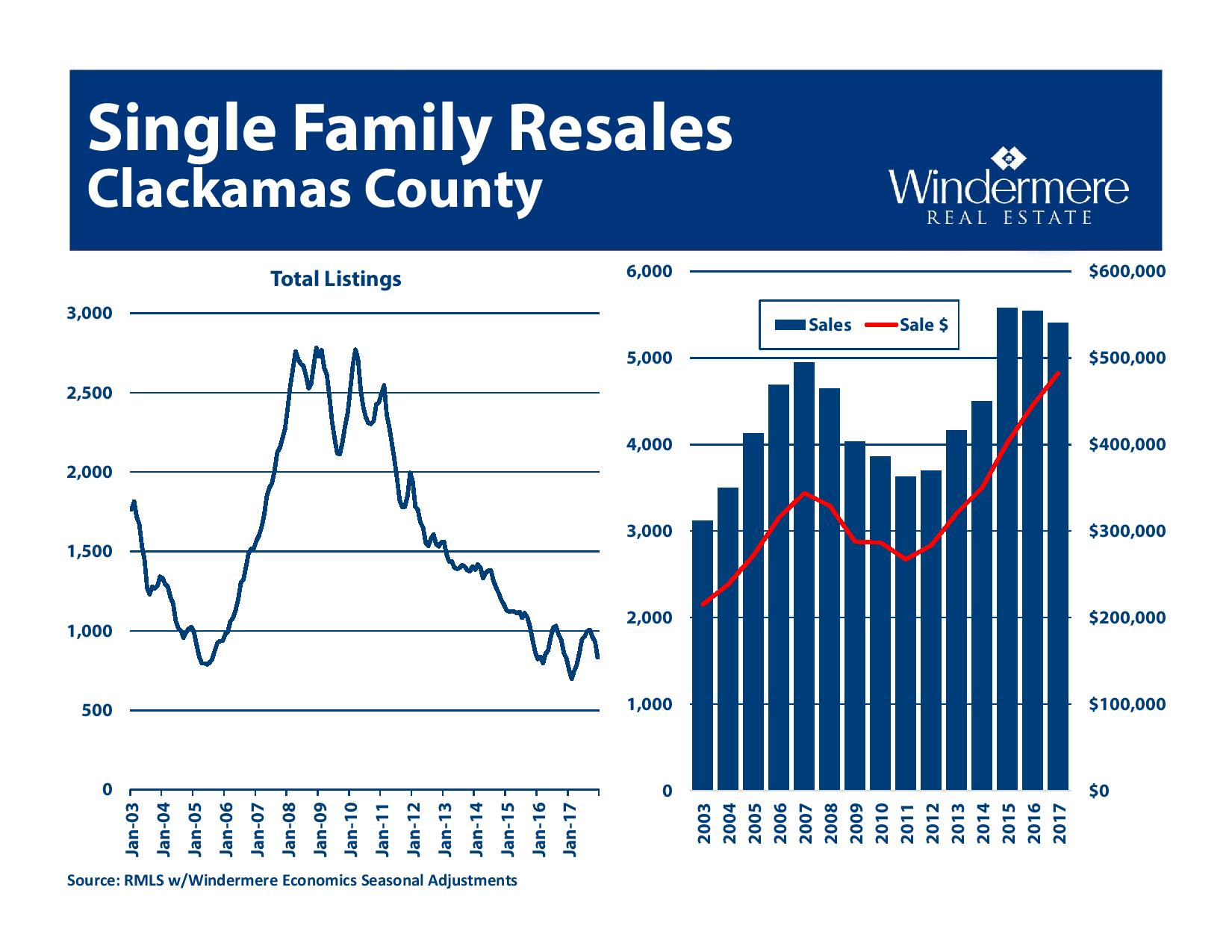

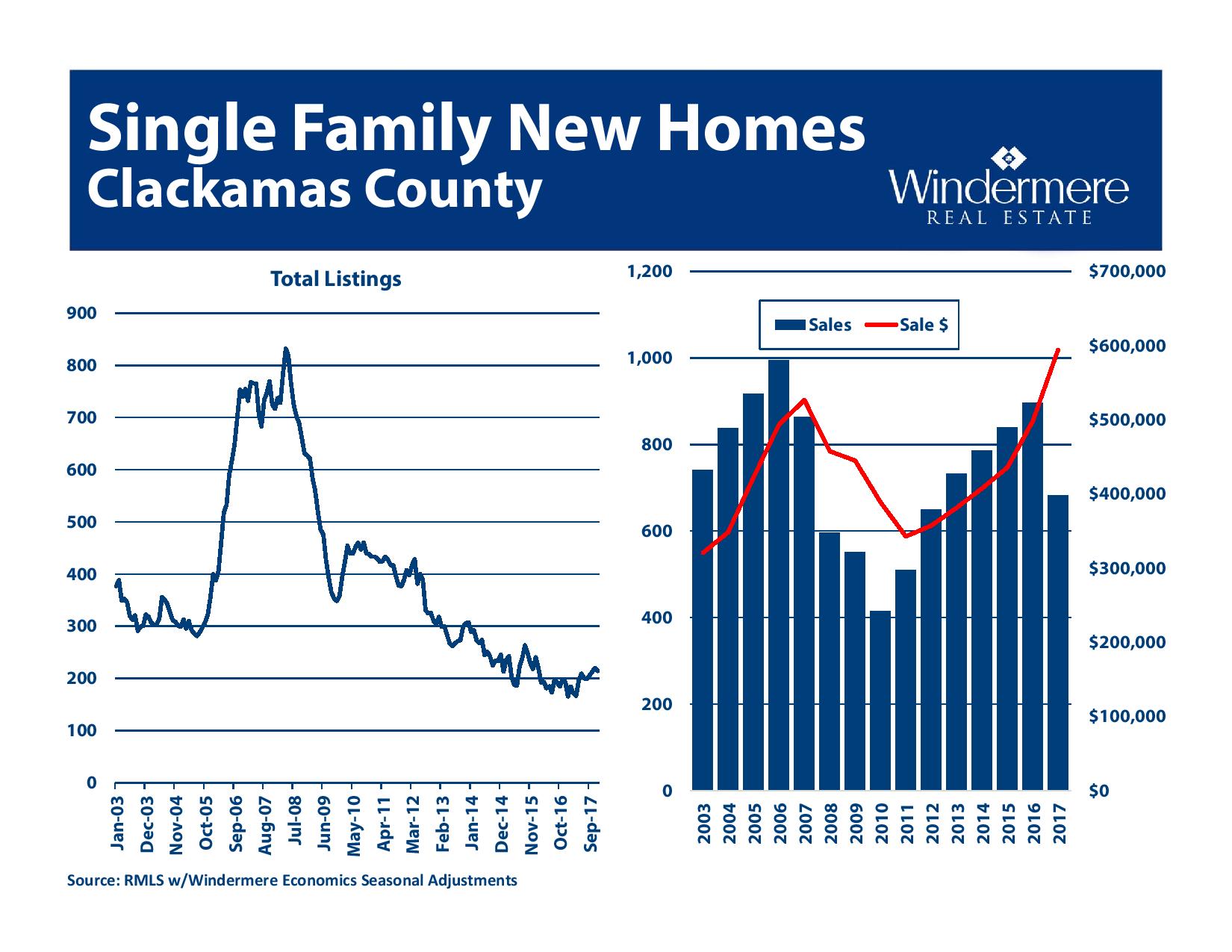

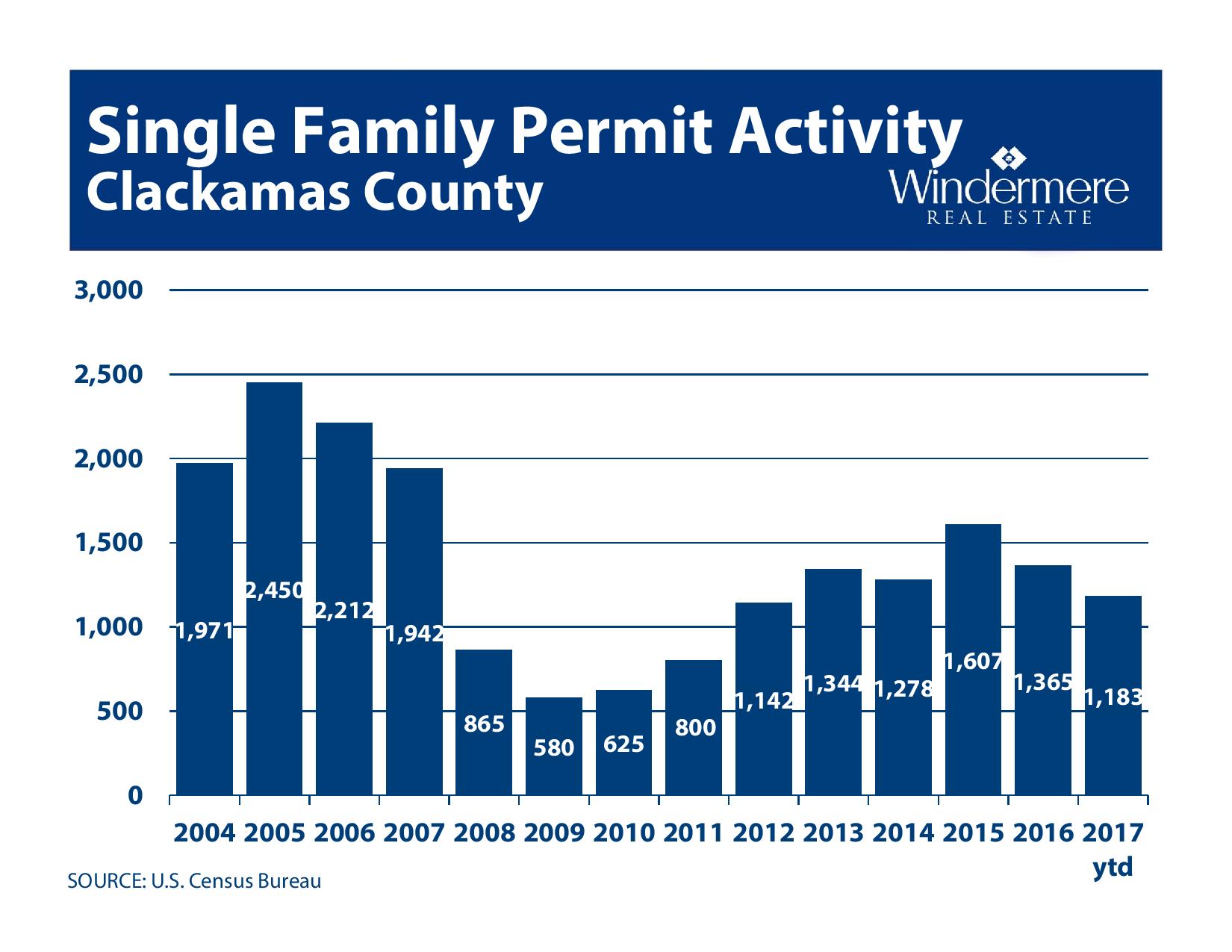

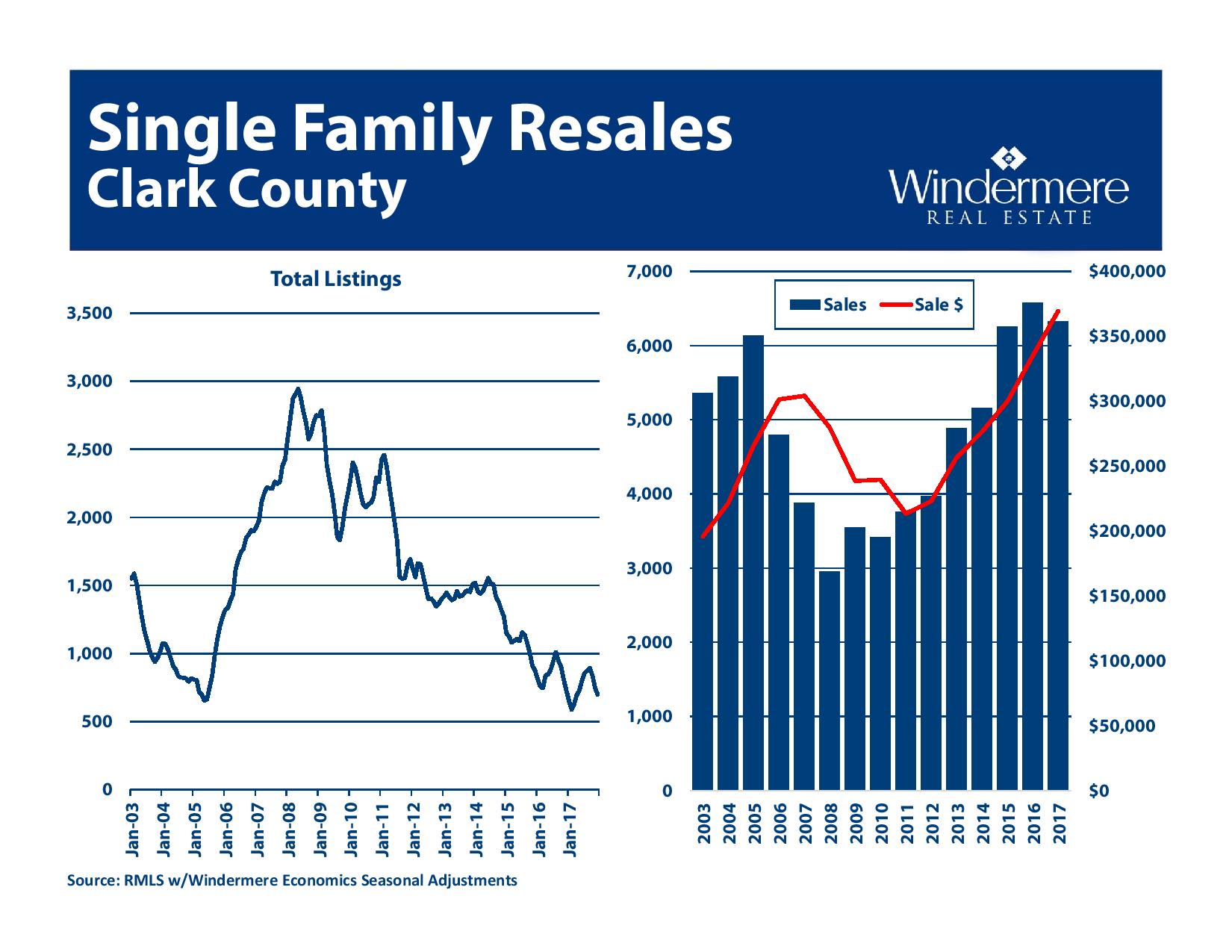

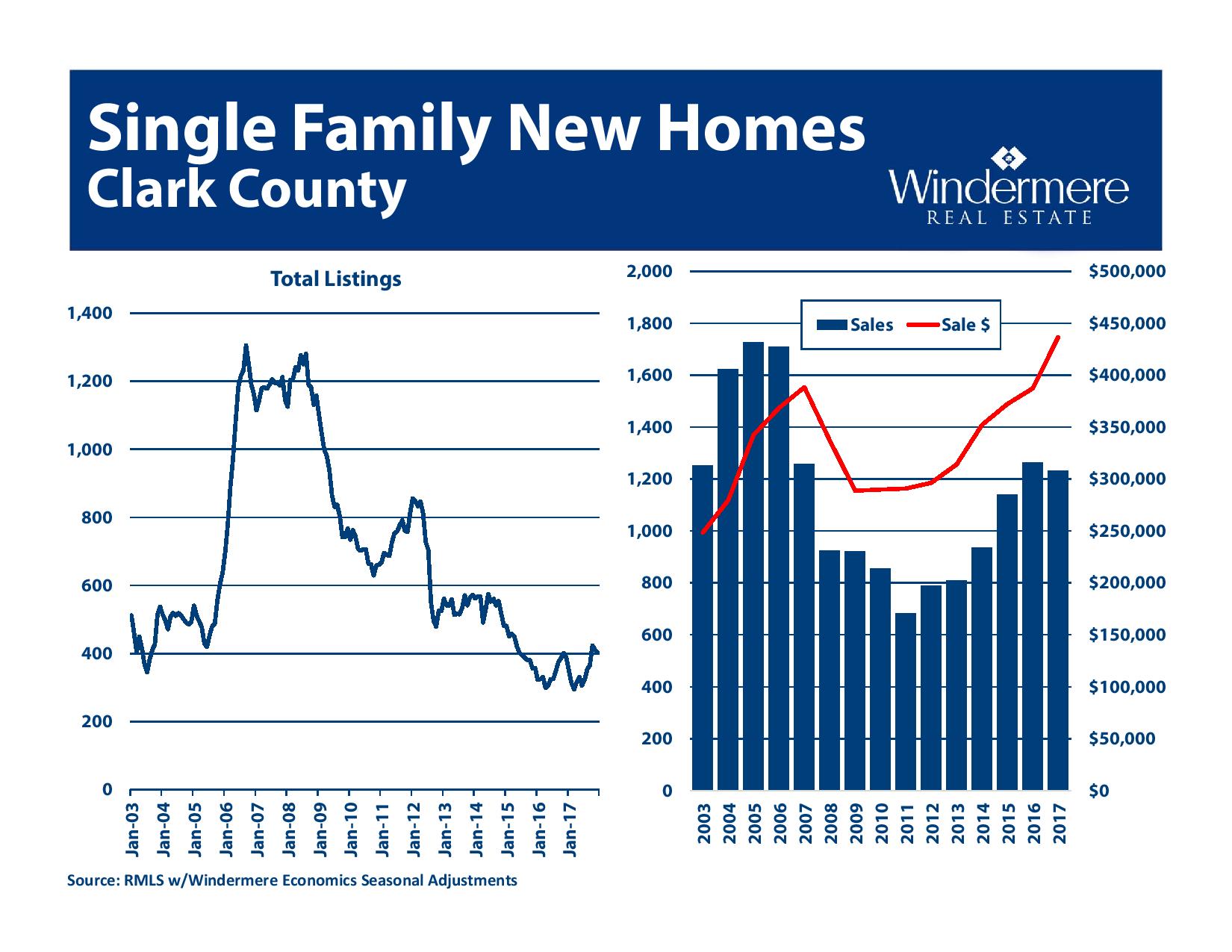

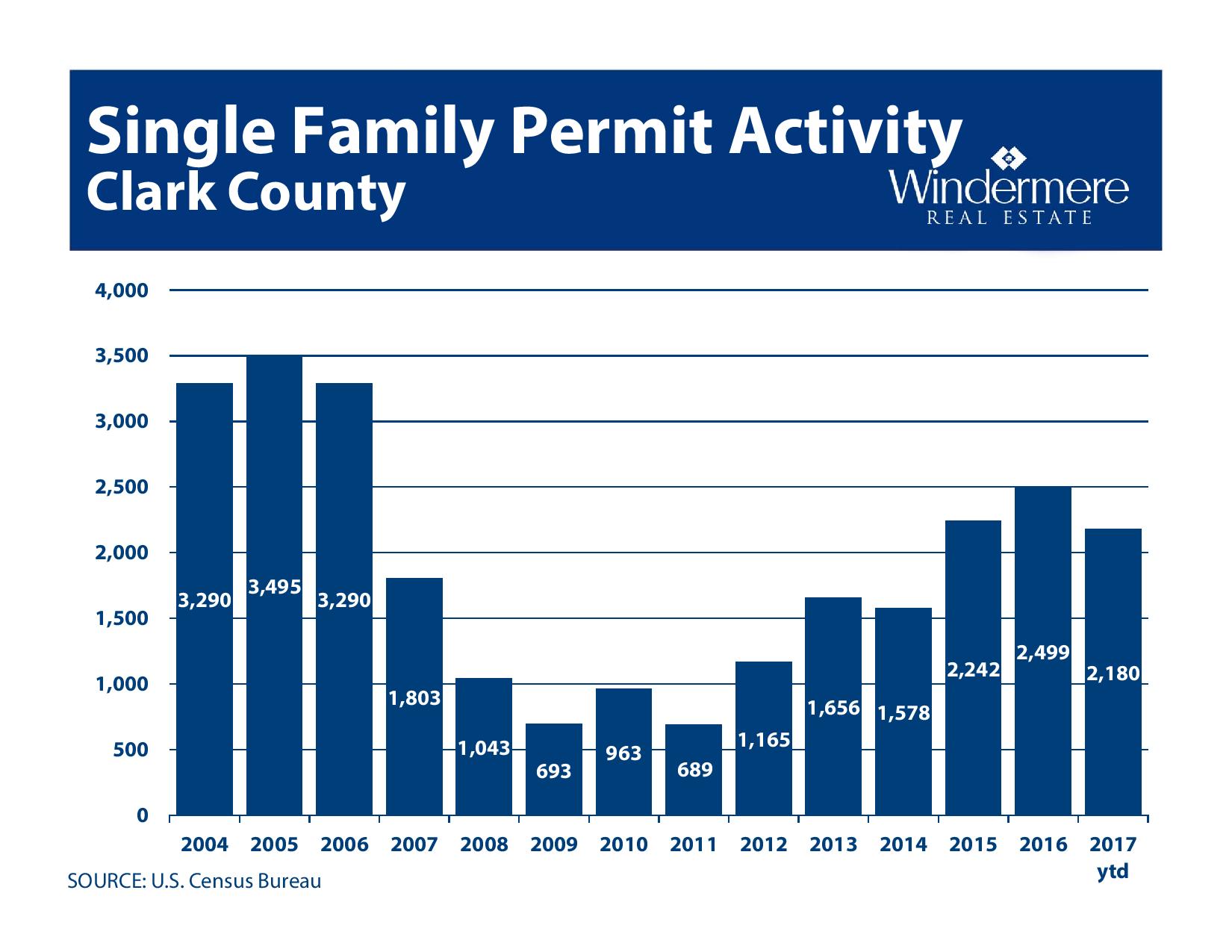

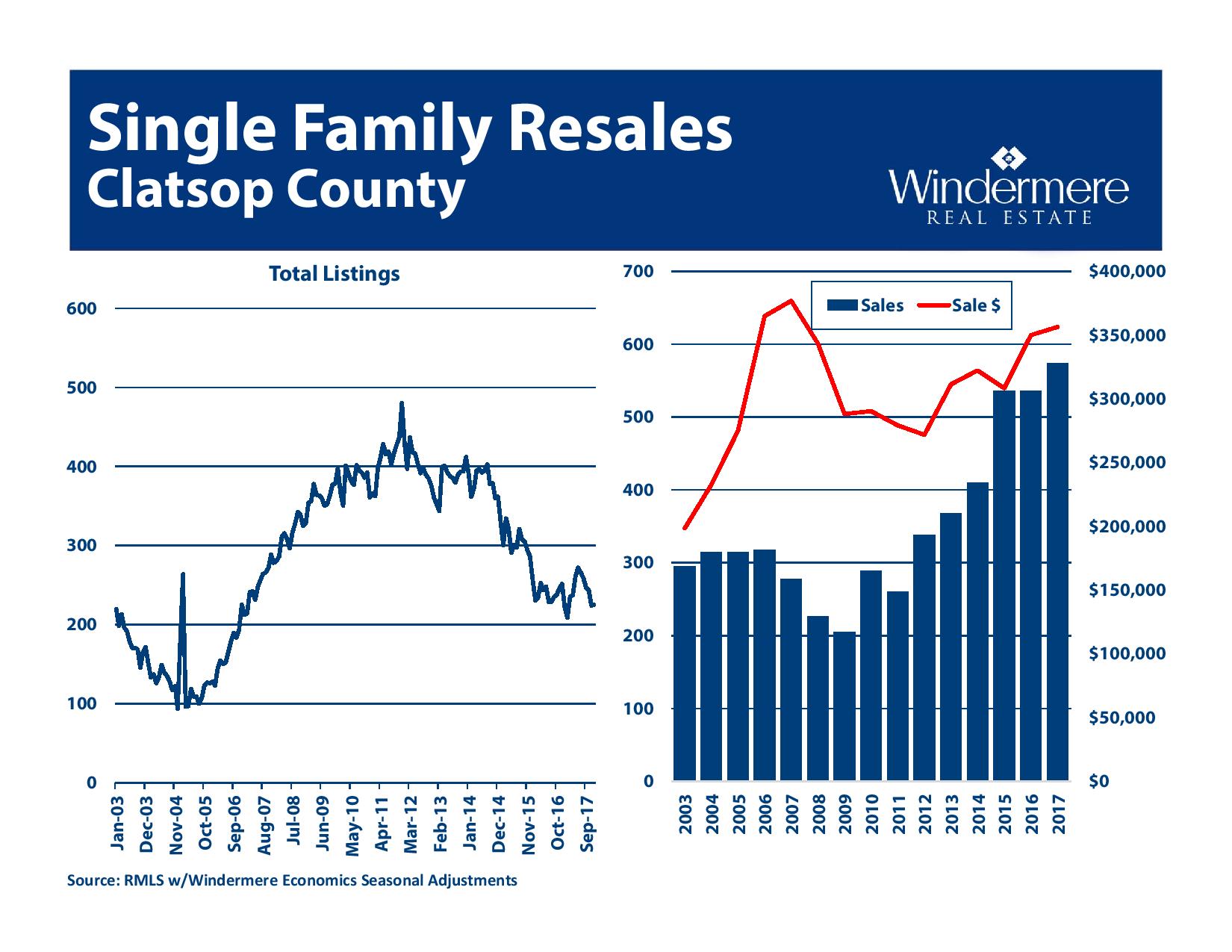

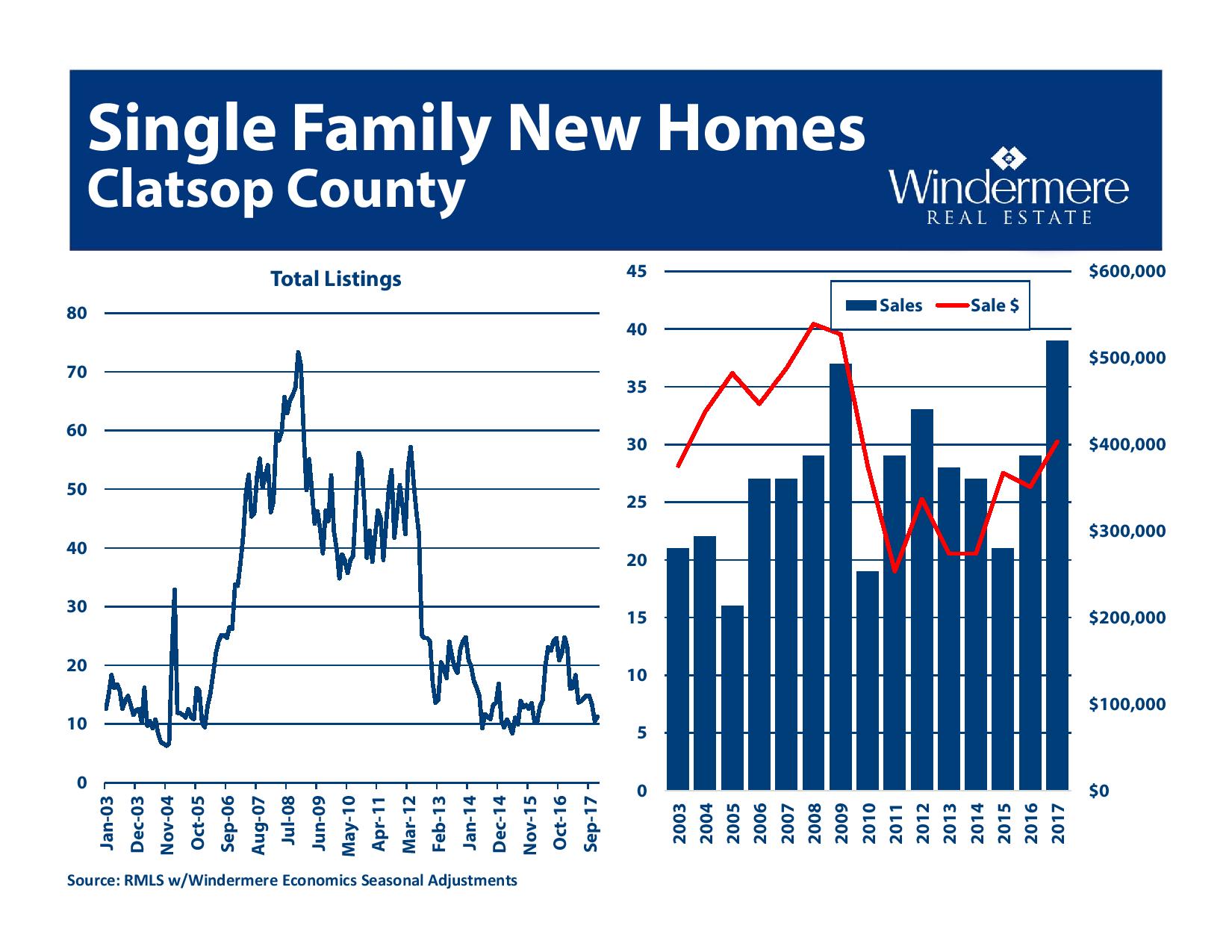

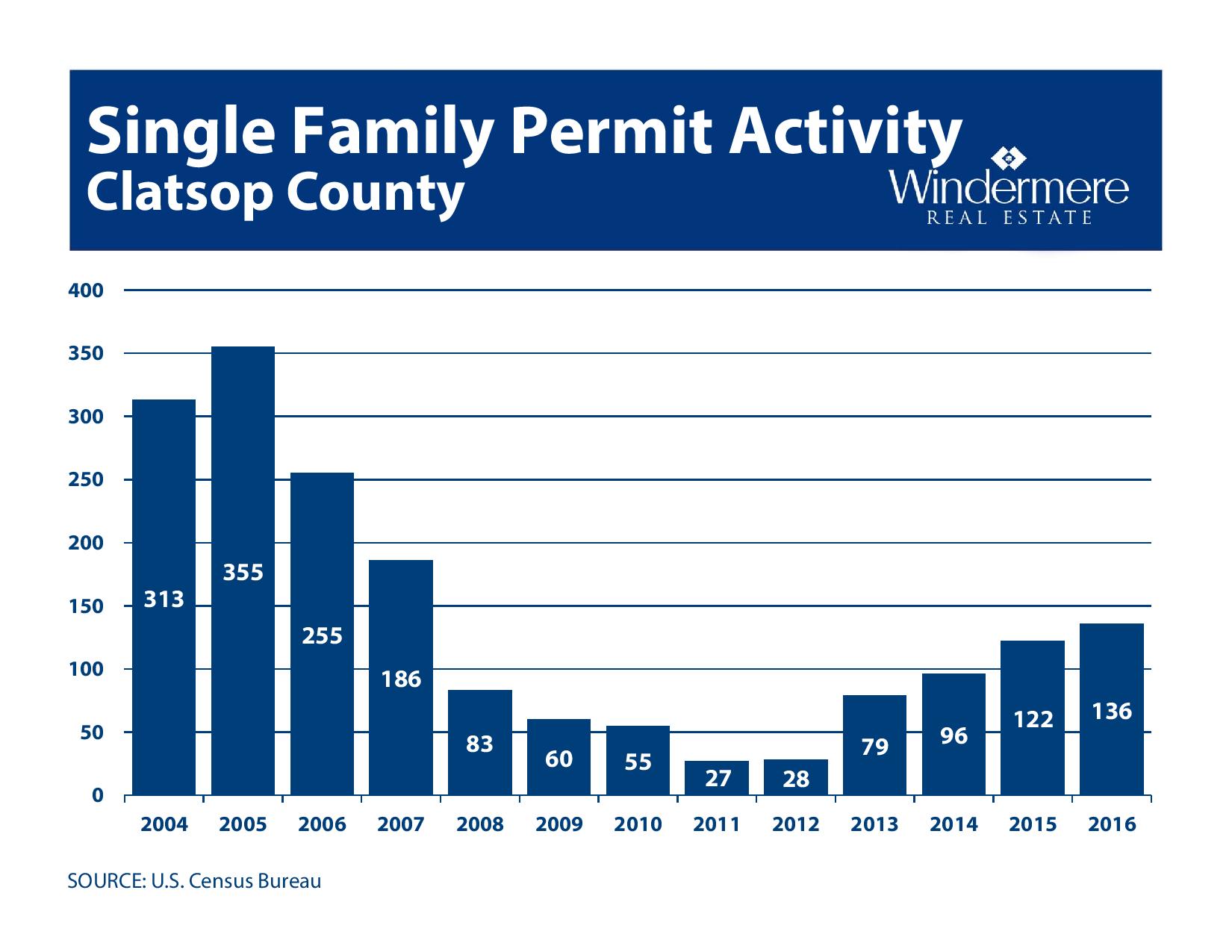

Low supply - there aren't many homes for sale

Supply and demand determine home values. Low supply continues to push prices. Multiple factors are keeping supply low:

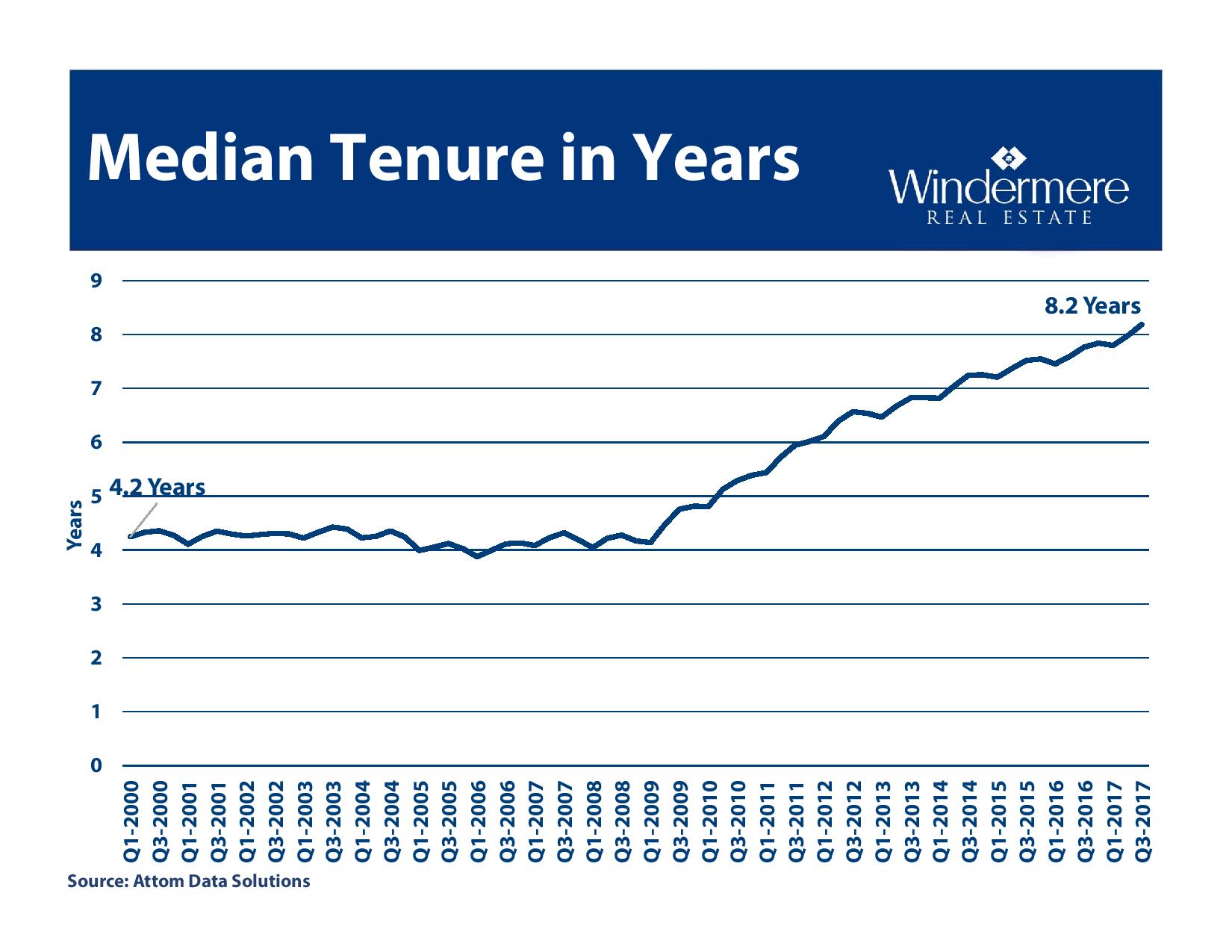

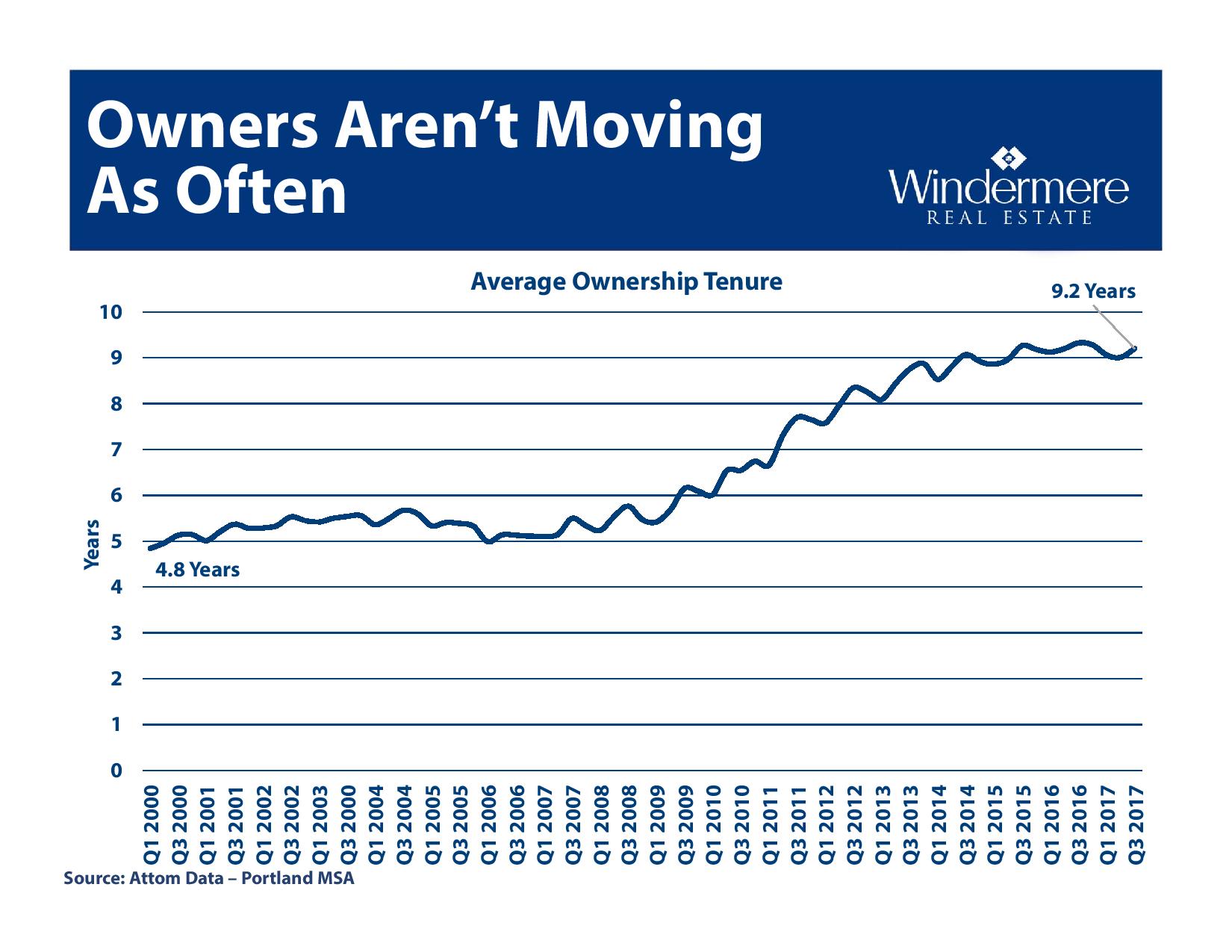

- We are living in our homes longer. The average time in a home has nearly doubled from 4 to 8 years over the past decade

- Baby boomers are not retiring and downsizing. This is causing a lot of gridlock and not allowing people to buy move-up homes

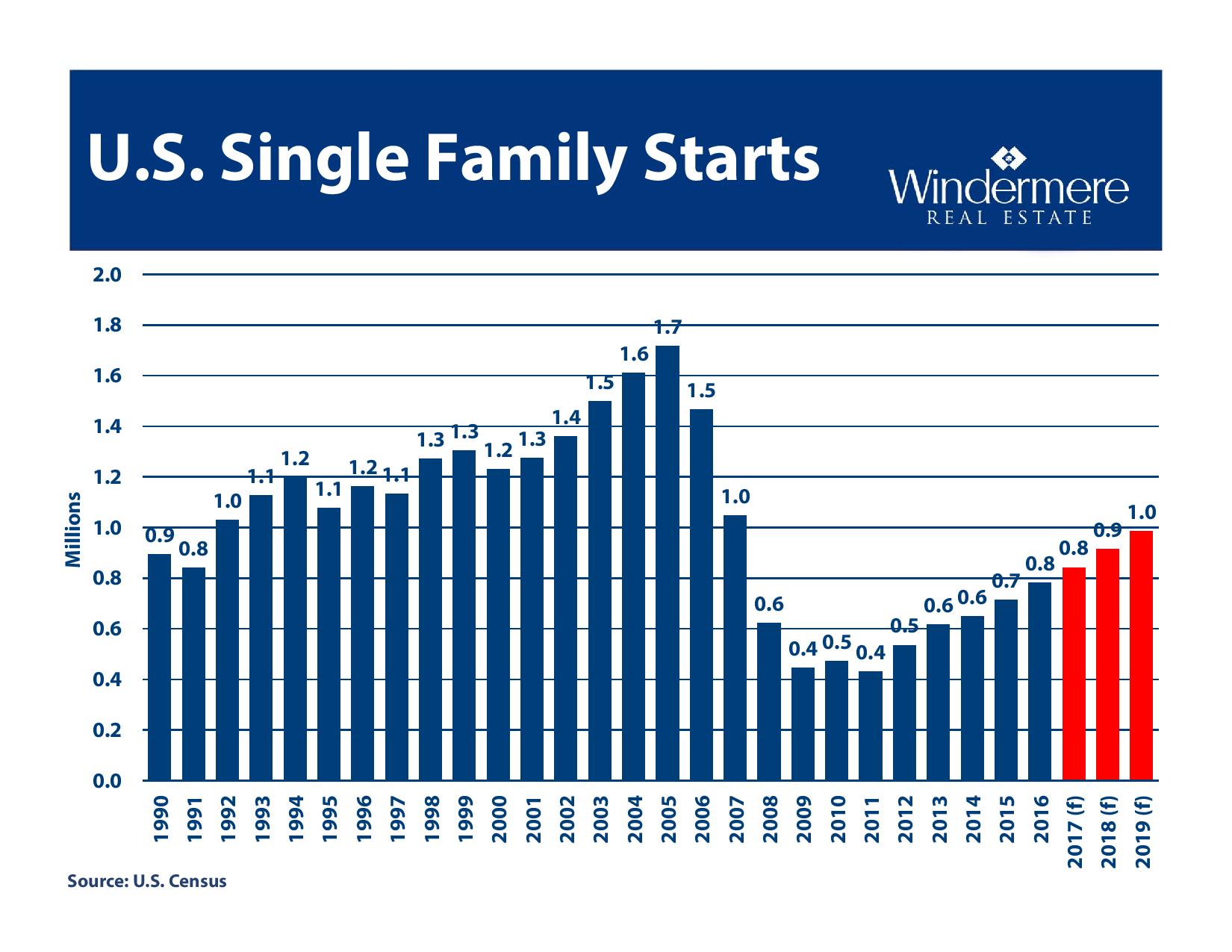

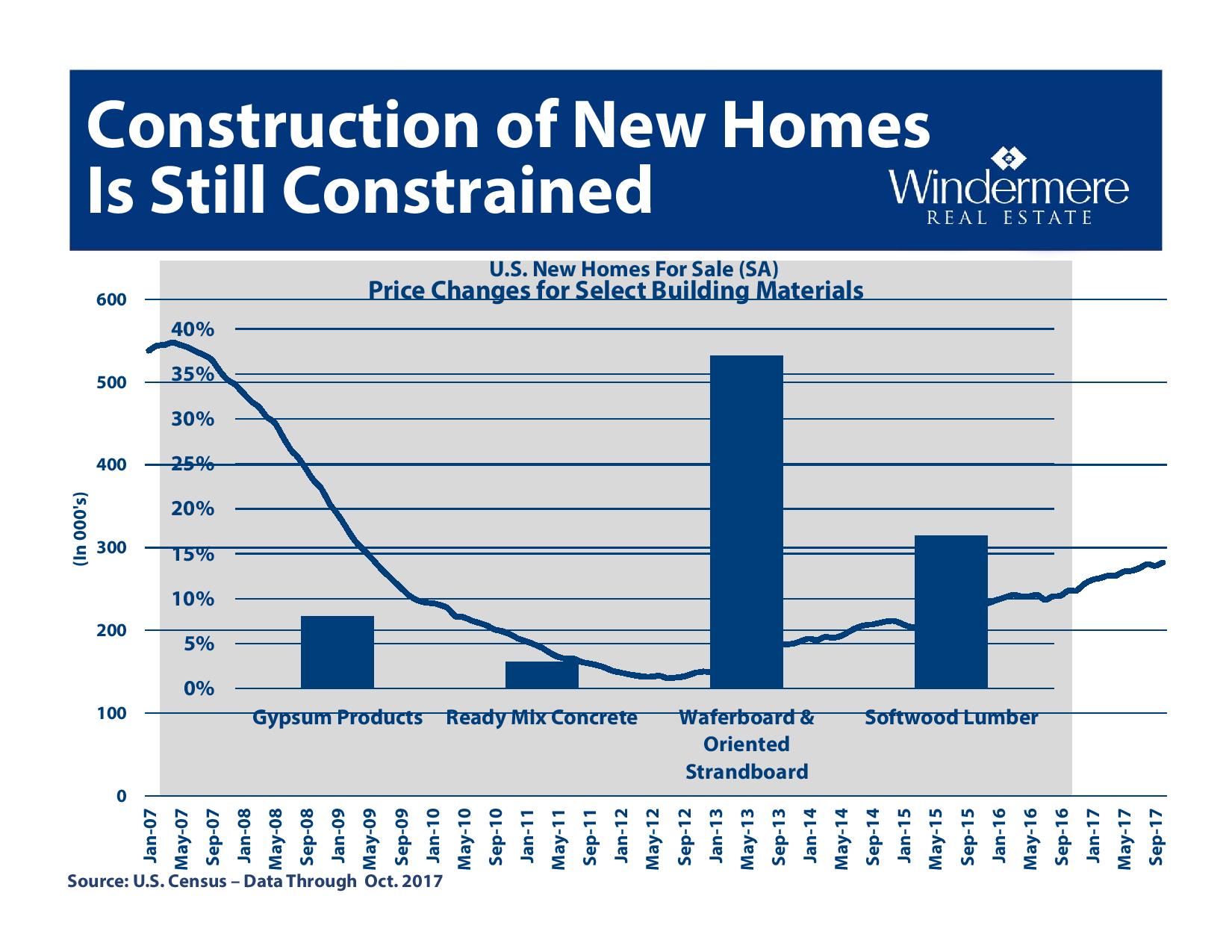

- Lack of new construction. Labor, materials, and land costs are keeping new construction at bay. Natural disasters has pulled labor to other markets and increased materials costs

- Remodels are on the rise. People are remodeling their homes instead of moving

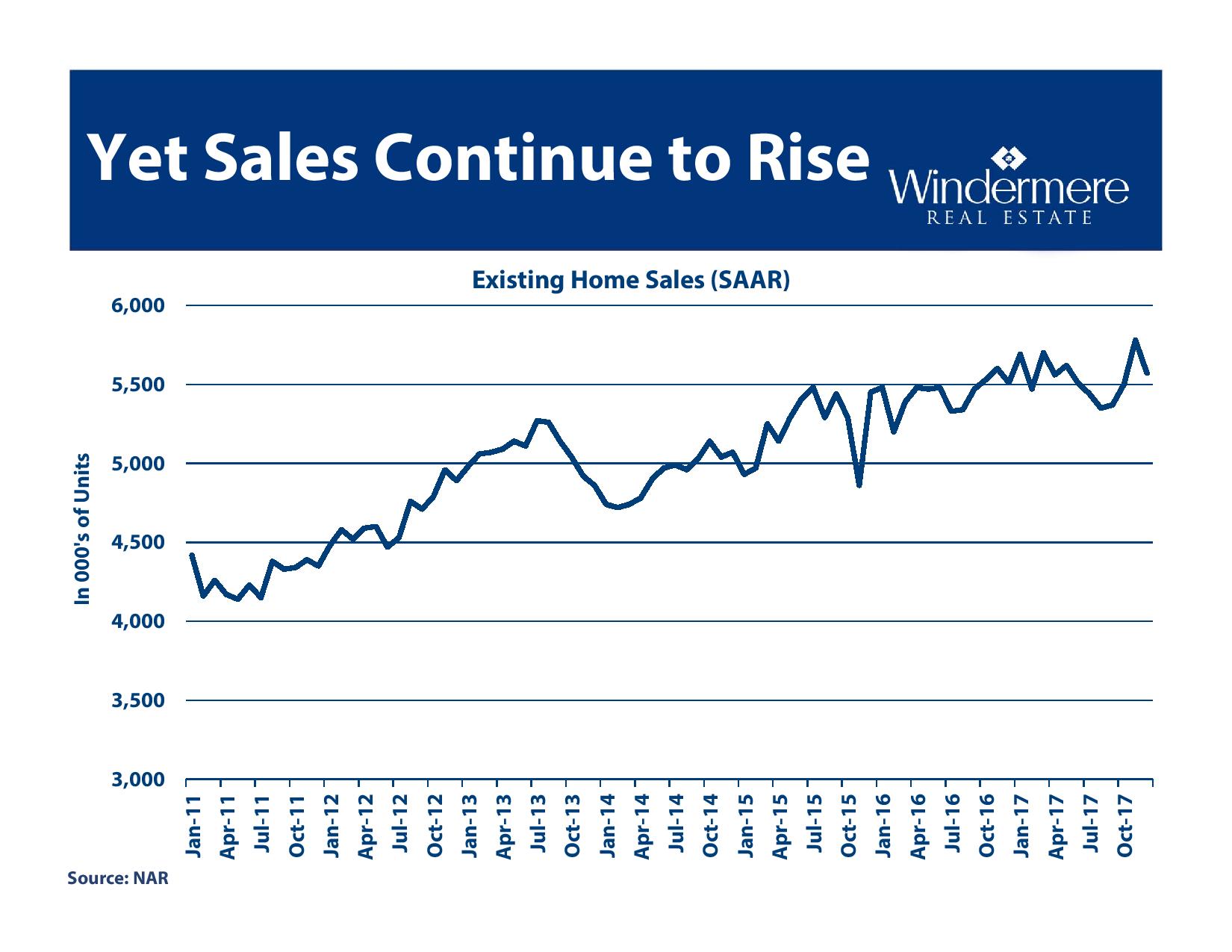

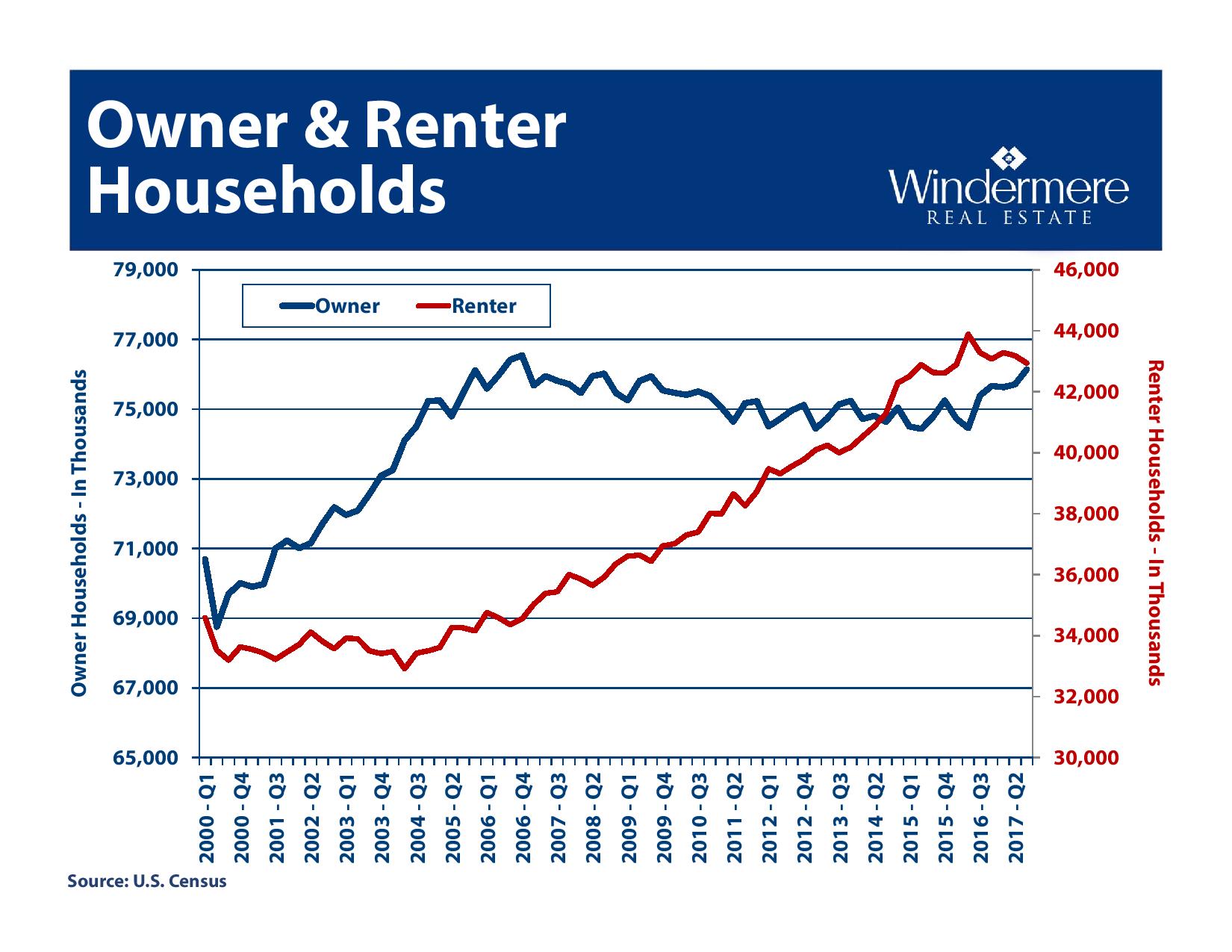

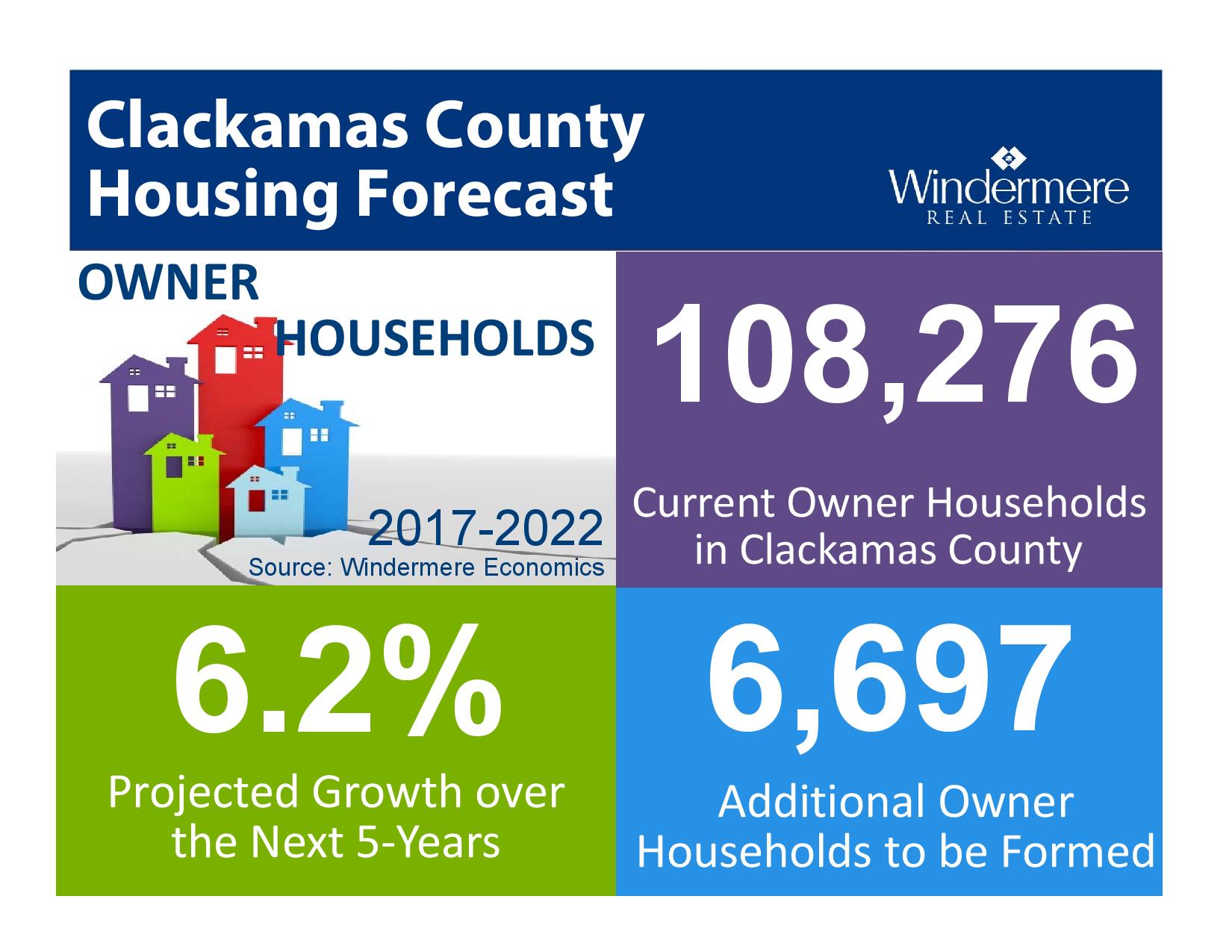

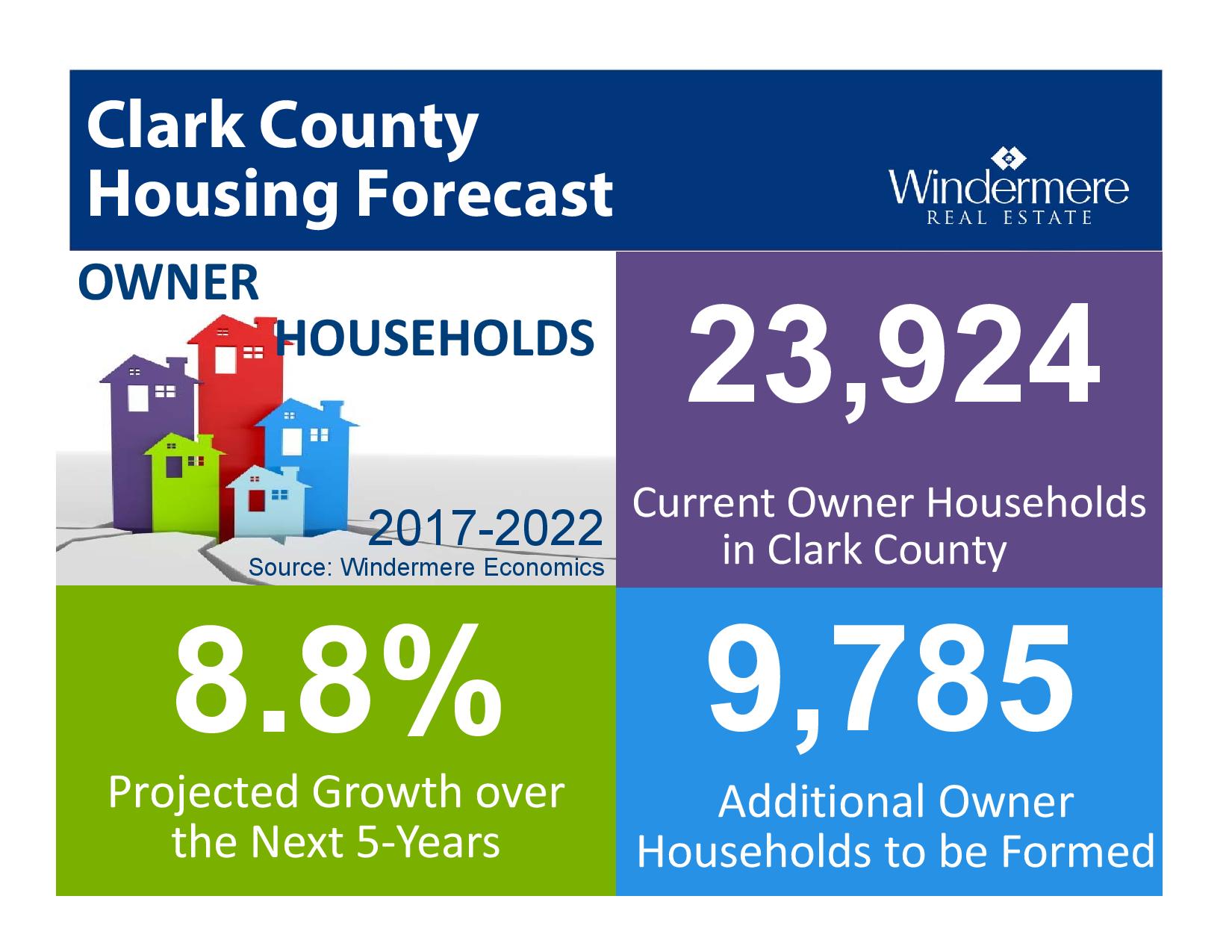

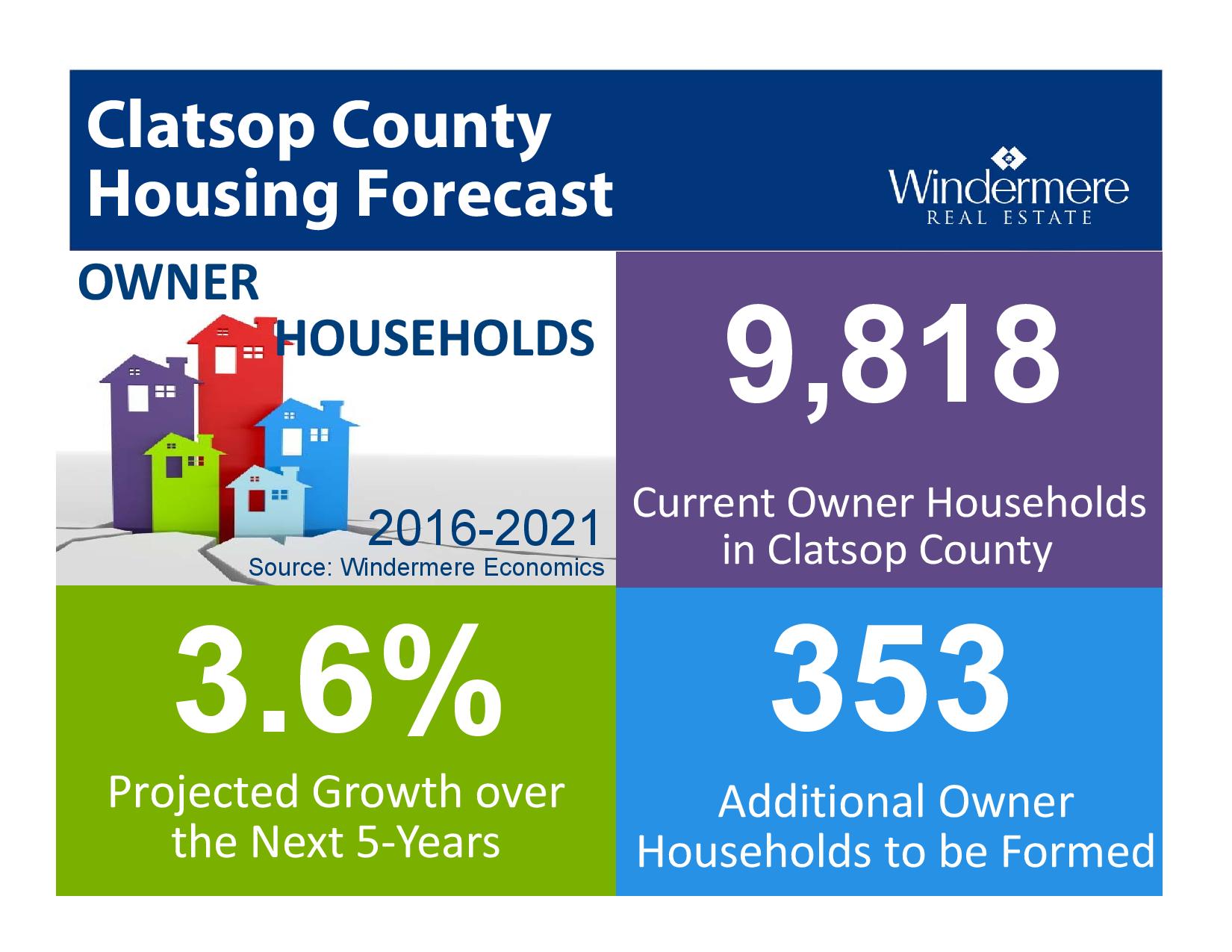

High demand - there are a lot of buyers

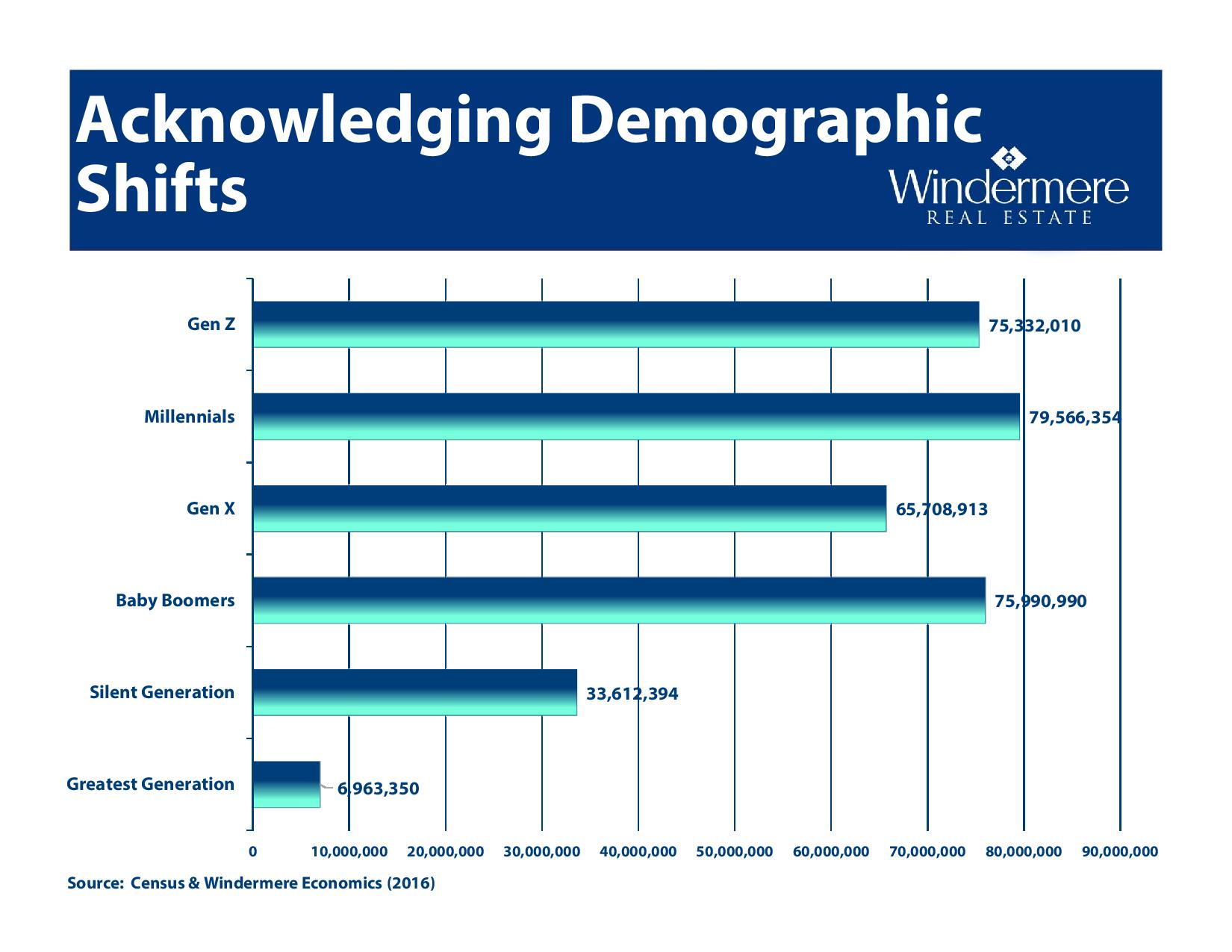

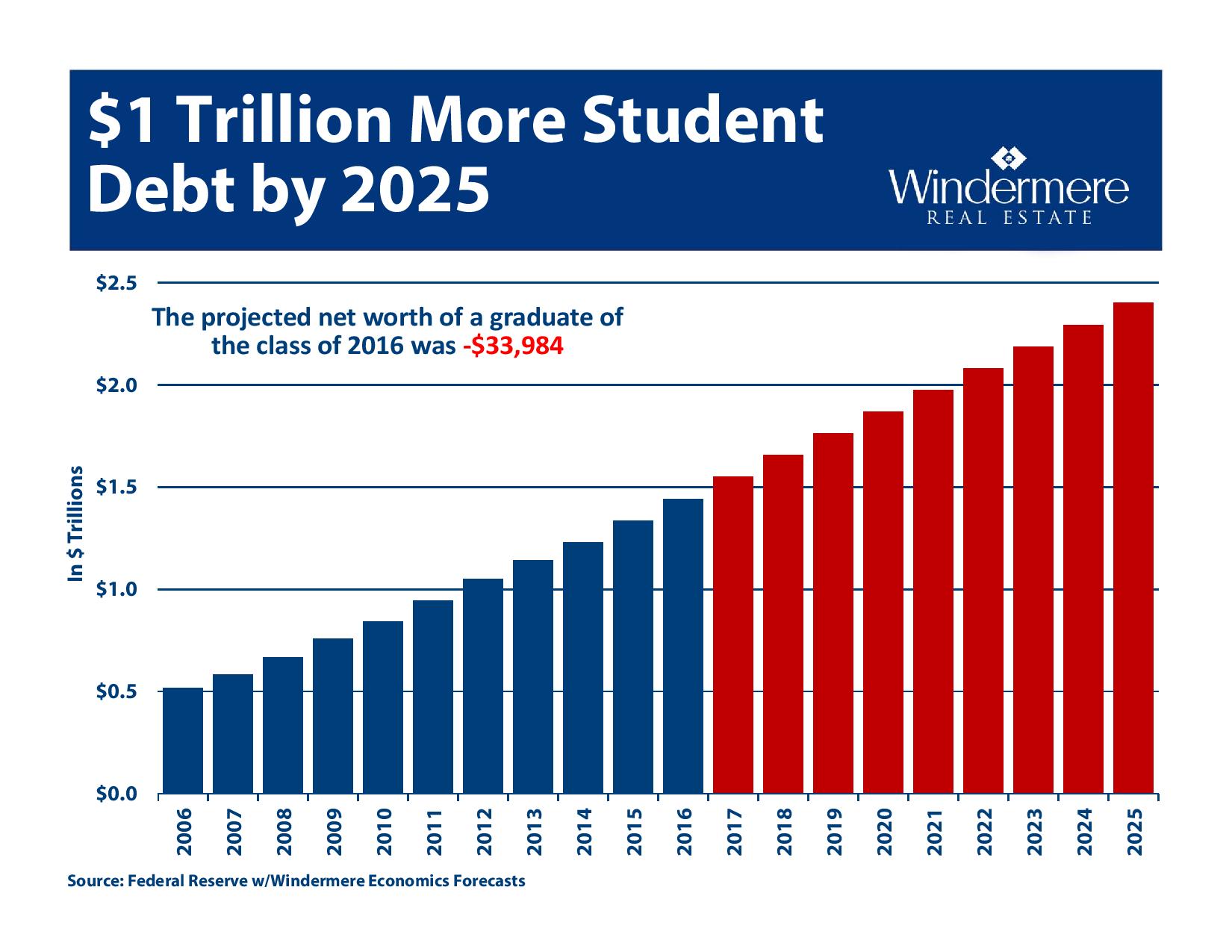

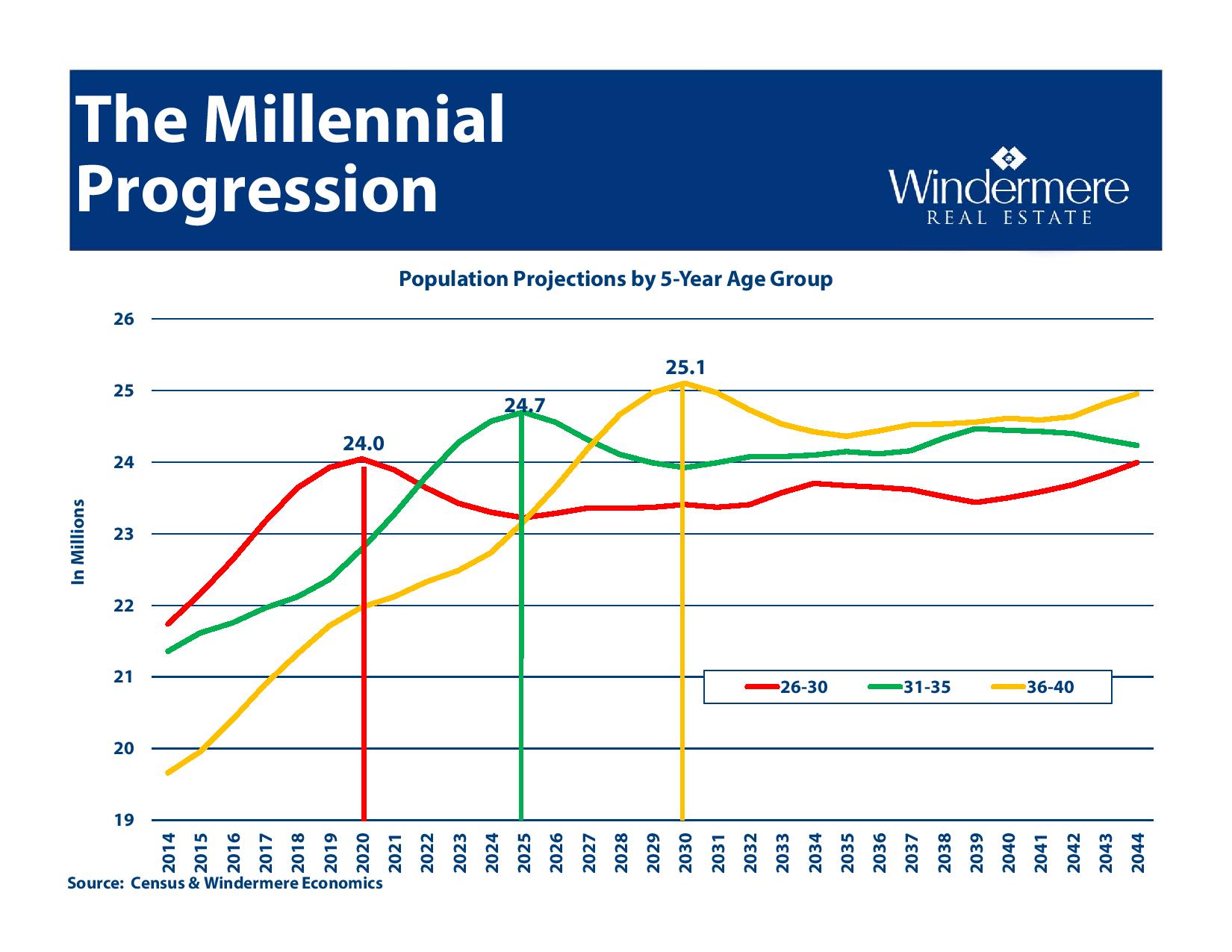

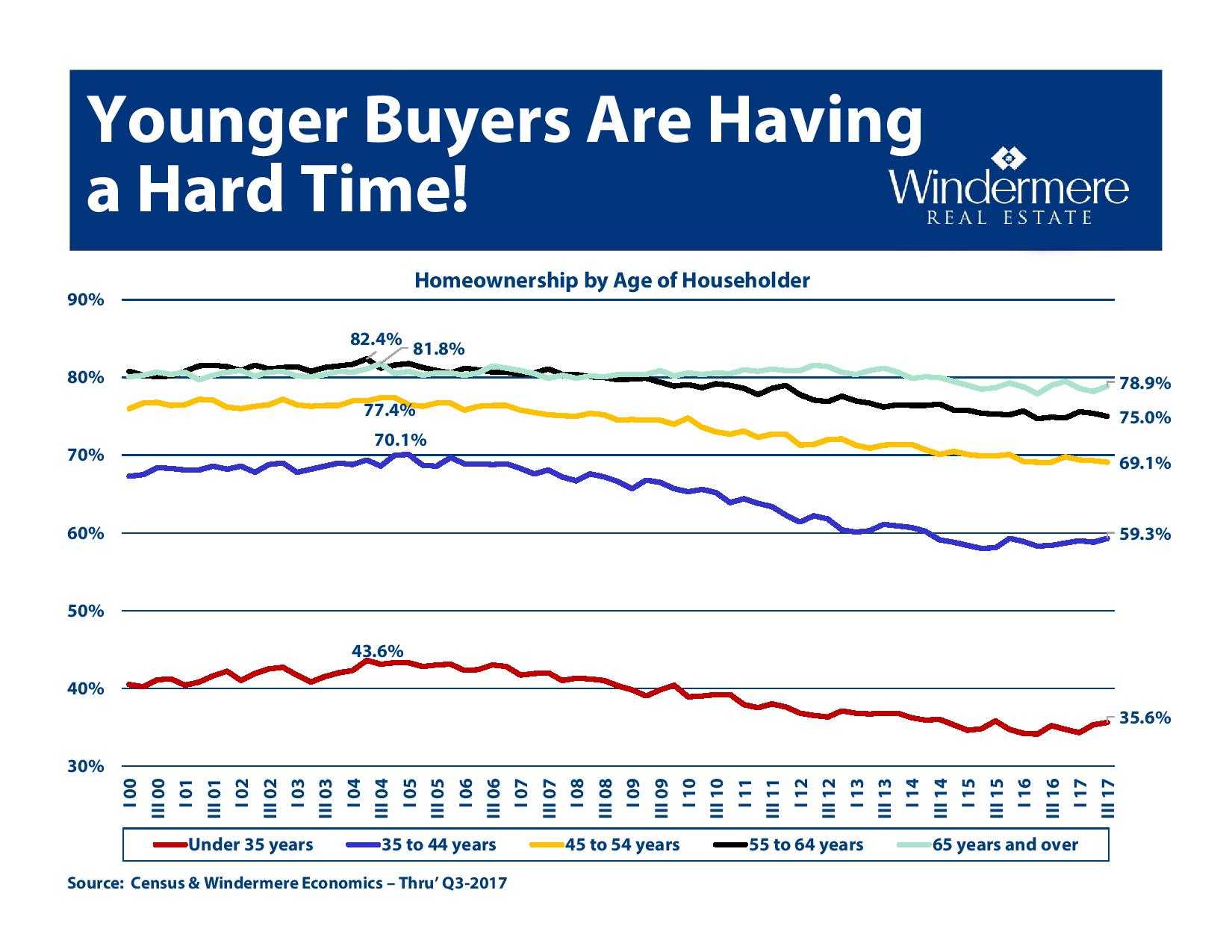

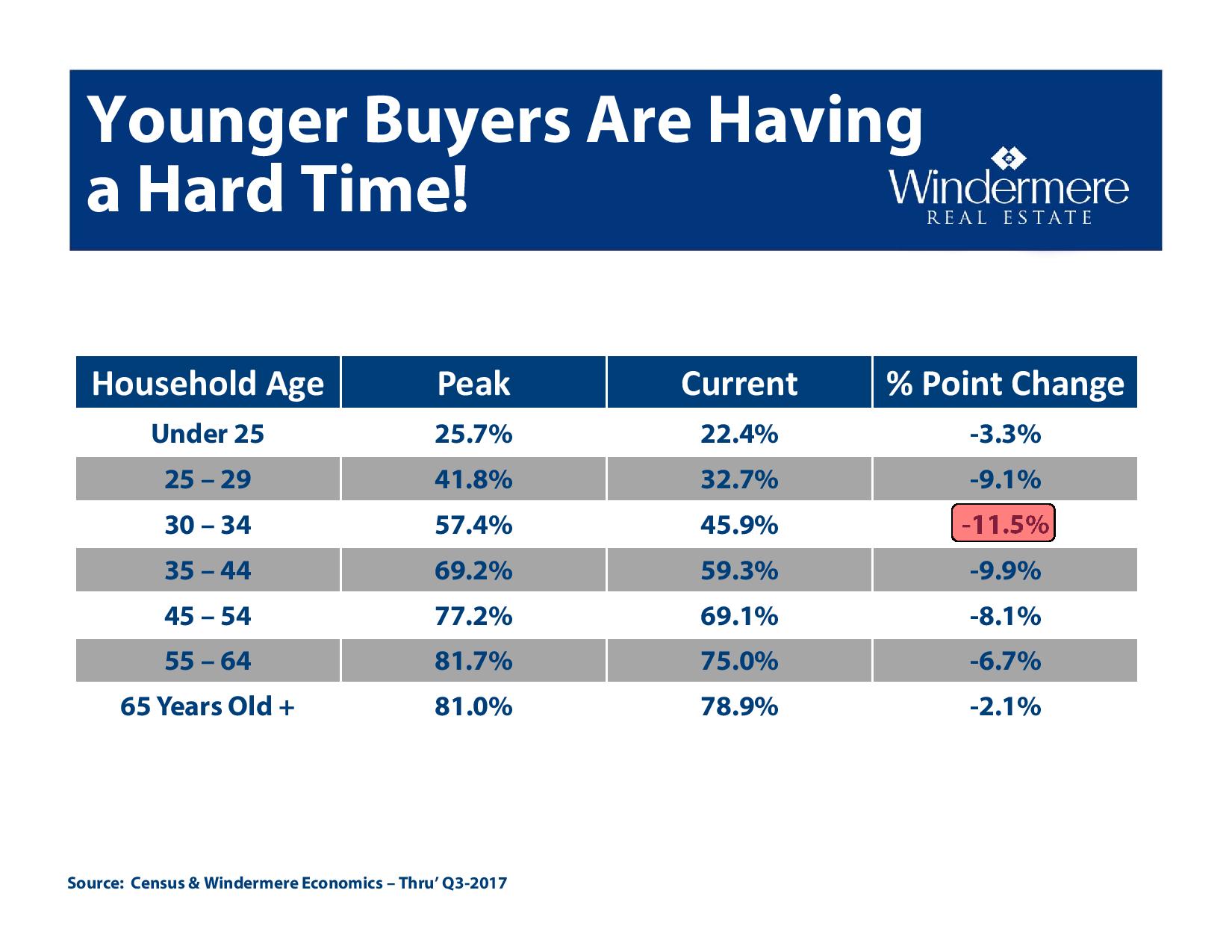

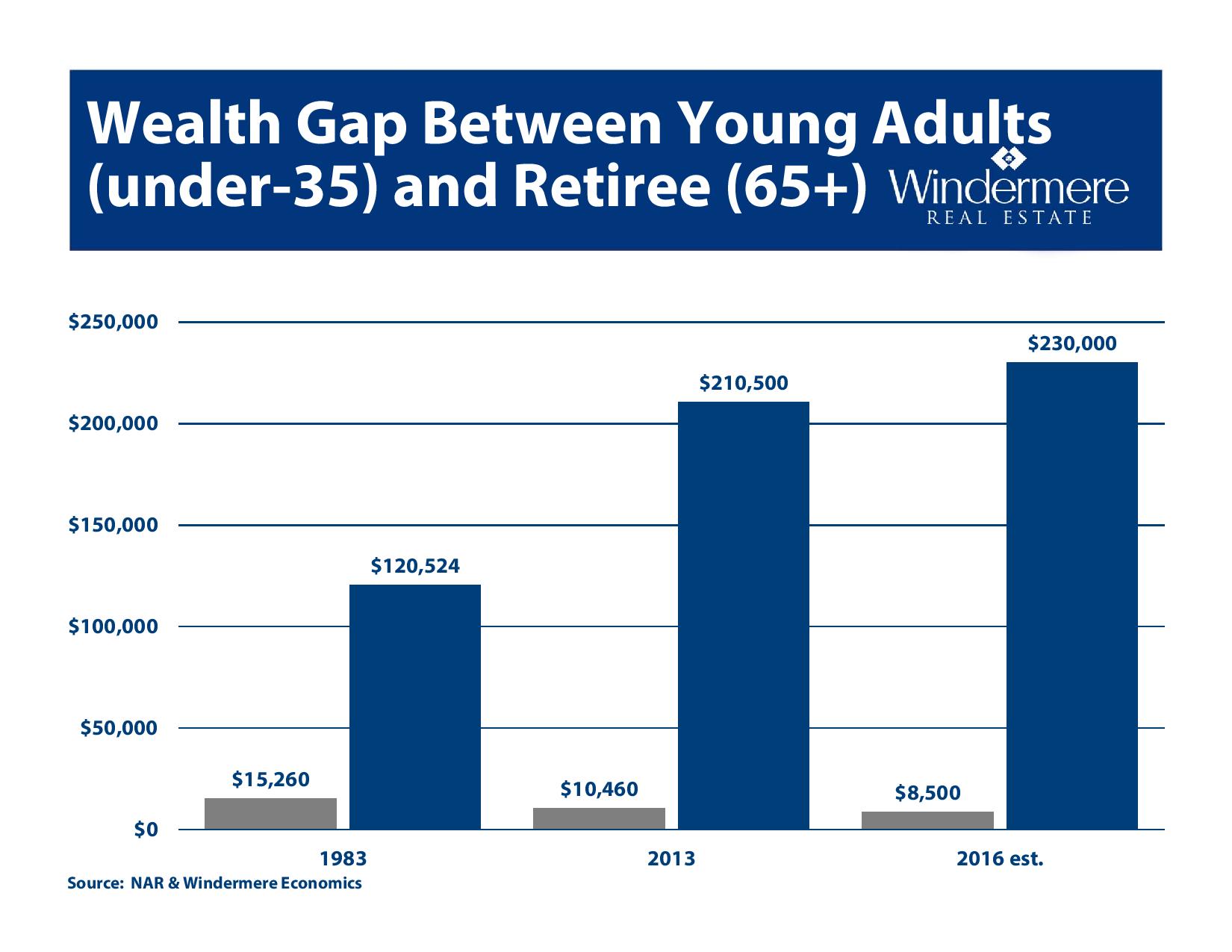

- Millennials are becoming a strong buying force. As first-time-homebuyers they don't have a home to sell while entering the buyer pool. This is pushing low supply / high demand even further

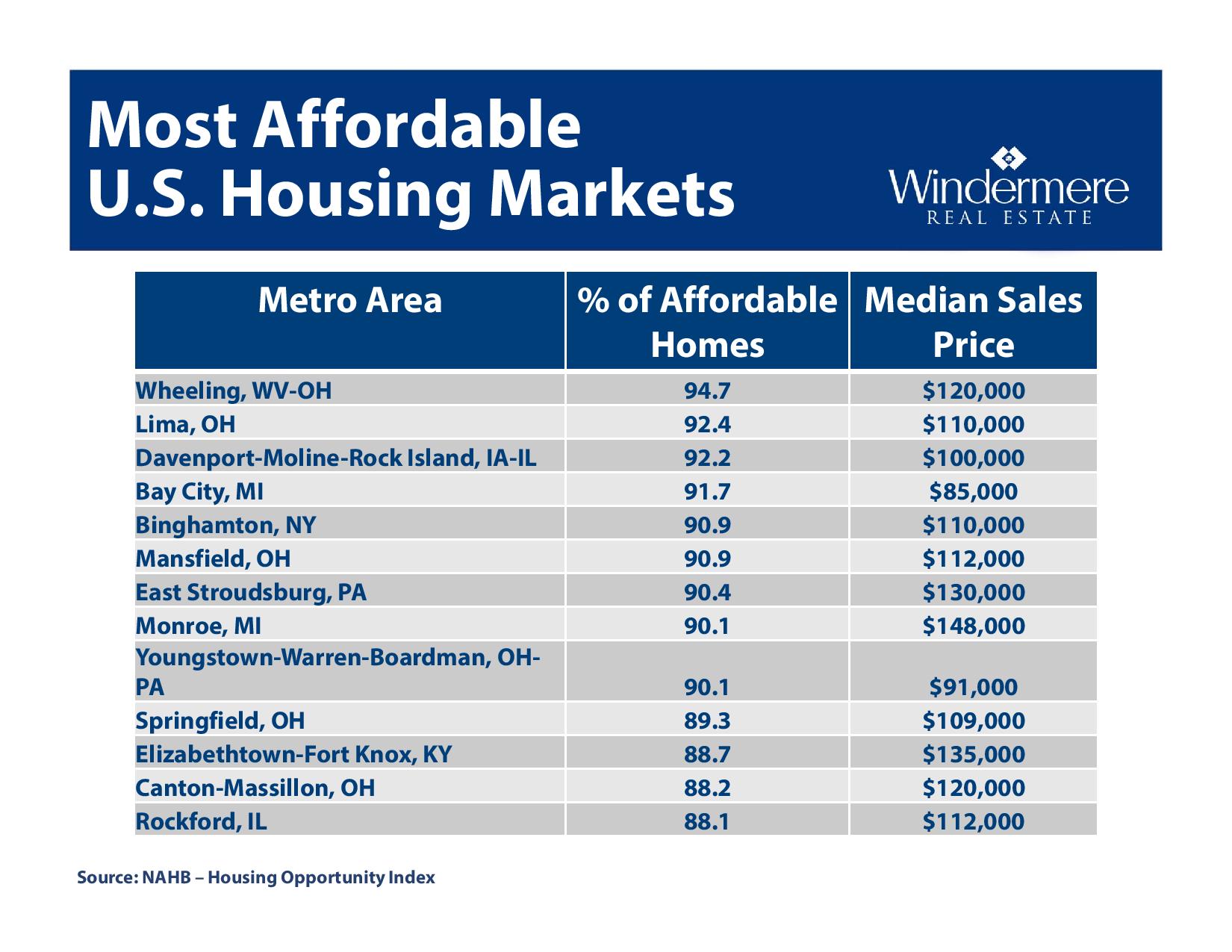

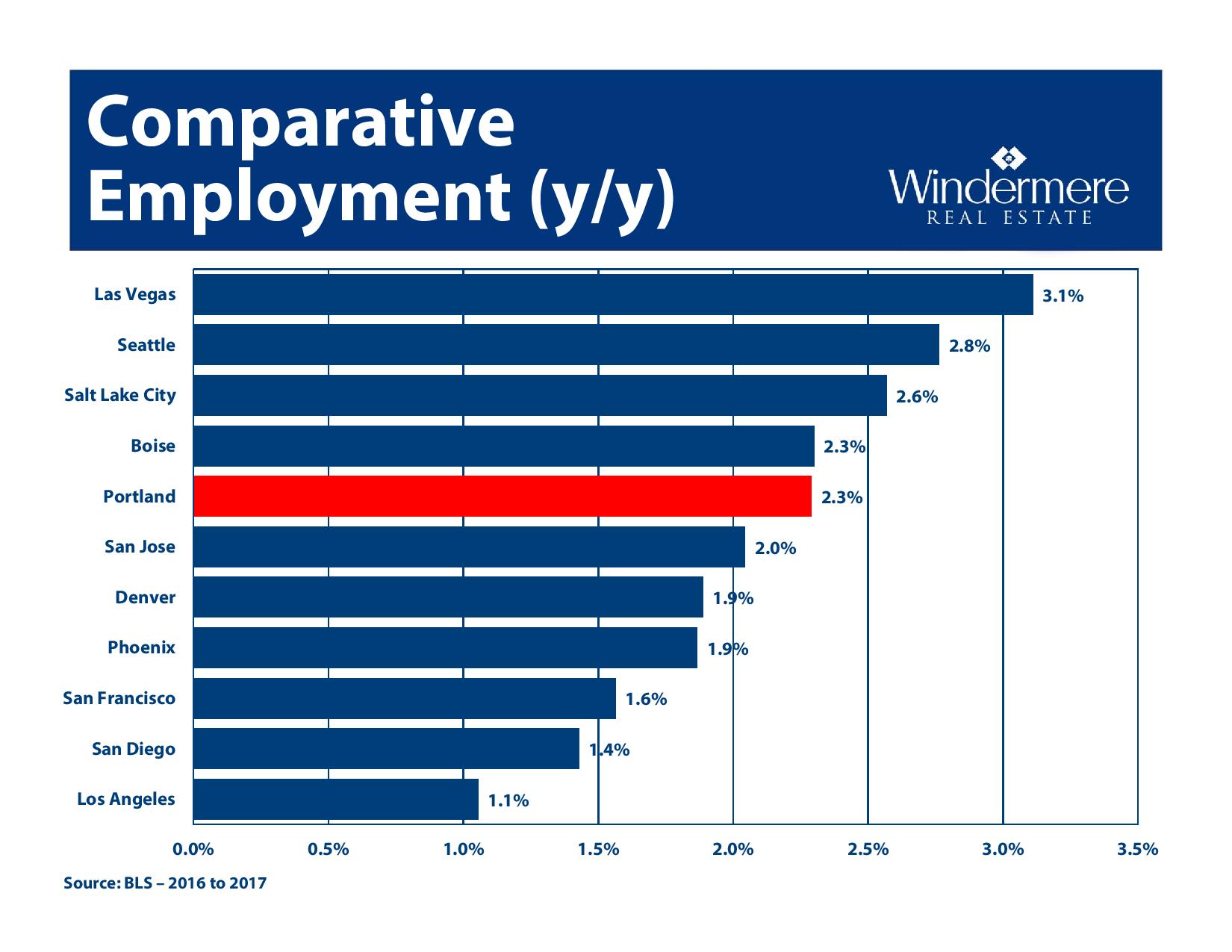

- Portland remains relatively cheap for west coast cities. The median sales price in San Francisco is $1.2 million

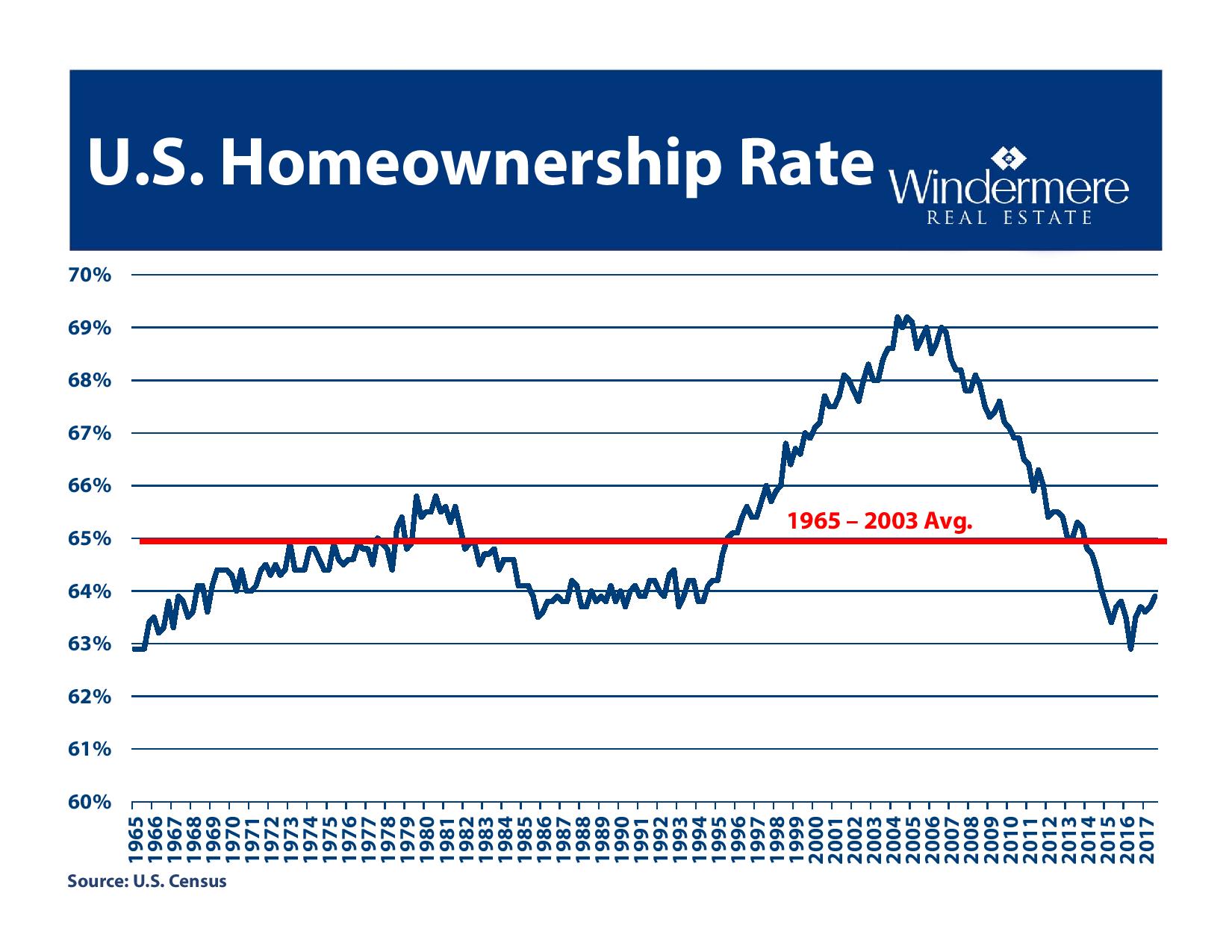

- People who foreclosed in 2008 - 2009 are becoming able to buy again. And they will

- While housing prices are strong, they are still below the peak by 12% when factoring in inflation

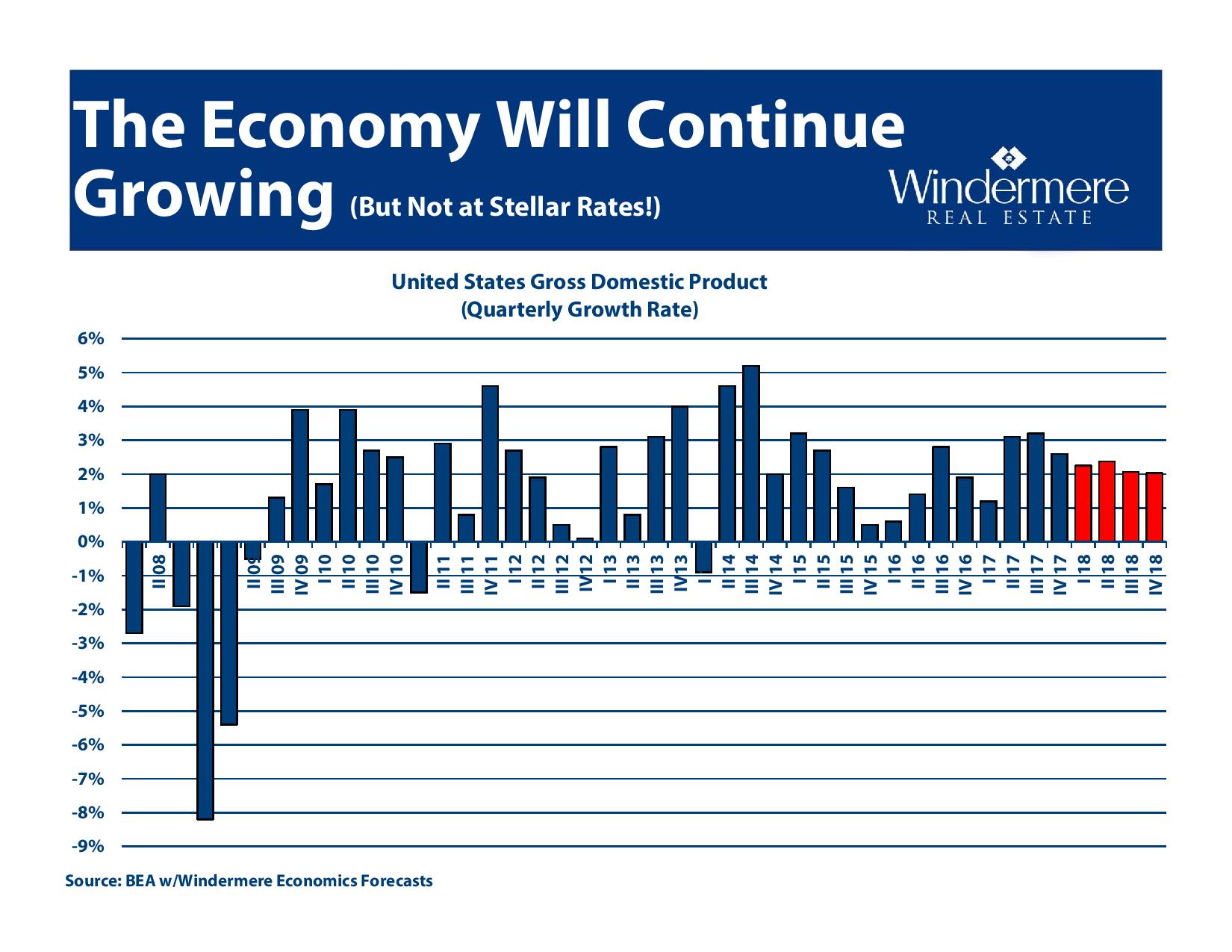

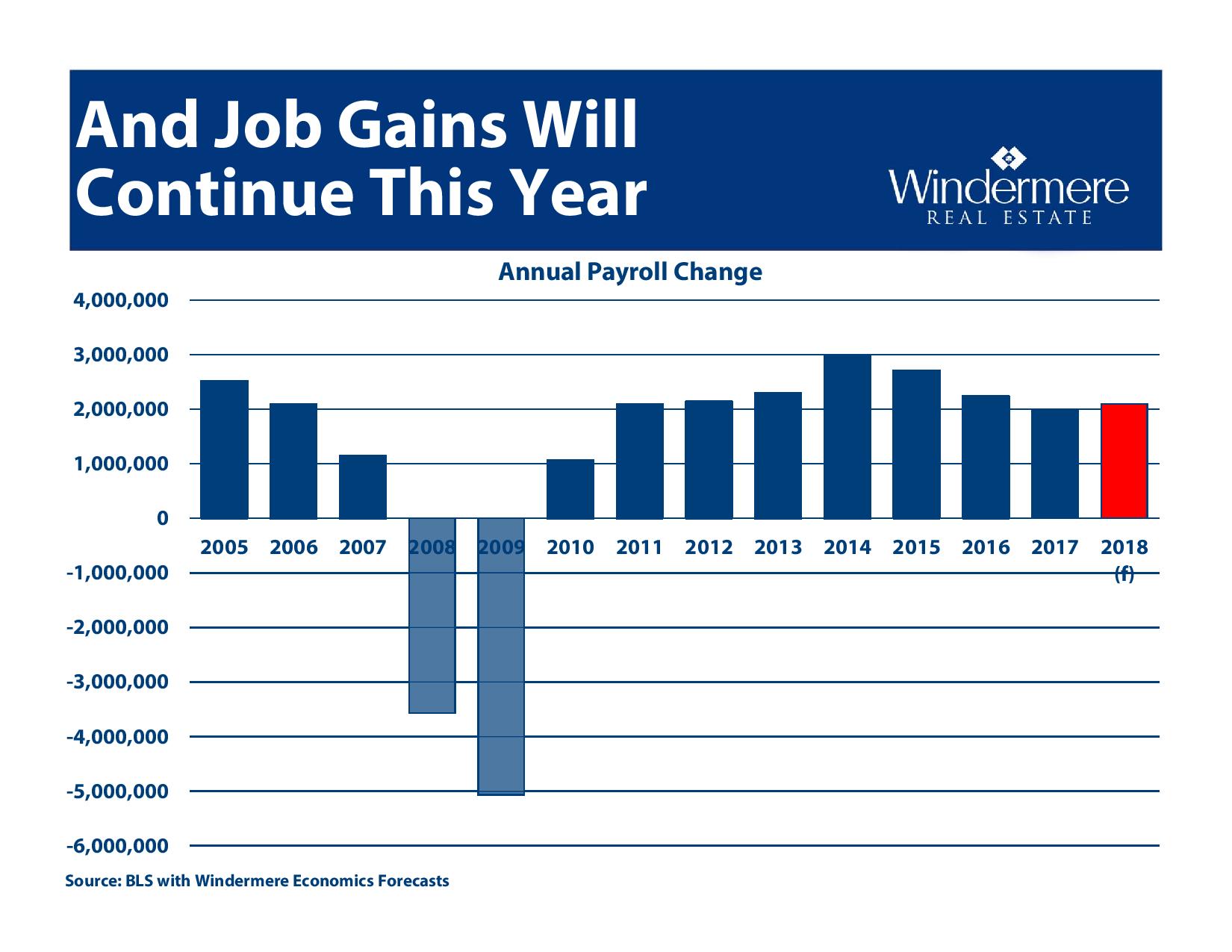

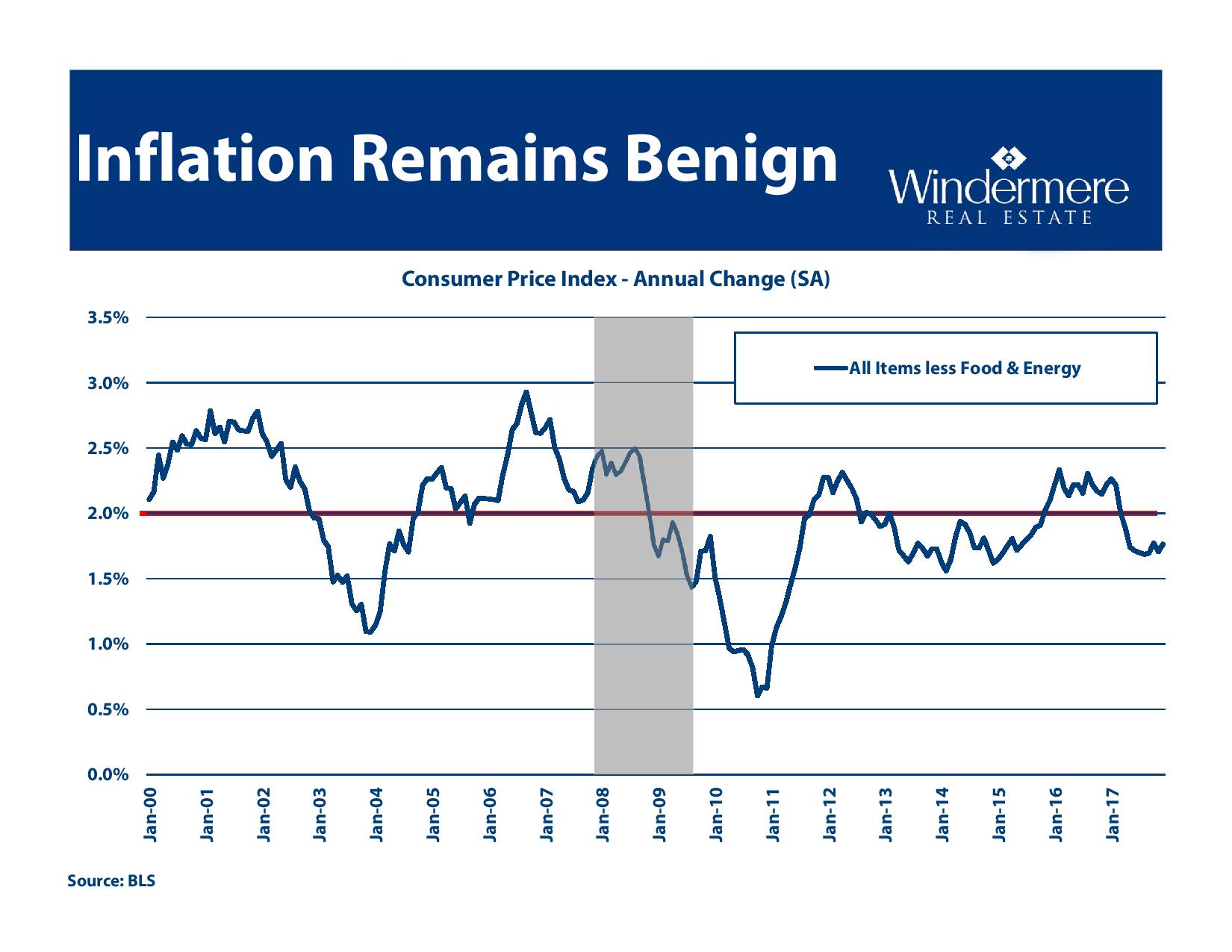

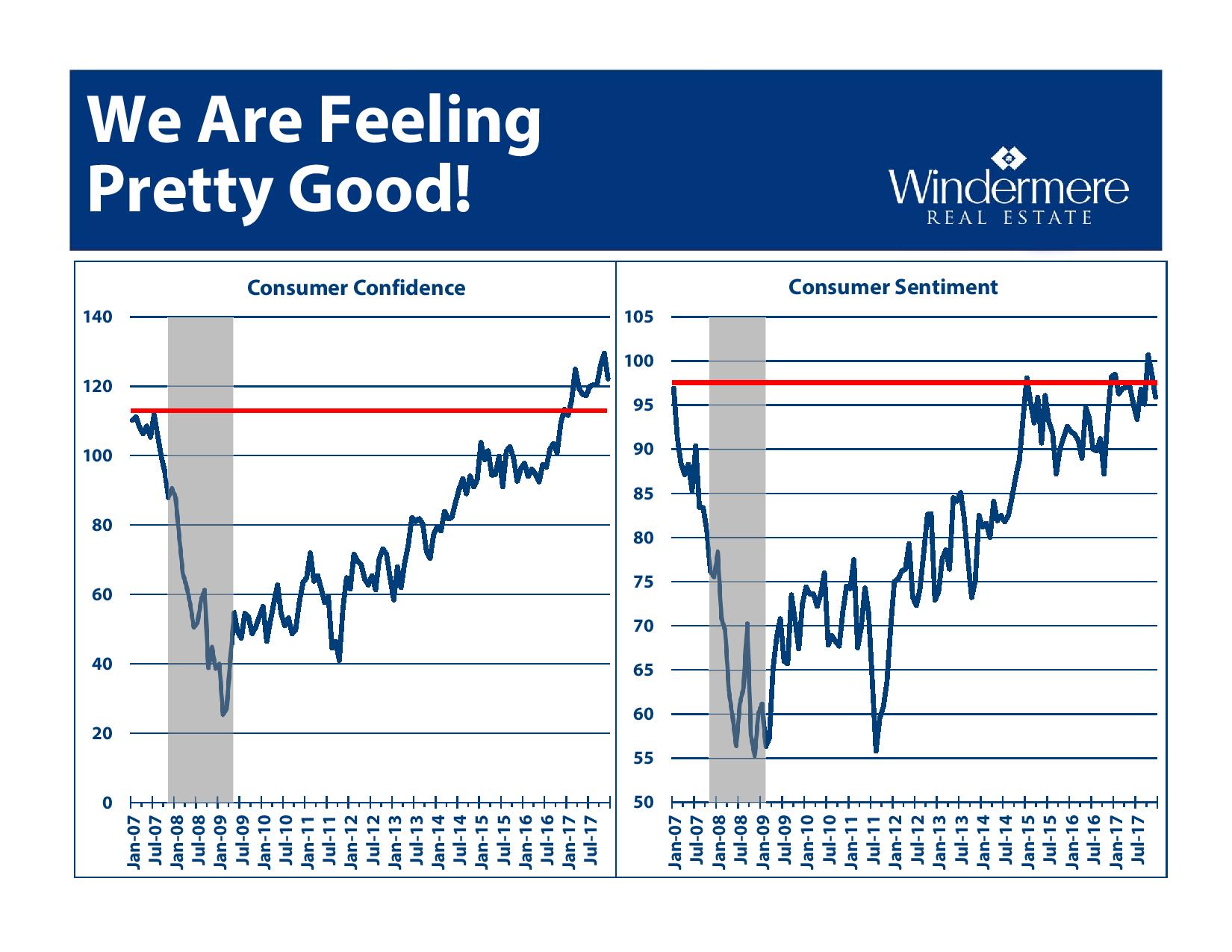

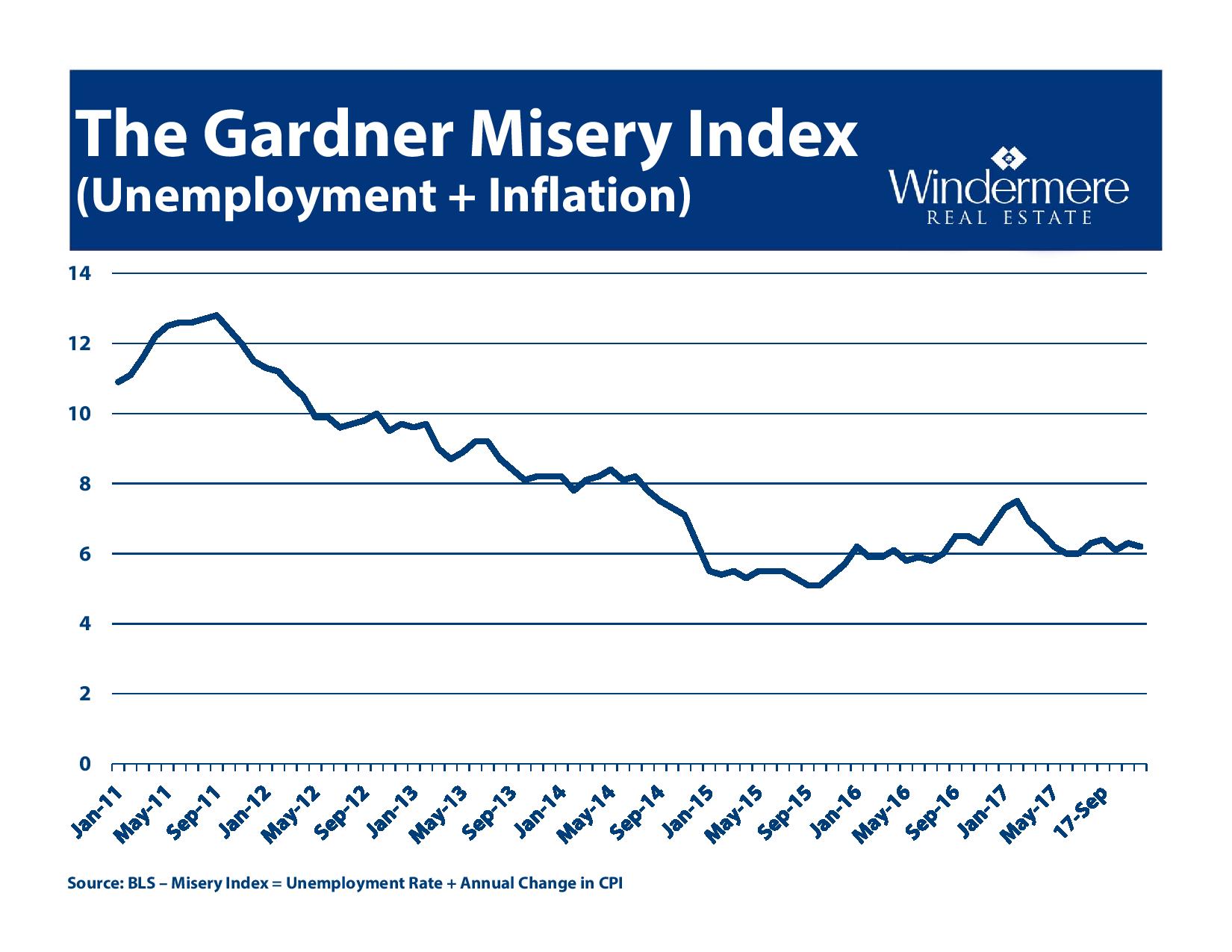

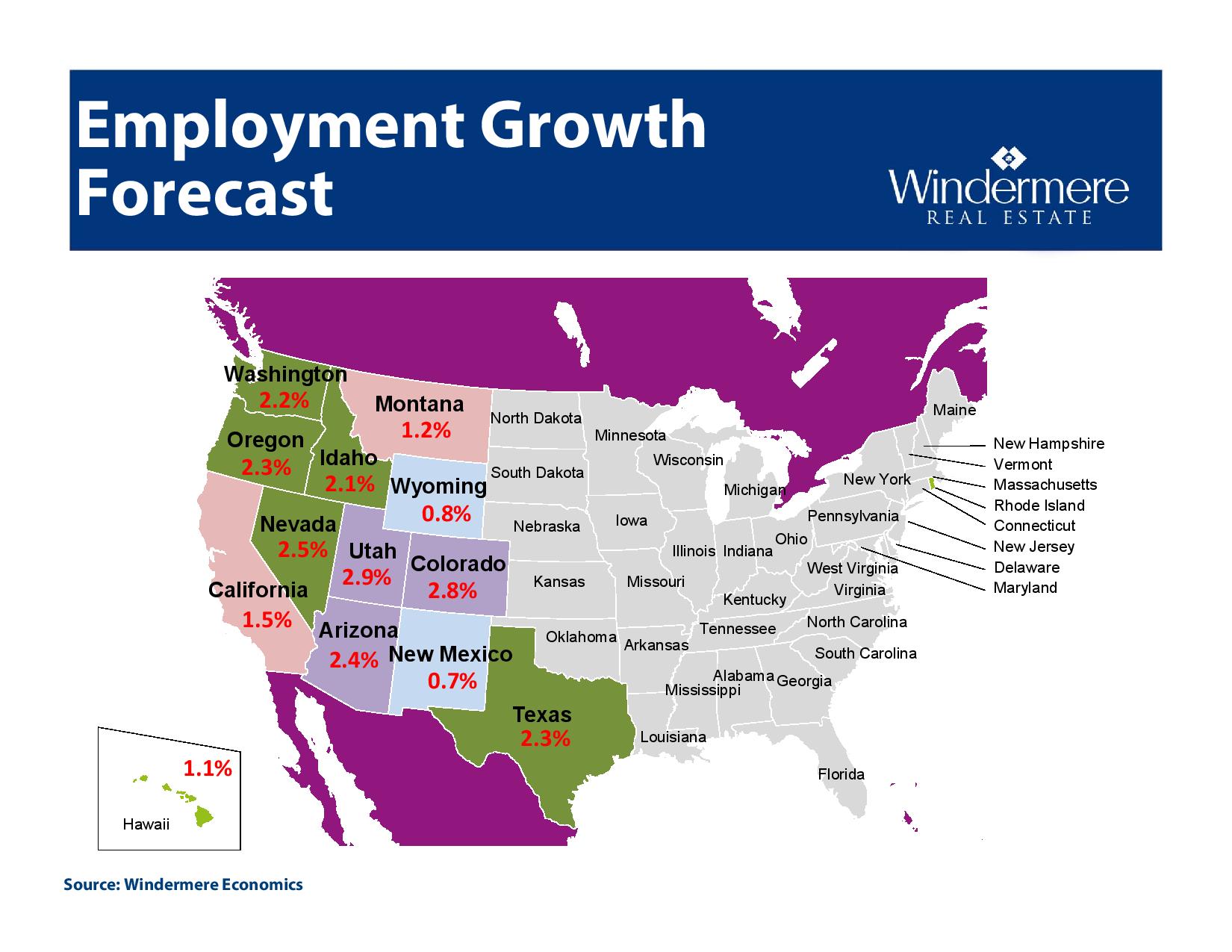

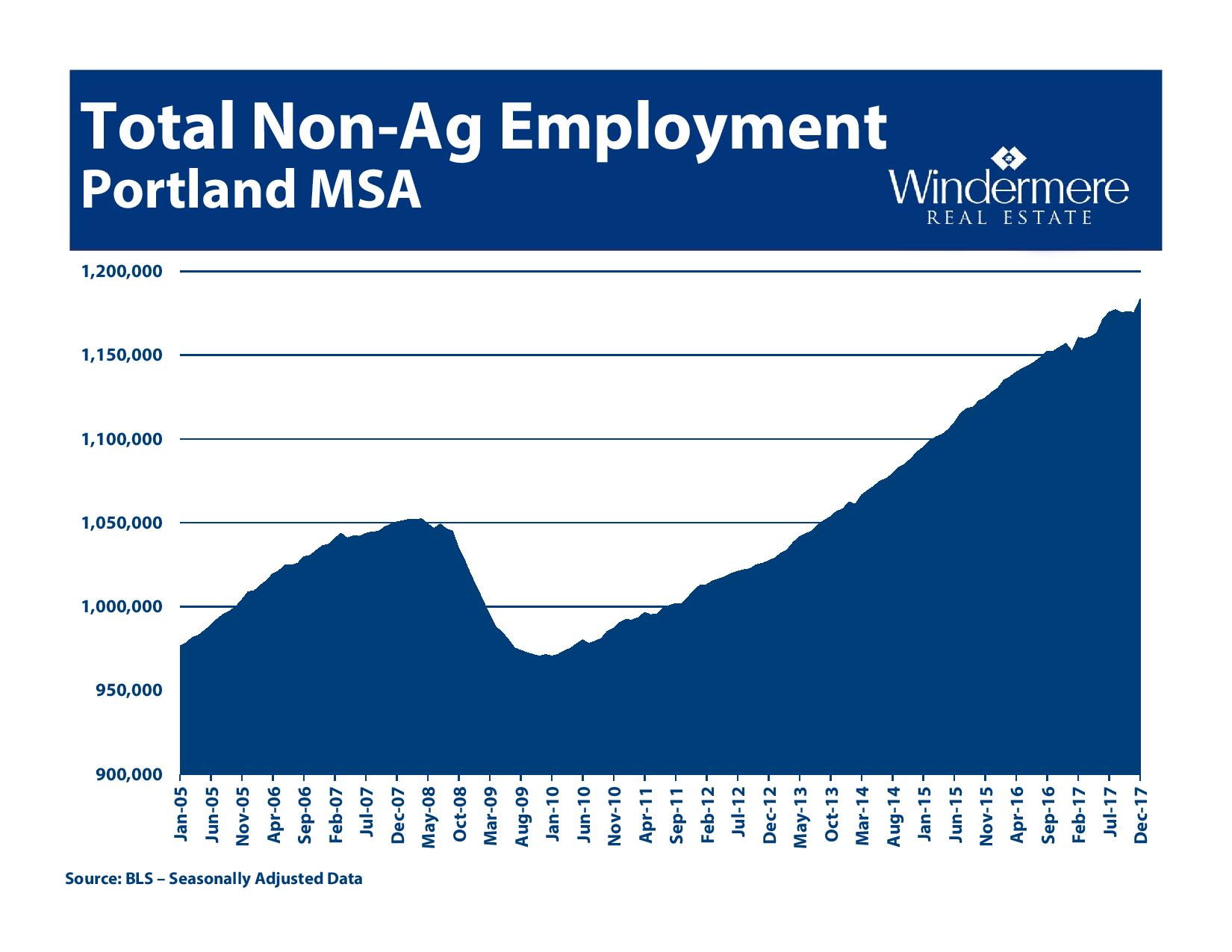

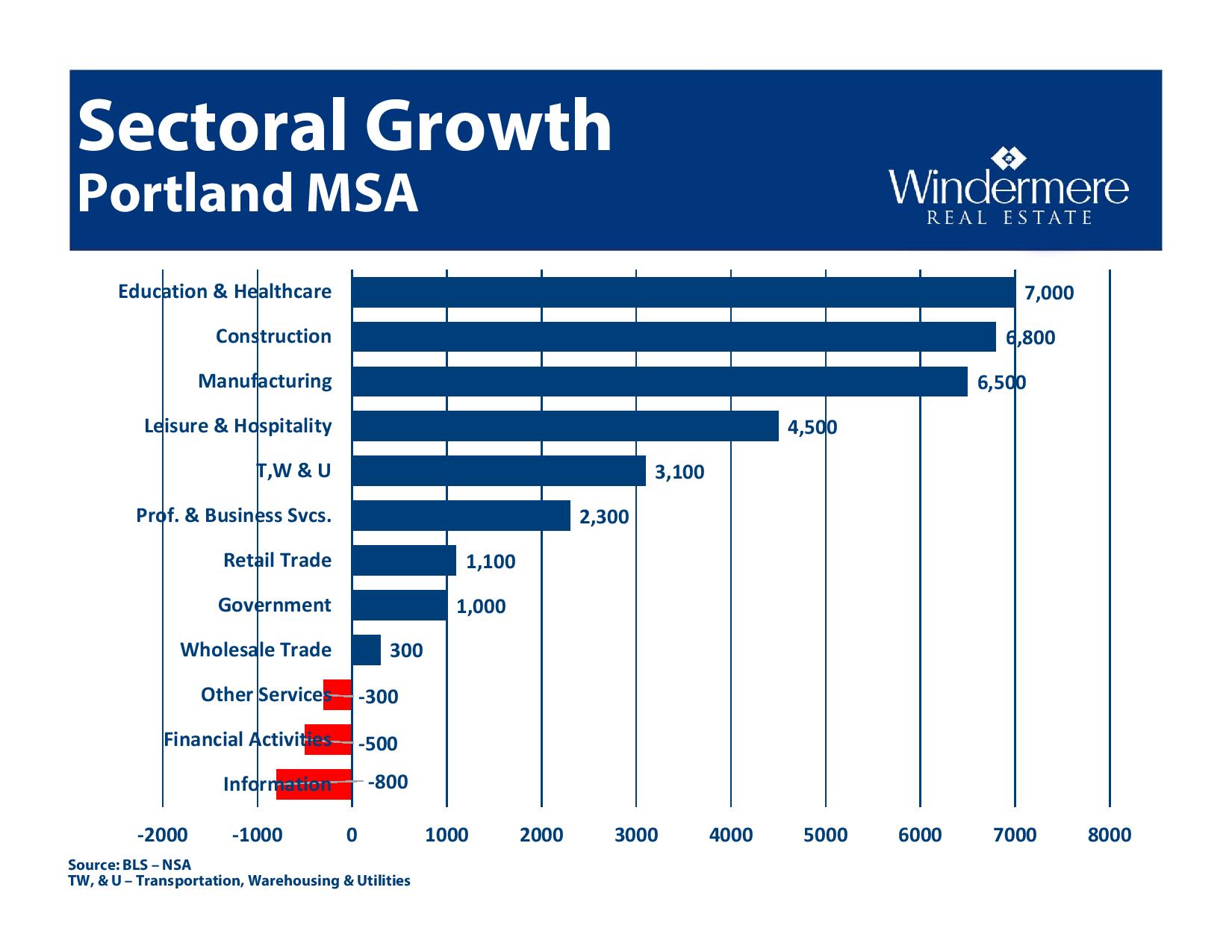

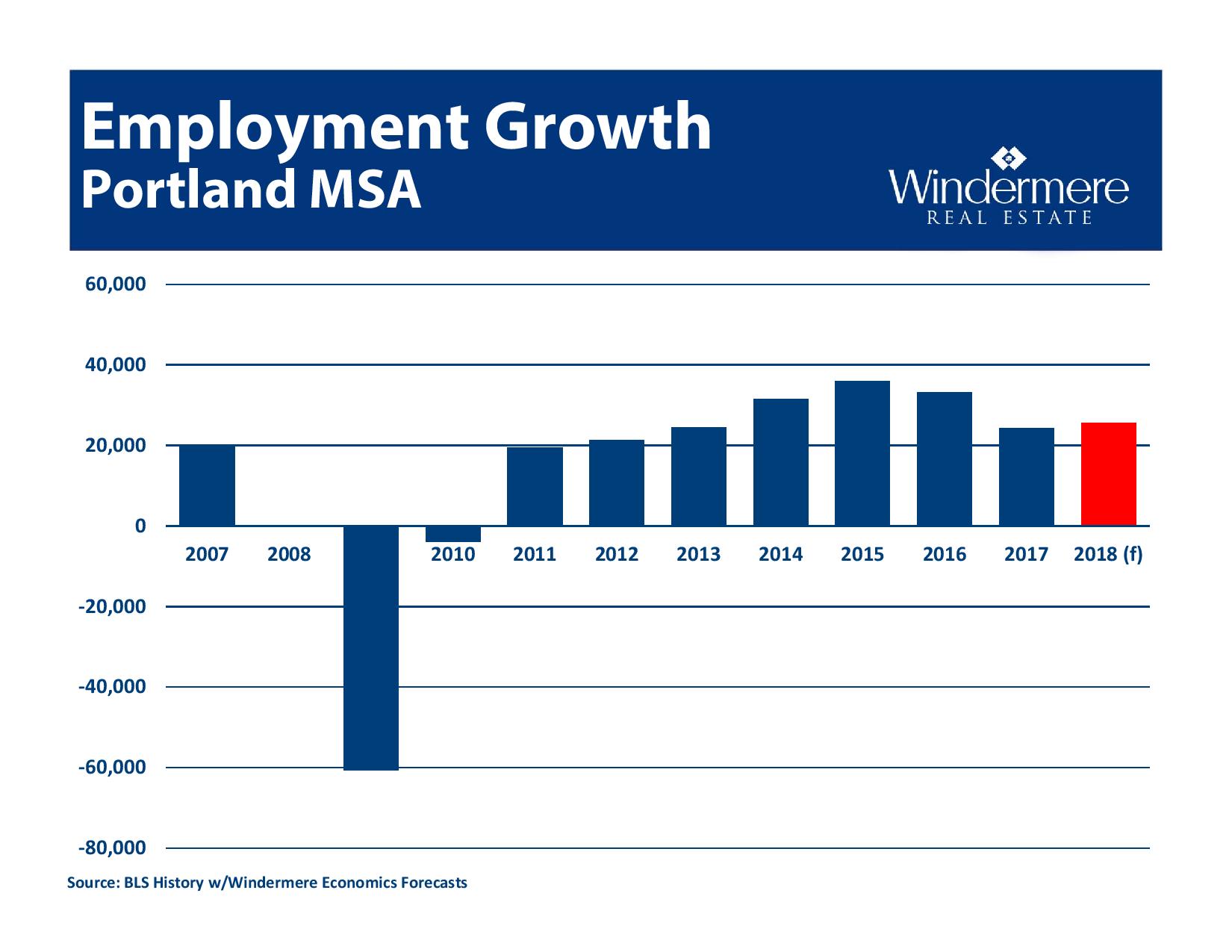

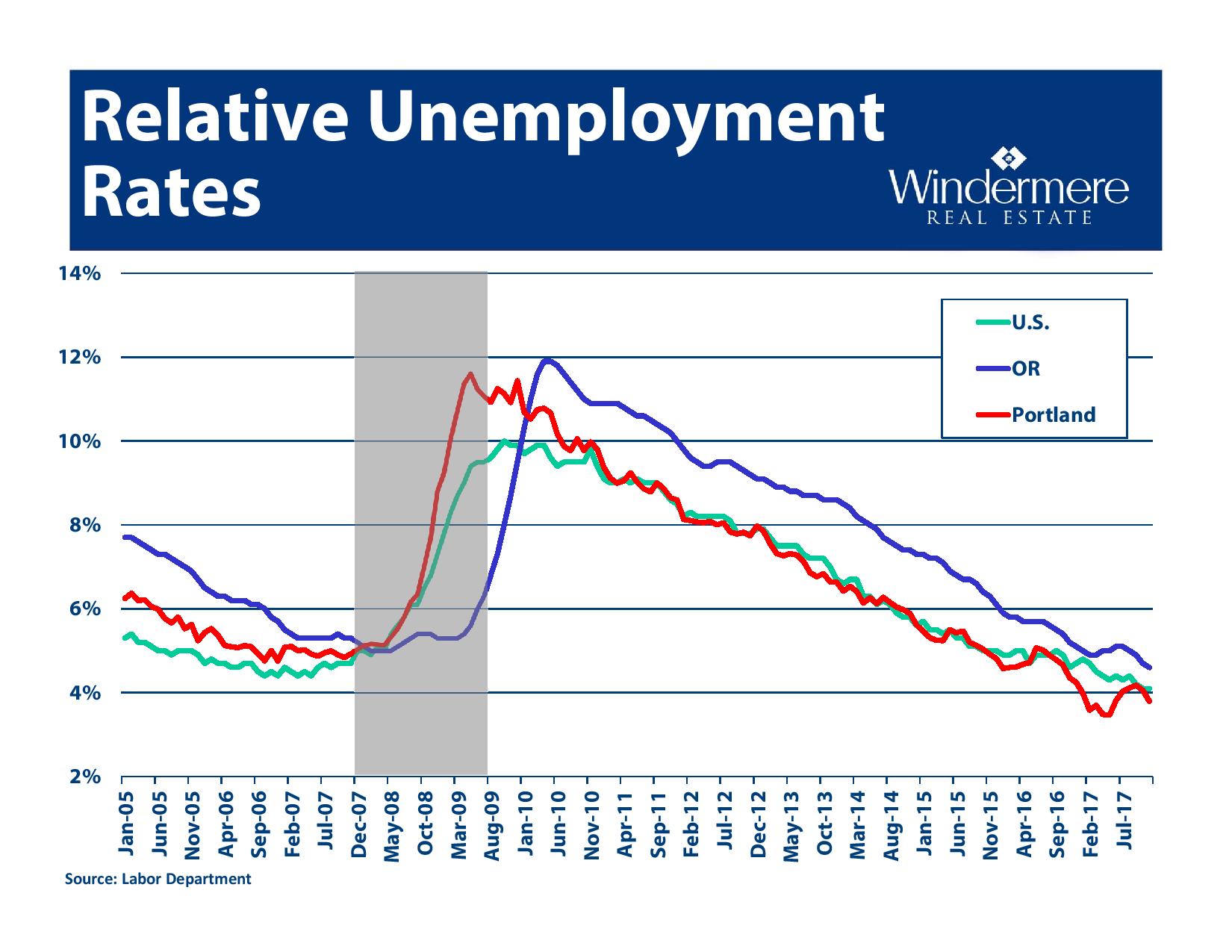

The economy is strong

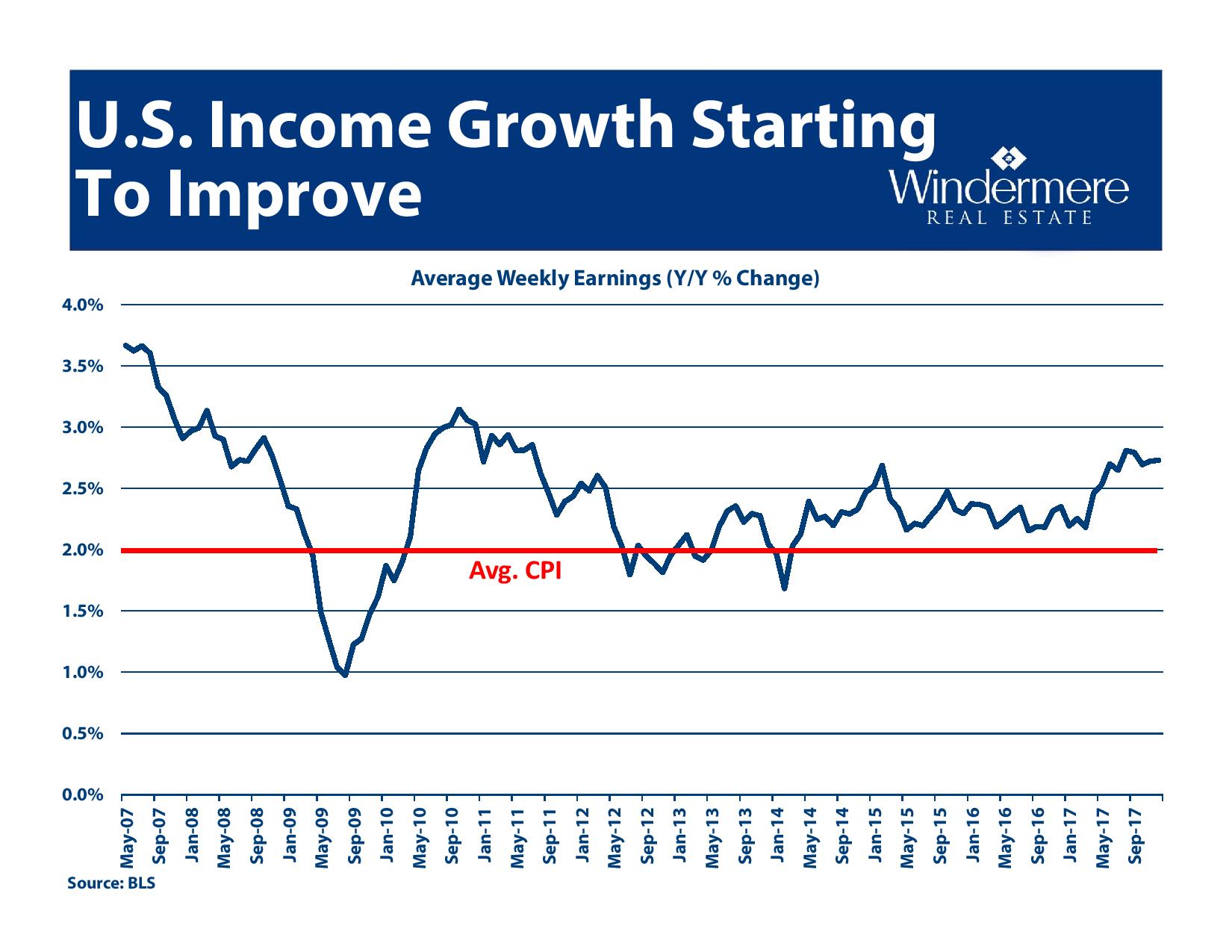

- Wages are finally beginning grow

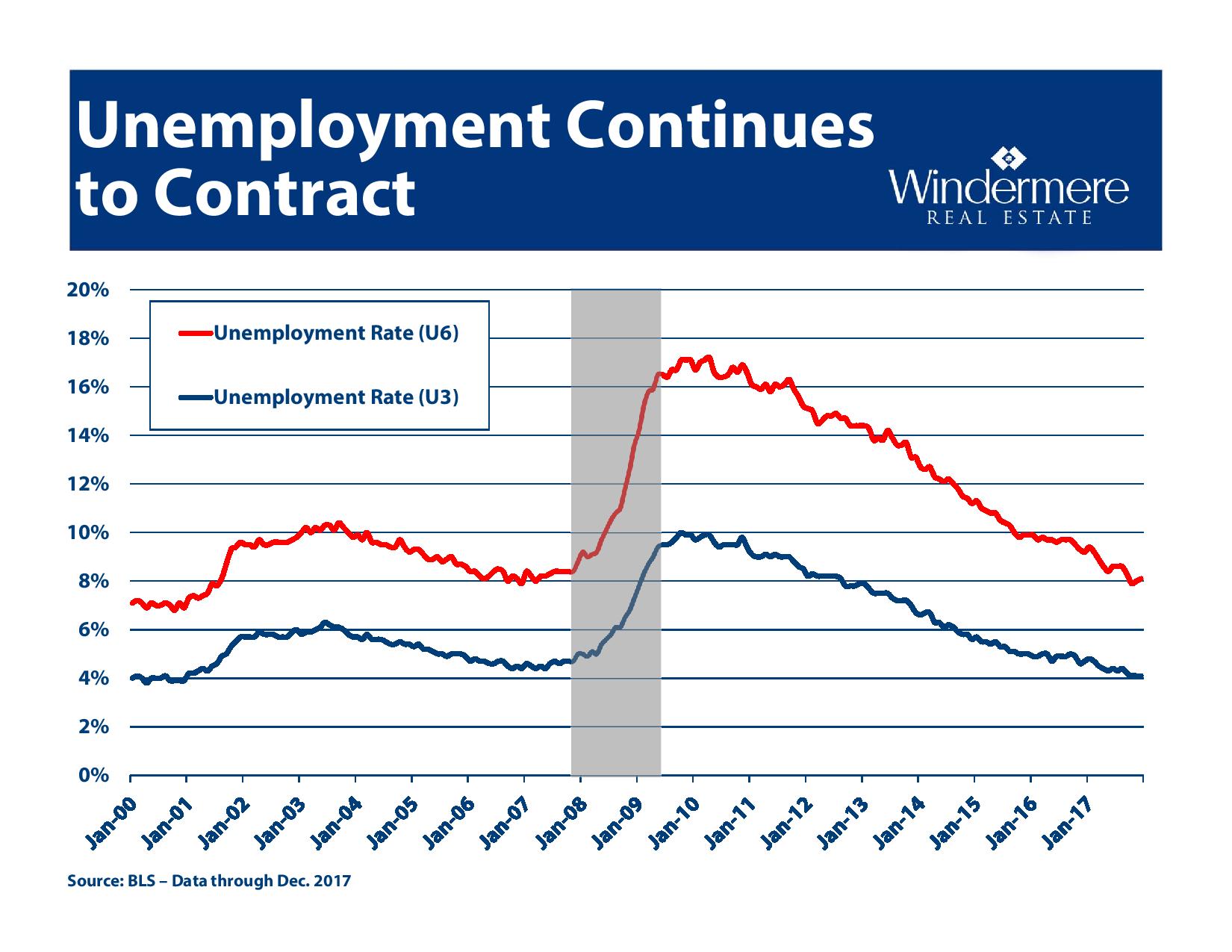

- Unemployment continues to contract

- Portland area should add 25,000 new jobs in 2018

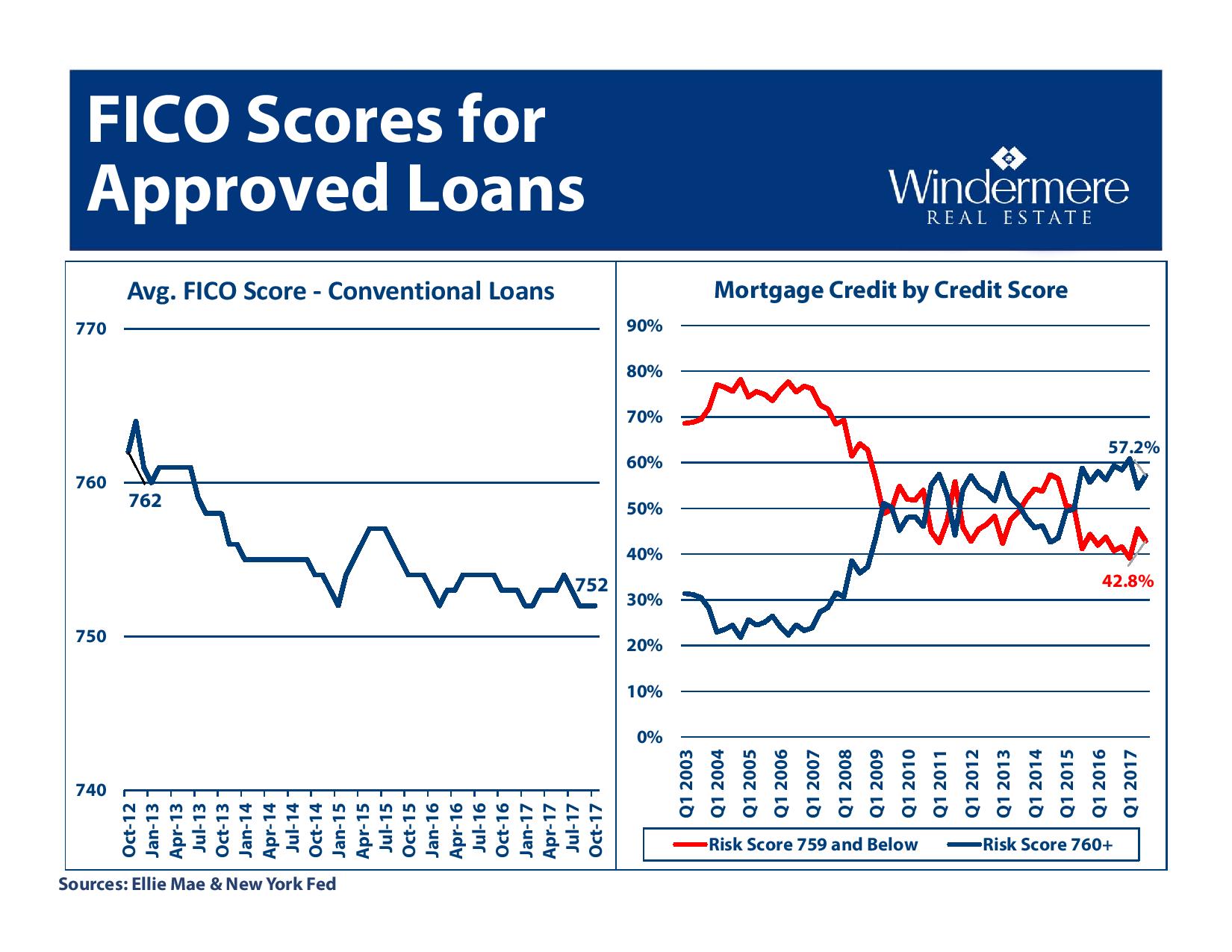

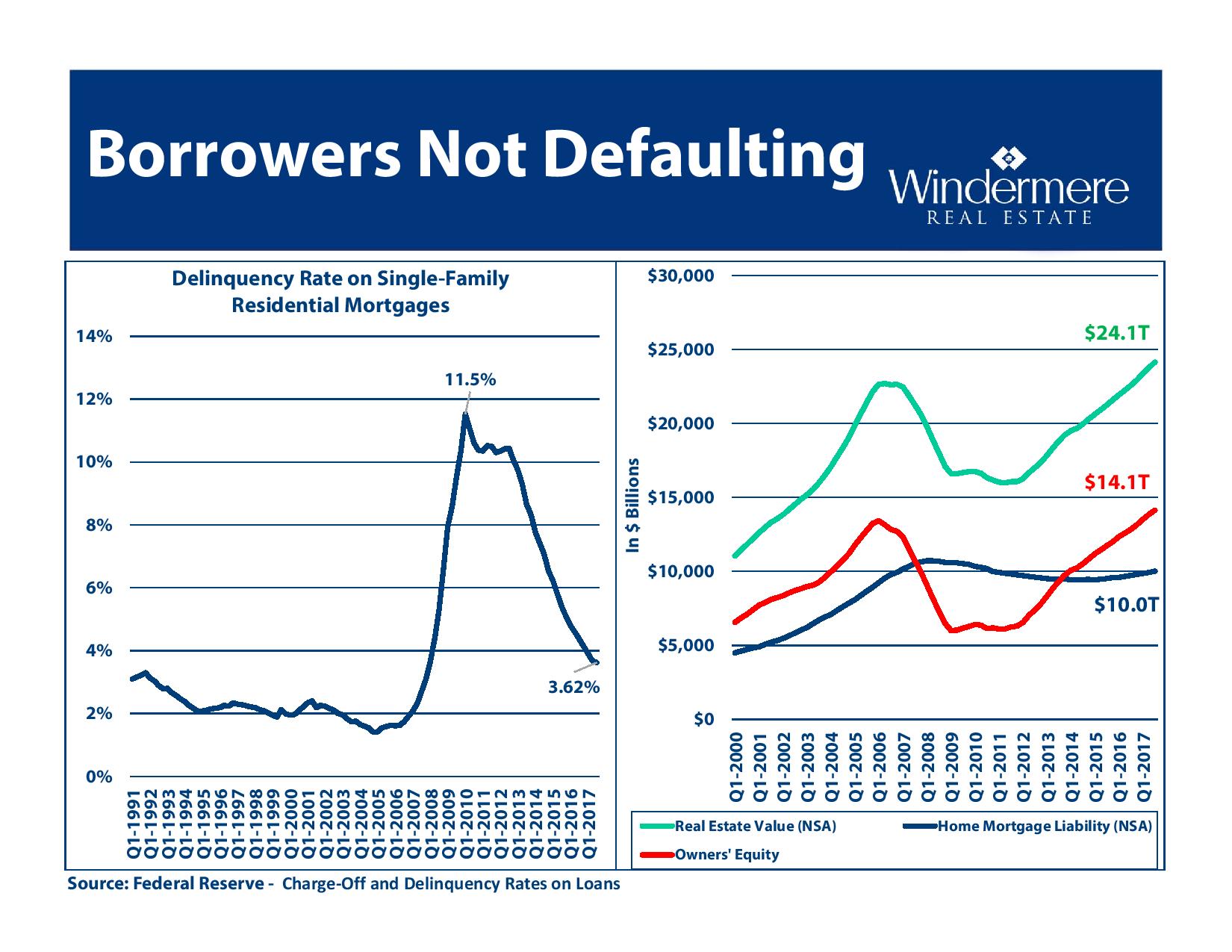

- Borrowers are not defaulting

- Average FICO scores on conventional loans are above 750

While all these signs point to continued growth of home values, there's a few reasons growth will begin to slow down:

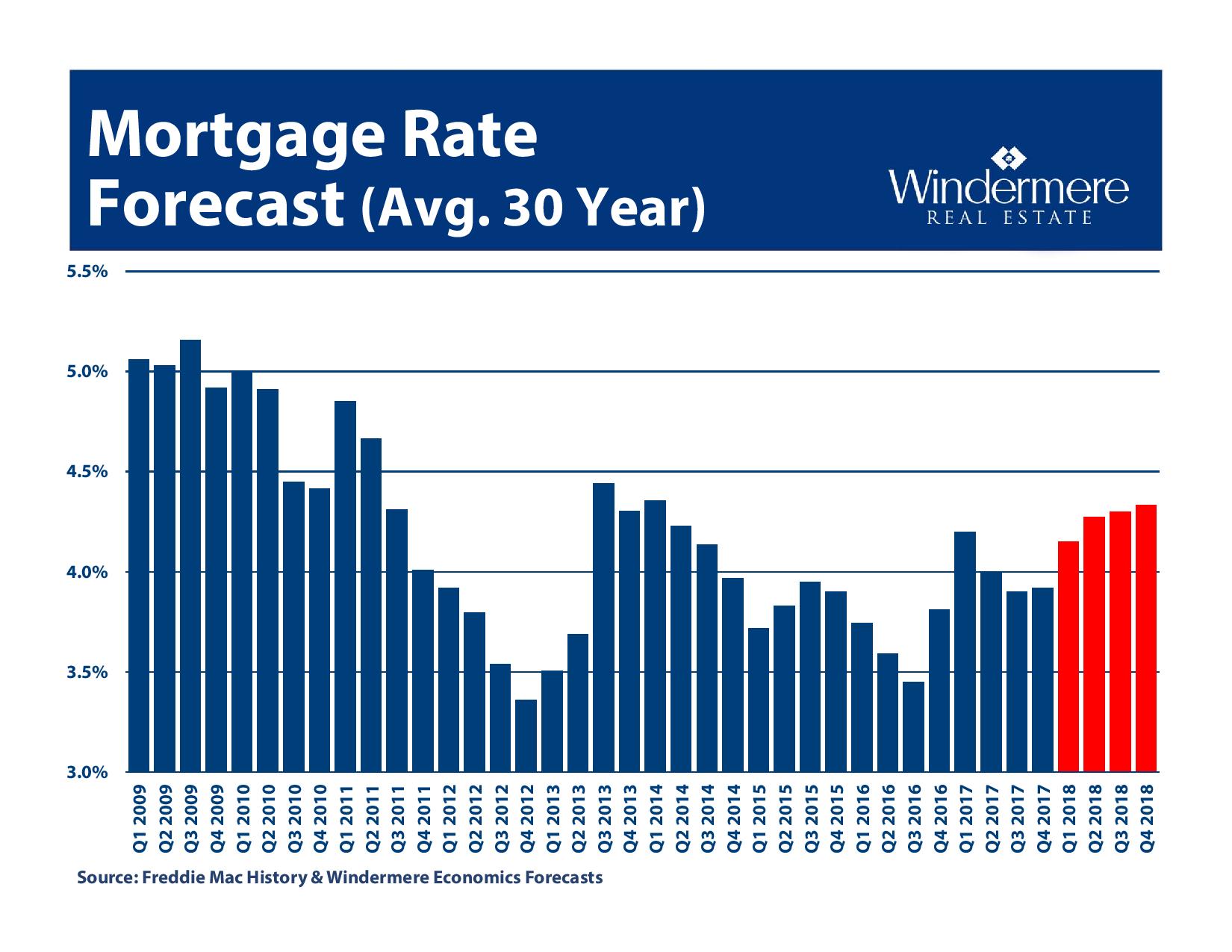

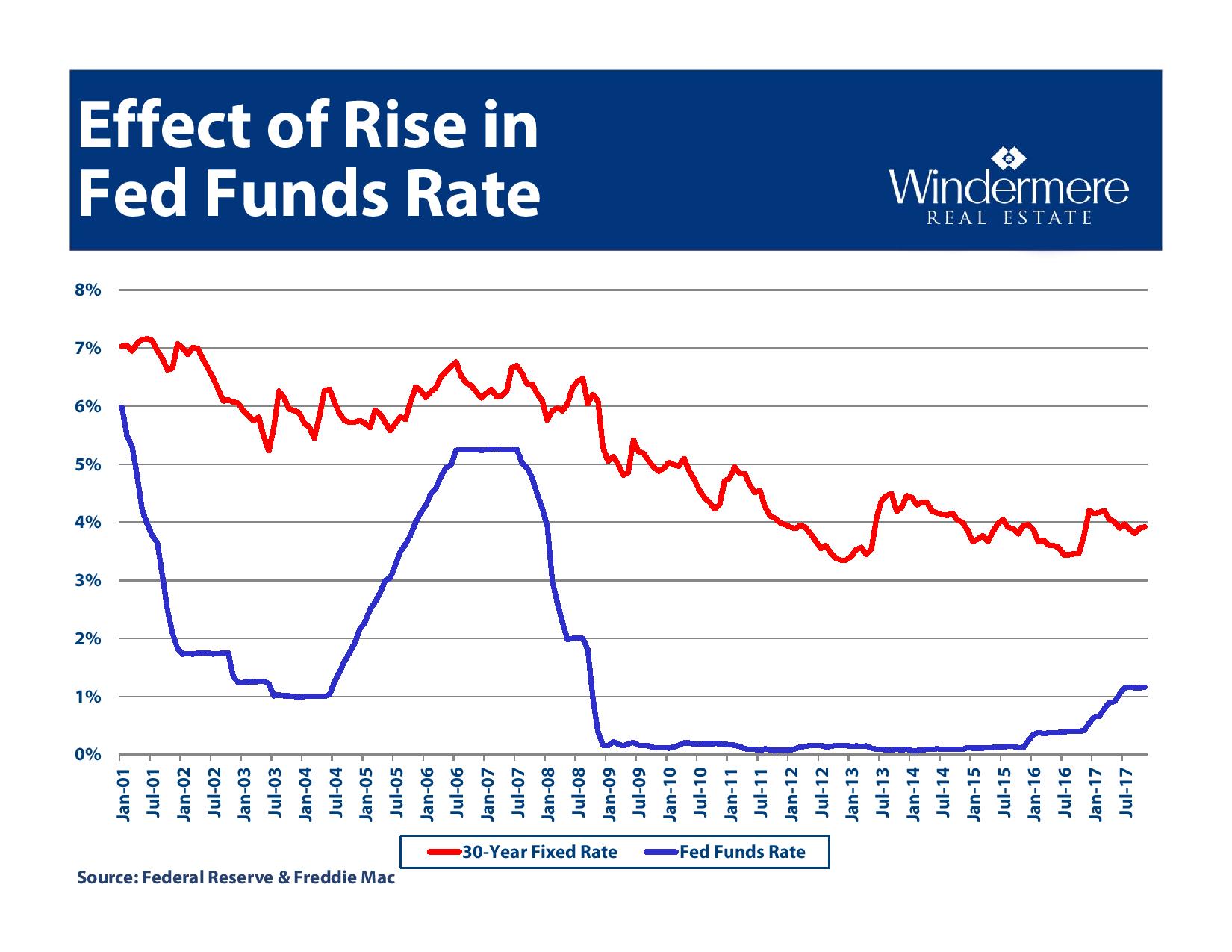

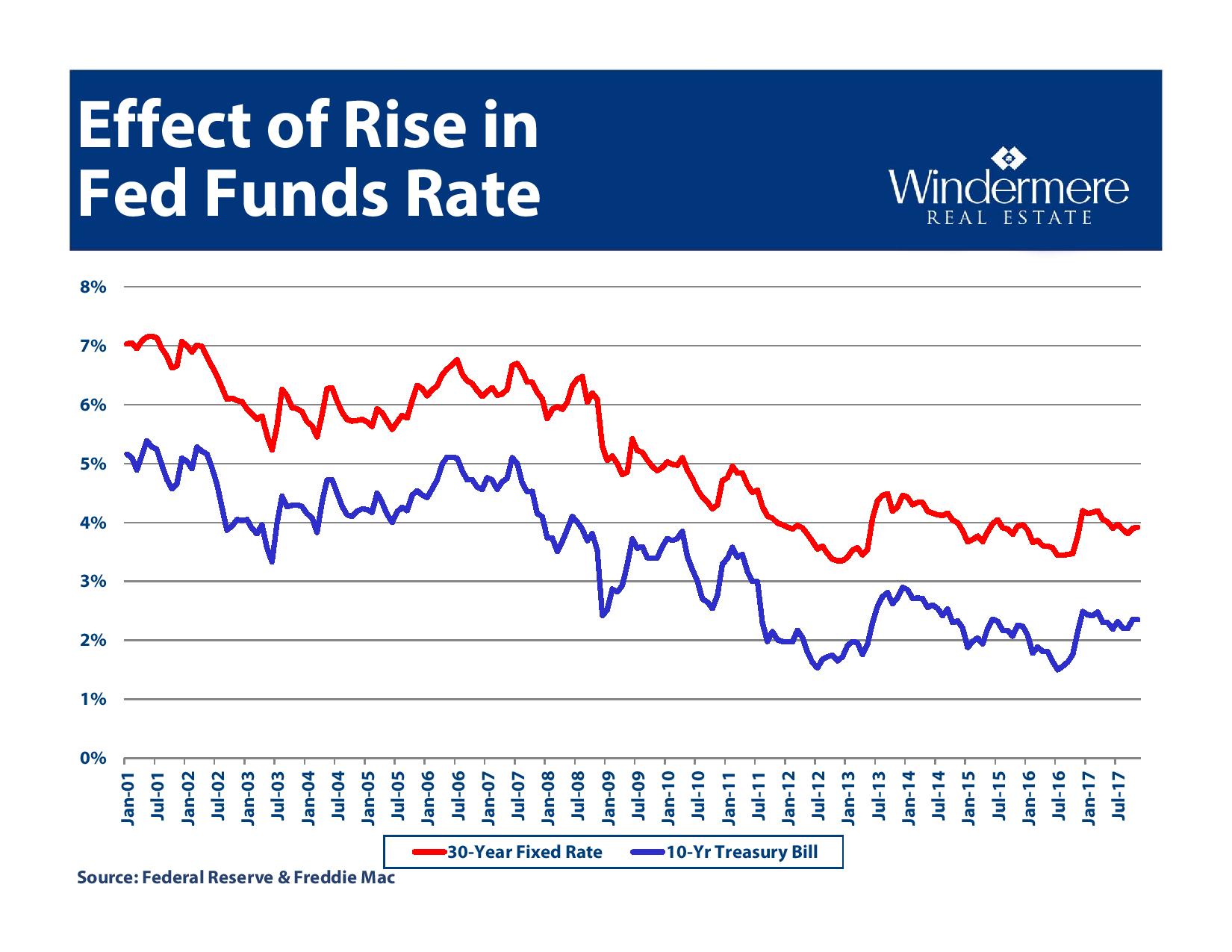

- Interest rates are rising. We expect the fed to continue their rate hikes throughout 2018 which could increase borrowing rates. A general rule of thumb, is that a 1% increase in interest rates decreases a buyers purchasing power by 10%.

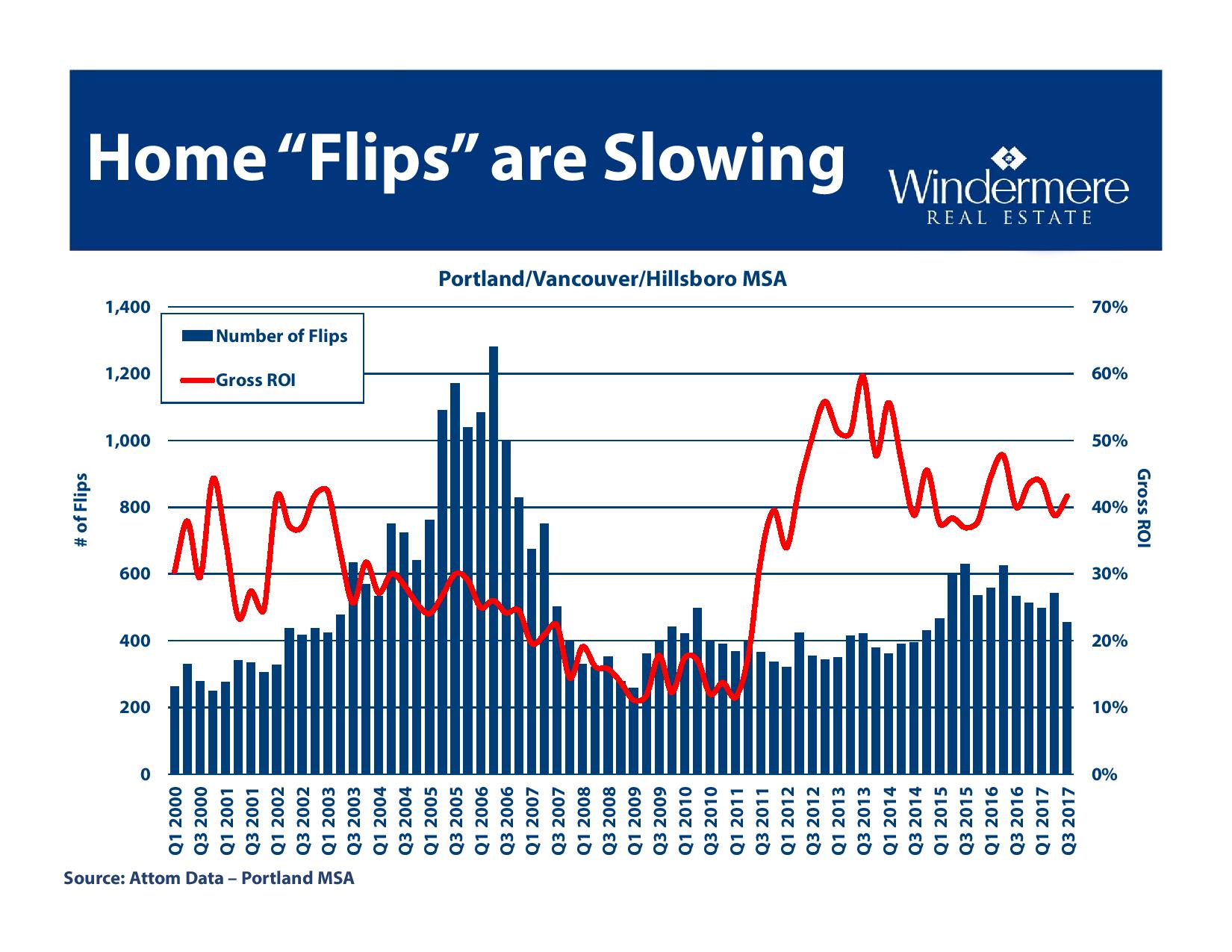

- Home "flips" are slowing down

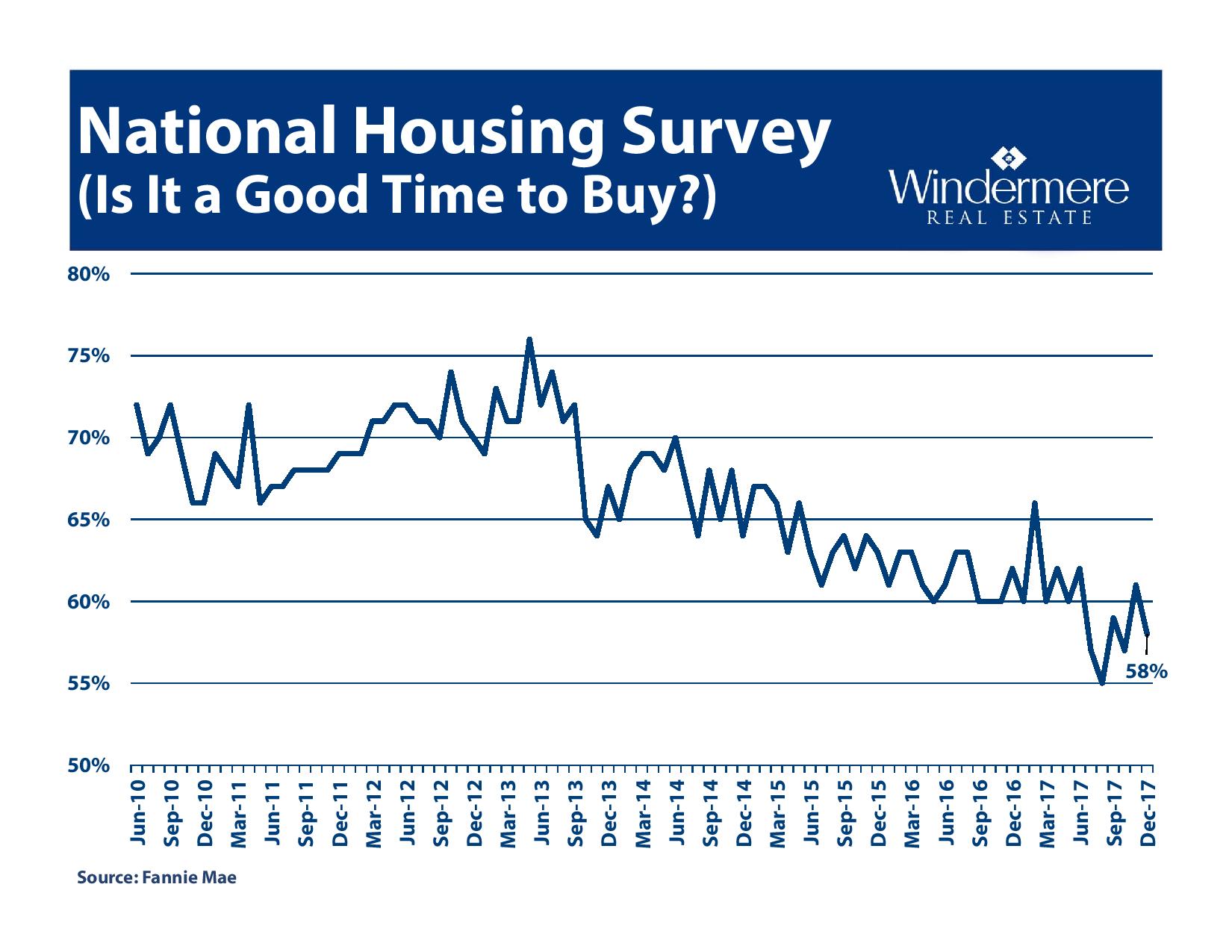

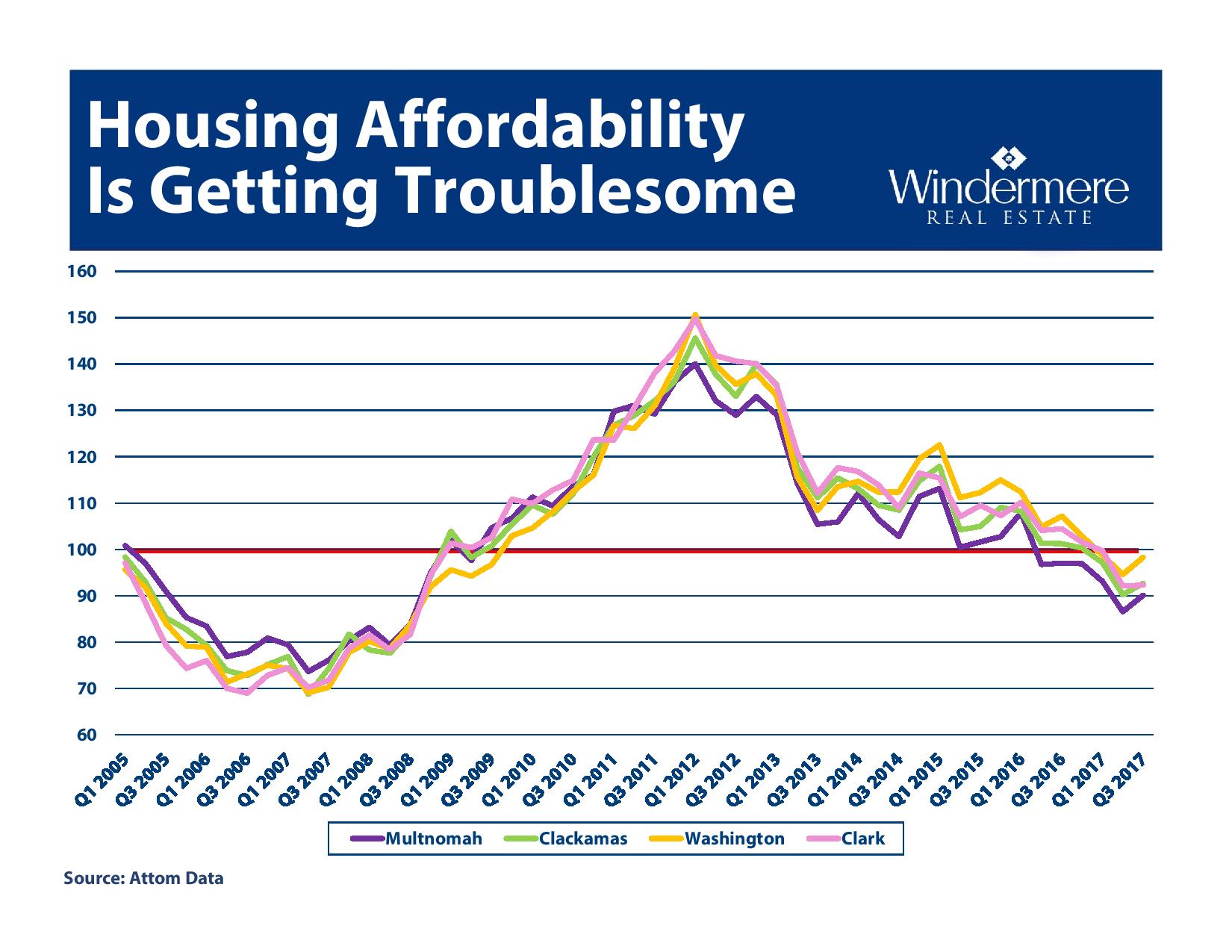

- Housing affordability will become a larger concern soon

Check out the slides below for a deeper dive: